Stock Market Downtrends Continue

Stock-Markets / Stock Markets 2012 May 13, 2012 - 10:39 AM GMTBy: Tony_Caldaro

The US market gapped down at the open on monday to SPX 1364. Then proceeded to make lower downtrend lows but rebounded to that level, or 2 points higher, every day this week. It was a somewhat volatile week with a range between SPX 1343 and 1374. In the end the SPX/DOW lost 1.5%, and the NDX/NAZ lost 0.8%. Foreign markets were mixed with the DJ World index down 2.1%, Asia down 3.5%, and Europe up 0.3%. Economic reports for the week remained on the downside with negatives outpacing positives 6 to 4. On the uptick: consumer credit, a budget surplus, consumer sentiment and the WLEI. On the downtick: wholesale inventories, export/import prices, the PPI, plus jobless claims rose and the trade deficit widened. Next week there are reports on housing, the CPI, industrial production and the FOMC minutes. Best to your week!

The US market gapped down at the open on monday to SPX 1364. Then proceeded to make lower downtrend lows but rebounded to that level, or 2 points higher, every day this week. It was a somewhat volatile week with a range between SPX 1343 and 1374. In the end the SPX/DOW lost 1.5%, and the NDX/NAZ lost 0.8%. Foreign markets were mixed with the DJ World index down 2.1%, Asia down 3.5%, and Europe up 0.3%. Economic reports for the week remained on the downside with negatives outpacing positives 6 to 4. On the uptick: consumer credit, a budget surplus, consumer sentiment and the WLEI. On the downtick: wholesale inventories, export/import prices, the PPI, plus jobless claims rose and the trade deficit widened. Next week there are reports on housing, the CPI, industrial production and the FOMC minutes. Best to your week!

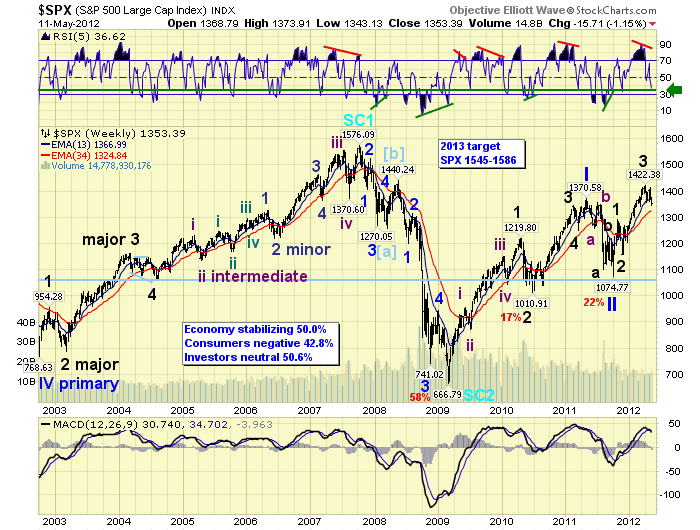

LONG TERM: bull market

The US stock market continues to act bullishly despite a slowdown in the BRIC countries and recessions in several of the Eurozone countries. It looks like the US, first to act in a meaningful way to the economic crisis, will be the first to arise out of this Secular deflationary cycle when it ends. The charts suggest, this is exactly what is unfolding over the past few years.

The current bull market appears to be following the characteristics it displayed in its earliest waves. We continue to count this multi-year rise as Cycle wave [1] of the next multi-decade Supercycle bull market. Cycle wave bull markets unfold in five Primary waves. Primary wave I concluded at SPX 1371 in May11 and Primary wave II ended at SPX 1075 in Oct11. Primary wave III has been underway since then. In bull markets Primary waves divide into five Major waves. Major wave 1 ended in Oct11 at SPX 1293, Major wave 2 ended in Nov11 at SPX 1159, and Major wave 3 ended in Apr12 at SPX 1422. Major wave 4 is underway now. When it concludes, likely between SPX 1300 and 1340, Major wave 5 should carry the SPX close to 1500. Then another correction will conclude Primary wave IV, before Primary wave V ends the bull market somewhere between SPX 1545 and 1586.

