Worried that Stock Market is Overbought? Play Defense with Kraft Foods (NYSE: KFT)

Companies / Investing 2012 Mar 28, 2012 - 02:09 AM GMTBy: Elliot_H_Gue

Conventional wisdom holds that consumer staples names such as food and beverage manufacturers are slow-growth stocks that hold up best when the market swoons and lag when equities rally.

Conventional wisdom holds that consumer staples names such as food and beverage manufacturers are slow-growth stocks that hold up best when the market swoons and lag when equities rally.

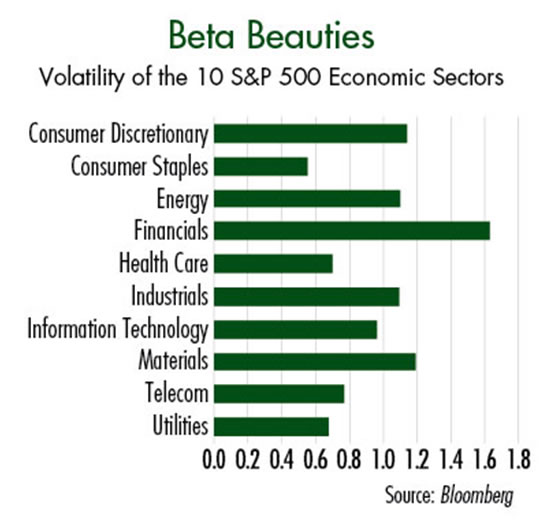

But that’s a misconception. As “Defensive Stocks Play Offense” shows, the S&P 500 Consumer Staples Index has soared nearly 130 percent since 2000—compared to the 17 percent gain posted by the S&P 500—and outperformed its parent index in all but the strongest bull markets. These outsized returns were produced with significantly less volatility (see “Beta Beauties”).

Consumer staples and health care, two of the most defensive groups in the S&P 500, are among my favorite sectors. They’re a great way to enjoy strong growth and low volatility.

With information technology and other market-leading sectors increasingly vulnerable to a pullback, investors should take profits on high-flyers and reallocate the proceeds to defensive names that are poised to take off.

Here’s a look at one stock that fits the bill.

The largest food manufacturer in the US, Kraft Foods (NYSE: KFT) is behind some of the world’s most iconic brands, including Oreo cookies, Trident gum, Planters nuts, Philadelphia Cream Cheese and, thanks to a USD19.4 billion acquisition in 2010, UK-based Cadbury chocolates.

As with Sara Lee Corp (NYSE: SLE), which I profiled here, the investment case for Kraft Foods rests on its imminent split into two companies: a slow-growing, North American grocery business that pays an ample dividend and a rapidly growing international snack food company. Kraft plans to separate its financial statements in the second quarter of 2012 and will finalize the split before the end of the year.

In North America, packaged-foods manufacturers have suffered from weak volume growth because of a sluggish economy and consumers’ preference for value brands. Kraft Foods’ unit sales were off 0.6 percent in 2011, but this disappointment wasn’t as bad as the 2.4 percent decline for the US food and beverage industry as a whole.

The good news: Kraft Foods has generated growth in a weak economy by boosting prices, cutting costs, introducing new products and eliminating underperforming products. Although sales volumes were off overall, net revenues for its “power brands” were up 4.5 percent, aided by a significant boost in marketing.

New product introductions in 2011 were mainly extensions of existing brands such as a line of chocolate Philadelphia spreads, new “healthy lifestyle” meat products under the Oscar Mayer line and a spicy Ritz cheese cracker. Higher-margin new products accounted for about 9 percent of net revenue in 2011, up from 6.5 percent two years ago.

The North American grocery business isn’t likely to be a fast grower, but can continue to generate solid cash flows and reliable profit margins. The company plans to institute a substantial dividend payout for this business, with a likely yield of 4 percent or higher.

Meanwhile, Kraft’s international snack foods business is the growth play, generating 44 percent of its $35 billion in total revenue from developing markets. The company’s biscuit brands portfolio—including Oreo, LU and belVita—saw net organic revenue growth of 9 percent in 2011, with developing markets up at a double-digit pace and developed markets posting respectable growth in the mid-single digits. In Russia and China, biscuit sales were up roughly 40 percent in 2011. For more growth plays, check out my free growth stock picks report.

In chocolates, total sales were up 6 percent but developing market sales were up well into the double digits. In India, for example, the company has generated strong growth in this category by distributing refrigerated displays known as Visi Coolers to all parts of the country. These chilled displays maintain chocolates at their ideal temperature even in the hot Indian climate.

The planned Kraft split will heighten the value of the firm’s brands and its growth potential in emerging markets.

Elliott H. Gue is editor of Personal Finance, a one-stop source for market-beating investing advice. Mr. Gue scours the world for the best investments – whether it be growth stocks, bonds, Master Limited Partnerships or commodities – to build and protect your wealth no matter what the “market” does. Mr. Gue delivers in-depth insight and analysis that cuts through the noise and hype to reveal the truth about the economy, the market and your investments.

Mr. Gue is also editor of The Energy Strategist, helping subscribers profit from oil and gas as well as leading-edge technologies like LNG, CNG, natural gas liquids and uranium stocks.

He has worked and lived in Europe for five years, where he completed a Master’s degree in Finance from the University of London, the highest-rated program in that field in the U.K. He also received his Bachelor’s of Science in Economics and Management degree from the University of London, graduating among the top 3 percent of his class. Mr. Gue was the first American student to ever complete a full degree at that business school.

© 2011 Copyright Elliott H. Gue - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Elliott H. Gue Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.