Why Canada’s Deal With China Could Produce A Boom In Uranium Explorers

Commodities / Uranium May 11, 2012 - 08:14 AM GMTBy: Jeb_Handwerger

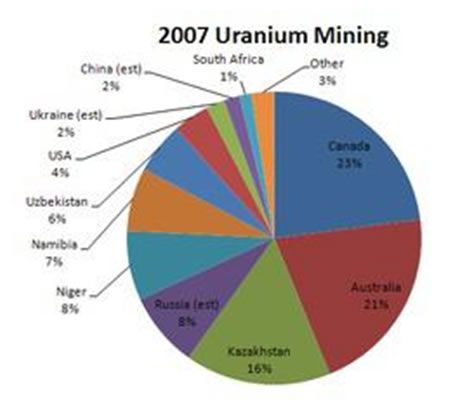

Canadian uranium producers (URA) can now compete with Kazakhstan, Australia and Russia to sell uranium to China. Canada produces about 20% of the world's uranium and exports over 80% of annual production. The fast growing nuclear industry has never been open to China and will create a boom in the Athabasca Basin for uranium explorers.

Canadian uranium producers (URA) can now compete with Kazakhstan, Australia and Russia to sell uranium to China. Canada produces about 20% of the world's uranium and exports over 80% of annual production. The fast growing nuclear industry has never been open to China and will create a boom in the Athabasca Basin for uranium explorers.

This deal will allow Cameco (CCJ), the largest publicly traded uranium company to deliver 52 million pounds of uranium to China by 2025. The contract is worth about $2.5 billion in sales. China is hungry for nuclear with dozens of reactors planning to be built over the next 10-15 years.

Investors are well aware that the Megatons to Megawatts agreement between Russia and the United States expires in 2013. New demand is rising rapidly as stated by the World Nuclear Association who expects world uranium consumption to grow and new demand will require double the amount of current production by 2020.

Cameco and Rio Tinto (RIO) is predicting a supply shortage within 18 months. The last time this happened the spot price of uranium rose to $138 per pound.

Today there are 435 nuclear reactors in operation all over the world. Add to this another 100 nuclear reactors are under construction or on the drawing boards.

Projections by the World Nuclear Association expects 650 nuclear reactors over the next twenty years. Saskatchewan, Canada may turn into "The Next Saudi Arabia" over the next twenty years. Nuclear power is reemerging as the go to energy source for expanding Asian economies.

Recently, Prime Minister Harper signed a deal with China that brings almost $3 billion dollars worth of energy supply which includes uranium from the Athabasca Basin to satisfy China's insatiable hunger for its expansion into nuclear power. Now may be the right time to look for uranium explorers in the Basin.

We have expected to see an increase in Mergers and Acquisition activity in this region for some time. We observed the transaction by Rio Tinto who outbid Cameco in 2011 for Hathor Exploration's Roughrider Deposit, Denison (DNN) and Energy Fuels recently signed a deal to create a large U.S. producer. Fission Energy (FSSIF) just acquired Pitchstone Exploration for its 13 Athabasca exploration properties. These are all signs that M&A activity is on the rise.

Uranium stocks (NLR) have pulled back after a significant rally in the first quarter and we believe that now may be a good time to look for junior uranium explorers in the Athabasca Basin.

We believe Rio Tinto bought out Hathor as a strategic move to gain a presence in this mining friendly region, free of rising resource nationalism, geopolitical risk and lower grade uneconomic uranium mines. Different sources within the Basin are mentioning that the big boys are looking at potential projects for acquisition or joint ventures.

CITIC Group, which is a Chinese tentacle, are interested in uranium explorers in the Athabasca Basin. The interest from them in the Athabasca Basin is evidenced by the signing of large future supply contracts with Cameco. The recent spin off of Denison's Canadian assets specifically its Wheeler River Deposit, (higher grade and larger than Hathor's Roughrider) partnered with Cameco may be indicating that Denison is setting itself up as a potential acquisition target.

The big boys such as Cameco, Rio Tinto, Sovereign Asian Funds and possibly BHP (BHP) are realizing that large profits from uranium production will come from the Athabasca Basin. This is where deposits have grades tens to hundreds of times greater than conventional projects worldwide.

The majors are having problems dealing with the ever rising threat of resource nationalism as exemplified by their experience in Namibia, which is making noises that they may institute a super tax on miners. We have witnessed the uprising in Mali and growing Black Empowerment movements in South Africa. Of these aforementioned entities Rio Tinto and China is finding a warmer welcome in the mining friendly Athabasca Basin.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

© 2012 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.