Forget Retirement... and Retirement Savings

Personal_Finance / Pensions & Retirement May 02, 2012 - 11:12 AM GMTBy: Jeff_Berwick

You've been sold a bill of goods for the last four to six decades. You've been told that nation-states, democracy and socialism is good. You've been told our monetary system prevents instability. And, while the government and central banks put your unborn children or grandchildren into debt for life they've been telling you that there will be a socialist safety net to protect you and that the "American dream" includes retiring in your 50s or 60s to a wonderful life of golf and lying on the beach.

You've been sold a bill of goods for the last four to six decades. You've been told that nation-states, democracy and socialism is good. You've been told our monetary system prevents instability. And, while the government and central banks put your unborn children or grandchildren into debt for life they've been telling you that there will be a socialist safety net to protect you and that the "American dream" includes retiring in your 50s or 60s to a wonderful life of golf and lying on the beach.

It even appeared to work for a short while thanks to demographics and the greatest advances in human history.

The baby boom caused by the nation-state (which created World War II) and central banking (which created the depression and funded World War II) was truly a boom creating a once-in-a-lifetime chance to make it appear as though some of these inane socialist theories could work.

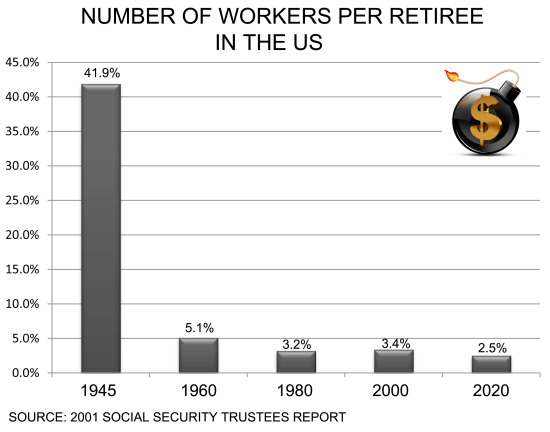

A look at the number of workers per retiree in the US shows this plainly.

And, with the advent of the internet, productivity also increased massively in the 1990s and 2000s, further obscuring the collapse to come. And it is coming. In fact, it's already started. So, if you are basing your future retirement plans on what has happened in your living memory you better snap out of it.

SOCIALIST SECURITY - THE ULTIMATE PONZI SCHEME

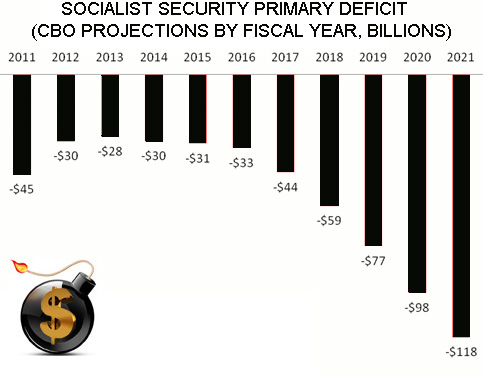

A ponzie scheme is defined as "a fraudulent investment operation that pays returns to its investors from their own money or the money paid by subsequent investors, rather than from profit earned by the individual or organization running the operation". By this definition, the Socialist Security system in the US is a ponzi scheme.

The end of a ponzi scheme is always when net payments outstrip net income. This occurred in 2010 and there is no end in sight even under the US Government's own heavily massaged and always underguesstimated projections.

There is only one reason it and the US Government hasn't gone bankrupt yet. It's because they can still print dollars to cover all these deficits. But how much longer can that realistically last before hyperinflation sets in and the dollar becomes worthless? We can't see any way it goes more than five more years from here... and that's pushing it.

IF YOU DON'T HAVE TO PAY, DON'T

Obviously, you are forced at gunpoint to pay into the Socialist Security system so long as you are a worker (entrepreneurs can avoid payments) or live/work in your home country in the western world. So, as long as you live and work in the west this is unavoidable.

However, other tax-sheltered retirement plans can sometimes be avoided. IRA's (Individual Retirement Accounts in the US) are usually optional. In Canada, plans called Registered Retirement Savings Plans (RRSPs) are also optional. If you have the option do not bother paying into these type of plans.

