Bernanke – Additional Monetary Accommodation Is Entirely Possible

Interest-Rates / US Interest Rates Mar 27, 2012 - 02:06 AM GMTBy: Asha_Bangalore

Chairman Bernanke presented an extensive assessment of the labor market this morning. Bernanke repeated his depiction of the labor market as “far from normal,” which was his opinion at the February 29, 2012 semi-annual testimony to the Financial Services Committee of the House of Representatives. He listed positive developments in the labor market – the noticeable increase in payrolls in the three months ended February (+245,000, 3-month moving average), moderation in layoffs in the public sector, longer workweek, the drop in the unemployment rate from 9.0% in September 2011 to 8.3% in February 2012, and the declining trend of new jobless claims. On the negative side, he mentioned it is unclear if the recent gains in payrolls “will be sustained,” and listed another set of indicators to watch – jobless rate, long-term unemployment, and the rate of net hiring.

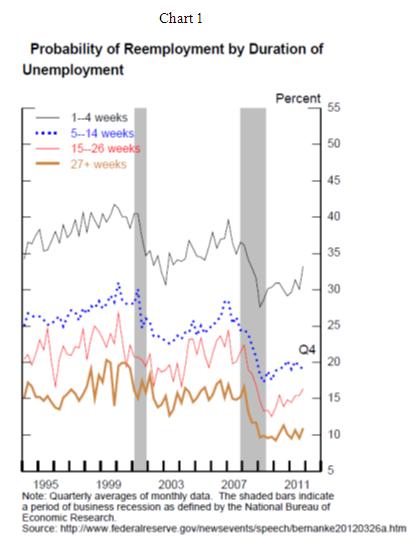

Bernanke spoke about, a much discussed issue, whether the current level of unemployment represents cyclical unemployment or structural unemployment. He concluded that both types of unemployment co-exist, but only “a modest portion” of unemployment is due to “persistent structural factors.” Bernanke pointed out that if long-term unemployment were being driven by structural factors rather than the deep recession just experienced, then the probability of finding a job for the long-term unemployed would not have advanced but would have instead trended down (see Chart 1).

In his opinion, more-rapid economic growth is the answer to the question as to what will lead to a sustained increase in hiring. Pulling all strings together, the remedy for the large scale unemployment is identical to that of economic recovery – another round of financial accommodation. Main takeaway from Bernanke’s remarks is that if the labor market remains on a rocky path, a third round of quantitative easing is entirely possible and for now, the Fed is on a watch-and-wait mode.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.