Whe Are U.S. Treasury Bond Yields Going?

Interest-Rates / US Bonds May 12, 2012 - 03:53 AM GMTBy: Tony_Pallotta

As the US Treasury curve sits near all-time highs the question on every investors mind is what happens next. Can Treasury yields move lower? In real terms when adjusted for inflation yields are negative. In other words you are losing money on an inflation adjusted basis to lend your money to the US Government.

As the US Treasury curve sits near all-time highs the question on every investors mind is what happens next. Can Treasury yields move lower? In real terms when adjusted for inflation yields are negative. In other words you are losing money on an inflation adjusted basis to lend your money to the US Government.

So many would clearly say anyone buying Treasury here is making a poor investment. The other side of the argument is if in fact Treasury does breakout one can make a hefty capital gain while collecting a 1.8% "dividend yield" in the case of the 10 year.

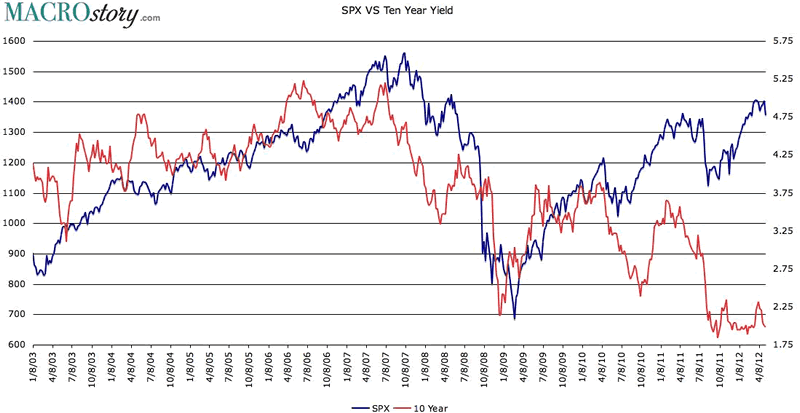

Regardless of which investment thesis proves right below are some charts that I believe will serve as a better guide in answering this important question. I mean after all just look at the following chart comparing the SPX to 10 year yield. Whoever gets this question right is going to make a lot of money.

SPX VS 10 Year Yield - 2003 to Present

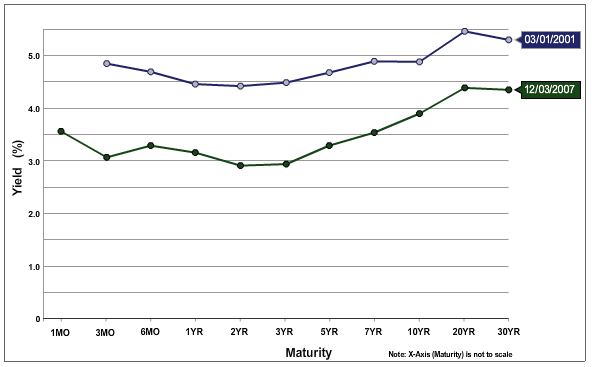

Yield Curve At The Start Of The 2001 and 2008 Recessions

Notice how at the start of the past two recessions how flat the yield curve was including inversion at the 20 year maturity as 30 year yield dips lower.

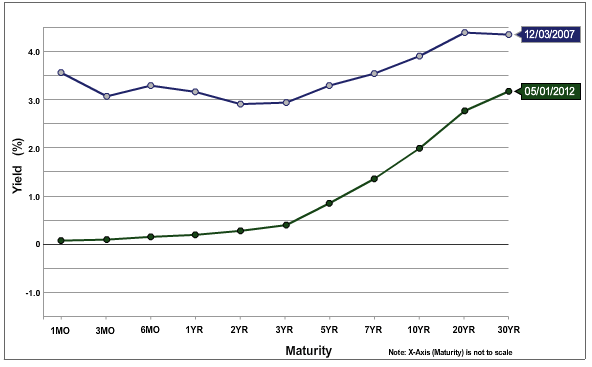

Now notice the current yield curve as compared to the start of the 2008 recession (December 2007).

Not only is the current yield curve steeper but there is no inversion at the 20 year maturity. Clearly Fed QE has inspired the shorter end of the curve to move lower causing such steepness but economic recession is always preceded by a flattening of the curve. So either short term rates would need to rise (highly doubtful), long term rates fall or both.

If in fact such inversion will occur at the start of the next recession as it has during the prior two then one can make the argument that 30 year yields will fall. Using current 20 year nominal yields of 2.65% and the 30 year of 3.02% an argument can be made that 30 year yields can easily fall 50-60 basis points. And if 30 year yields are falling, so will 10 and 20 which means 30 would fall even greater.

Bottom Line

So perhaps the real question investors should be asking is not whether or not Treasury will breakout from current levels but is the economy headed to recession or not. If you believe the economy is improving then odds favor yields holding current lows and eventually moving higher.

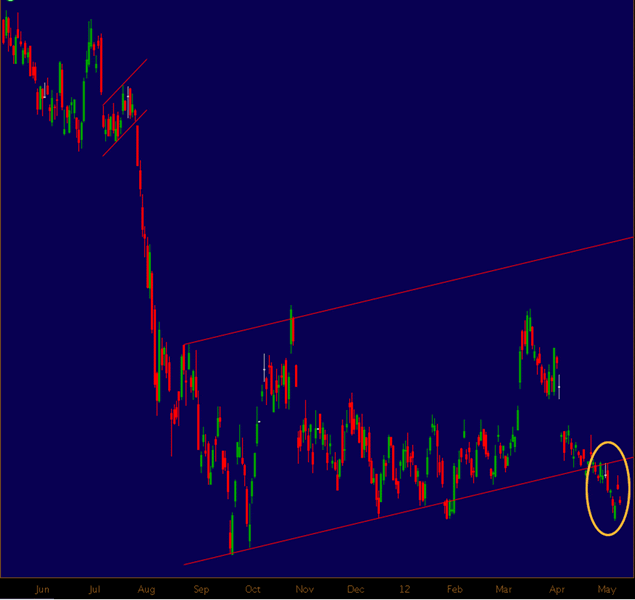

On the other hand if you believe as I do that the economy is deteriorating then the question is not a matter of if but when will yields fall. To answer that question one simply needs to look at the following chart of the 10 year Treasury.

It appears that moment has in fact already begun. If true then perhaps the ideal investment is in the 30 year Treasury assuming that since history "rhymes" that inversion will once again precede the next downturn.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2012 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.