Your government registered financial advisor (at least the great majority of them) will try to persuade you to do so. But he is running on the premise underwhich he was trained which states things like "stock markets always go up in the long run" and the belief that the current fiat monetary system is a permanent fixture for eternity. He, as usual, is wrong.

Under his thinking it makes sense to shelter some of your income now to get a tax break in the present and to delay paying those taxes in the future. But, with the coming bankruptcy of socialist styled fascist democratic nation-states and the collapse of the entire fiat monetary system this plan makes no sense. In fact, what is the most likely thing to happen is that as western governments collapse they will look at funds in accounts like IRAs and RRSPs as lucrative spoils by which they can confiscate or tax to stay alive a little while longer.

As well, most retirement savings plans (not all, see below) restrict you on your choice of investments and so you are limited and not able to invest in things like gold or silver bullion held abroad... so by putting funds into these accounts you are often stuck with investing in asset classes that will collapse in the coming years, such as the entire bond market.

And, even in the off chance that somehow these nation-states and their currencies can stay alive for another decade or two until you "retire" they will be in such a tattered state of affairs that the tax rate will be extraordinarily higher than it is today... so paying less tax now at lower rates in order to pay a higher tax rate in the future also makes no sense.

So, if you have yet to contribute to these kind of funds and have the choice to not participate, don't do it.

WHAT IF YOU ALREADY HAVE FUNDS IN IRA'S or RRSP's?

Every country is different and has different plans and tax laws so it is difficult to get into exact details for each. But, let's take the US as an example.

In the US there are two main types of tax-sheltered retirement plans: 401k's and IRA's. Often with a 401k there are severe penalties if you withdraw the money while you are still working for the company in which you were employed when the funds were contributed or before a certain age. Depending on the penalty, each individual needs to make their own decision on whether to withdraw the funds. Keep in mind that many of these funds are invested in assets that can and will go to zero so even a severe penalty may be worth getting the funds out and invested into something safer such as precious metals or other hard assets that will not become worthless in a fiat currency system collapse.

In the case you wish to keep the funds in the plan then sometimes there are options to have ownership and control over what the funds are invested in. In the US this is called a Self-Directed IRA (see TDV's Self-Directed IRA here). This enables you to invest the funds in almost any asset on Earth so it is much better than the majority of IRA plans where you are severely restricted as to what asset class and what geopolitical region you can invest in. Once you have a self-directed IRA set-up you can get a) your assets outside of your home country to make it difficult to seize them and b) can invest in asset classes like gold bullion which will survive your country's financial and monetary system collapse.

RETIREMENT IS A MARKETING CONSTRUCT

As part and parcel with the bill of goods you've been sold telling you that you need to go to 16 years of indoctrination training (school and college), work forty years in a cubicle and not ask questions, they needed to come up with something that made it all seem worthwhile. That carrot is the concept of "retirement". You see, if you can get through the nearly 20 years of child slave camps and 40 years of slavery where the majority of your income is taken and the rest is eaten up in interest costs for mortgages and loans so you can have a house and car, then you need a reason to do it all.

That reason, apparently, is that once you hit 65 you can stop going to work and can lie on the beach everyday. Of course, most people soon find out that lying on the beach everyday is fairly boring... and the lifestyle change is so great that many people have heart attacks in the weeks and months after "retirement" anyway.

A BETTER WAY

A much better way to live is to realize that all of this apparatus built up around us is mostly false... avoid public schools (home school or unschool) and socialist colleges (all info is freely available on the internet with no massive student debts or being pepper sprayed) as much as possible and start up your own business or become an independent contractor - preferably in one of the dozens of countries that has no noticeable taxes, regulations, and licenses that squeeze the incentive out of everyone. And, with all the money you make and the millions you will save from not having to pay egregious amounts of tax in the western world you can afford to do whatever you want whenever you want.

Here's the thing. You'll probably never want to "retire" because you'll be having such an enjoyable time doing what you are doing.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2012 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.