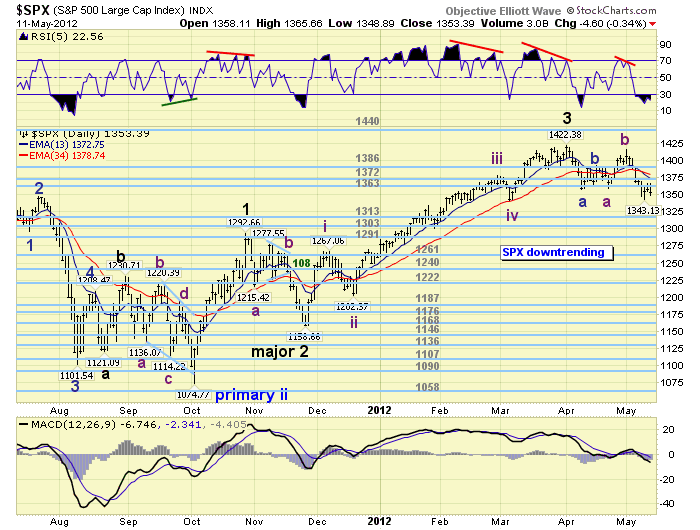

MEDIUM TERM: downtrend

This market has had an interesting series of events unfold during the past month or so. The DOW, however, has kept us on the right side of the market. Major wave 3 topped in early April at SPX 1422 and the market began to correct. The DOW confirmed the new downtrend, while the other major indices did not. The DOW bottomed early and started to rally with the other majors. Then the SPX make a double bottom just under 1360. As all four major indices rallied the DOW made a new high and confirmed an uptrend. This was not the usual launch of a rally higher. It was the end of the counter rally. Then all four majors began to decline. Currently the SPX/NDX/NAZ are all in confirmed downtrends, while the DOW is not. When the DOW confirms its downtrend the entire correction, from early April, will be close to over.

Our OEW SPX count displays Major wave 3 ending at 1422. Then an Intermediate wave A formed a double bottom just under SPX 1360. The rally that followed, to SPX 1415, was Intermediate wave B. Now the downward Intermediate wave C of the correction is underway. Thus far the low for the SPX has been 1343, this past wednesday. SPX 1340 is where Intermediate wave iv, of the previous Major wave 3 uptrend, ended. So there is good support there. The next lower target would be between SPX 1313 and 1327. We detailed all the fibonacci relationships, etc. in last weekend’s report. One other item of note. The minor corrections during this bull market have generally dipped to between a 30-35 reading on the weekly RSI. We posted a green line there when the correction started in early April. As you can observe from the weekly chart, market momentum is approaching that range.

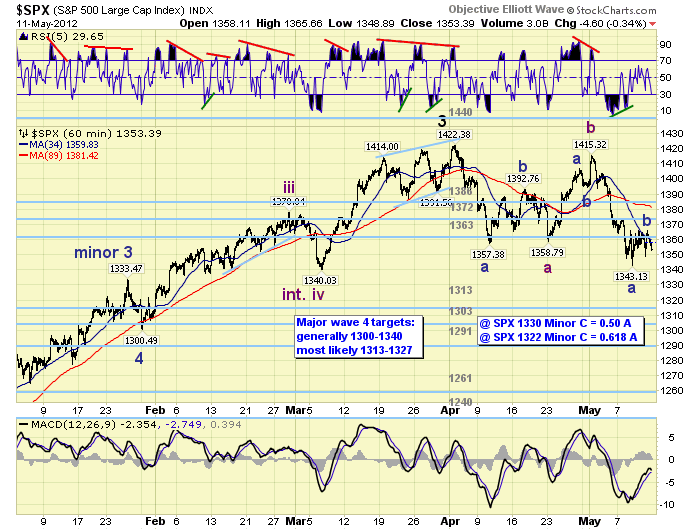

SHORT TERM

Support for the SPX is at the 1313 and 1303 pivots, with resistance at the 1363 and 1372 pivots. Short term momentum is approaching oversold after spending much time around neutral. After wednesday’s SPX 1343 low the market started to bounce off the OEW 1363 pivot. SPX 1364 on wednesday, then 1366 on thursday and friday. This suggests the SPX 1343 was an important low, for this decline, and 1366 an important high. As a result we have shifted our count a bit lower. Minor wave A ended at SPX 1343, and Minor B probably at 1366. If Minor C = 0.50 A, then the correction should end at SPX 1330. If Minor A = 0.618 A, then the correction should end at SPX 1322. Both are fairly close to our SPX 1313 to 1327 range.

Short term support is at SPX 1340 then the 1313 pivot. Overhead resistance is at the 1363 and 1372 pivots. The short term OEW charts remain with a negative bias from SPX 1395, with the swing point the upper range of the 1363 pivot. Best to your trading!

FOREIGN MARKETS

The Asian markets took the brunt of the selling this week losing 3.5%. Only Australia and China remain in uptrends.

The European markets actually gained 0.3% on the week. All indices are in downtrends.

The Commodity equity group lost 2.2% on the week. All indices in downtrends as well.

The DJ World index continues to downtrend losing 2.1% on the week.

COMMODITIES

Bonds continue to uptrend and are making new highs, gaining 0.3% on the week.

Crude continues to downtrend losing 3.0% on the week.

Gold remains in a three month downtrend, losing 3.7% on the week.

The USD is uptrending again gaining 1.0% on the week.

NEXT WEEK

Tuesday kicks off the economic week with Retail sales, the CPI, the NY FED, Business inventories and the NAHB index. On wednesday, we have Housing starts, Building permits, Industrial production and the FOMC minutes. Then on thursday, weekly Jobless claims, the Philly FED and Leading indicators. Friday is Options expiration. As for the FED. Governor Duke gives a speech on tuesday morning, on housing, at the NAR. Best to your weekend and week.

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2012 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.