Taiwan: The Democratic China

Politics / China May 14, 2012 - 05:14 AM GMTBy: EconMatters

In the 60 years since Chinese Nationalists retreated to Taiwan, the tiny island country has transformed itself quite differently from the mainland China. Thanks to a series of financial and economic reform by the Nationalist Party (KMT), Taiwan got a head start on economic and democratic development, while Mao's Cultural Revolution had left the Mainland in an over-a-decade-long developmental vacuum.

In the 60 years since Chinese Nationalists retreated to Taiwan, the tiny island country has transformed itself quite differently from the mainland China. Thanks to a series of financial and economic reform by the Nationalist Party (KMT), Taiwan got a head start on economic and democratic development, while Mao's Cultural Revolution had left the Mainland in an over-a-decade-long developmental vacuum.

Never declared independence from China, Taiwan had enjoyed rapid industrialization and GDP growth that brought about Taiwan Miracle during the latter half of the 20th century, thus becoming one of the "Four Asian Tigers" alongside Singapore, South Korea and Hong Kong. Since then, Taiwan (ROC - Republic of China) has evolved from a manufacturing-based economy into one that's more technology and service oriented, while "Made in Taiwan" has been replaced by "Made in China" at WalMart.

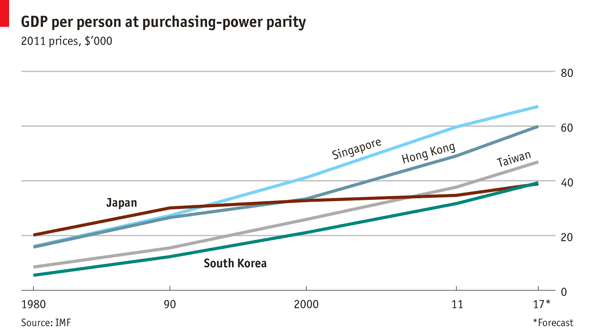

When comparing living standards on the basis of GDP per person measured at purchasing-power parity (PPP), which adjusts for differences in the cost of living in each country, the latest data from IMF shows that Taiwan already overtook Japan in 2010 (Hong Kong outranked Japan in 1997, and Singapore in 1993). This is partly due to Japan’s high price levels, especially for housing and food, bringing down the country’s true standard of living, but also speaks volumes about Taiwan's prosperity and affluence.

|

Chart Source: The Economist |

WSJ noted that Mainland China buys about 41% of Taiwan's exports. Roughly 70% of those exports are components for products made by Taiwanese-owned and operated factories that set up shops in China making finished products such as iPads or Nike shoes for the rest of the world.

During the eight-year rule of pro-independence DPP party, Taiwan had failed to take advantage of its position as an open, trade-based economy and its historical relation with China. After the 2008 landslide election victory, president Ma Ying-jeou (馬英九) finally pushed through the Cross-Straits Economic Cooperation Framework Agreement (ECFA) with Beijing on June 29, 2010.

ECFA has reduced tariffs and opened the mainland China for services and many cooperative economic projects for Taiwan. So far, the pact seems to have paid off quite well in terms of inbound investment and employment opportunities for Taiwan, particularly in the manufacturing and chemical materials sectors.

Hit primarily by the reduced demand from China and Hong Kong, the island's export fell 4.7% year-over-year in the first four months of 2012. Nevertheless, Taiwan's GDP is forecast to grow 3.48% in a report released April 24 by the Taiwan Institute of Economic Research. President Ma Ying-jeou's re-election this January is also seen as a signal of continuing cross-Strait relations and economic cooperations with mainland China.

Taiwan is one of the only two countries in the world that managed to maintain an average of 5% growth over five decades (the other one is South Korea). With the world economy surrounded by a high uncertainty deriving form euro debt crisis, and the high oil price, diversifying some of the long-term portfolio into Taiwan via ETFs such as iShares MSCI Taiwan Index Fund (EWT), or MSCI Emerging Markets Currency-Hedged Equity Fund (DBEM), as an alternative to direct investing into China, may not be a bad idea.

Disclosure: No Positions

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2012 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.