Euro Going To Zero!

Commodities / Agricultural Commodities May 31, 2012 - 06:14 PM GMTBy: Ned_W_Schmidt

We listened to confirmation this week that the Euro will indeed go to zero should Greece exit the Euro zone. That information was obtained from watching an exclusive cable news interview of Chicken Little by well-known anchor Henny Penny. Chicken Little, a former money manager that appears regularly on cable business programs, said that word on the matter came to him from reliable experts on the Street. These comments were valuable as no one else could find a reliable forecaster on the Street.

We listened to confirmation this week that the Euro will indeed go to zero should Greece exit the Euro zone. That information was obtained from watching an exclusive cable news interview of Chicken Little by well-known anchor Henny Penny. Chicken Little, a former money manager that appears regularly on cable business programs, said that word on the matter came to him from reliable experts on the Street. These comments were valuable as no one else could find a reliable forecaster on the Street.

So, will the Euro go to zero if Greece exits the Euro zone? Let us think about that. Suppose California fell into the Pacific Ocean tonight, as many have hoped for years. That would be a surprise, an unexpected or tail event. Therefore, the initial reaction of the dollar would be to decline. However, the loss of California would not be a reason for the United States to disintegrate. The dollar would still function as the money of the nation.

After some time, the market would realize that, one, the U.S. would continue as a united entity, and, two, that the U.S. is better off without California. The dollar would then recover the value lost. The same is true for the Euro zone. First, no reason exists for the Euro zone to disintegrate with the loss of Greece. Second, the Euro zone will be better off without Greece and the financial burden associated with it. The Euro's economic value would increase with the departure of Greece just as the value of a company's stock rises after the sale of a money losing subsidiary.

Agri-Commodity markets have not been immune to the gyrations caused by the small children without adult supervision that now dominate trading. We note that the group predicting the imminent collapse of the Euro have a fairly dismal record of forecasting success. They are also forecasting the demise of China, as they have been for a decade or more. We recently observed an article on the 14 reasons to sell China just as we saw similar articles on why to buy Gold, Silver, and Facebook. Investors might be wise to go with China rather than with the forecasters.

Demand for Agri-Foods is fairly resilient. Consumers may decide not to buy a new mobile phone, but they must buy food. That is true of consumers in whatever nation they reside. In the case of China we seemed to have read somewhere that the country has a lot of consumers, most of which may not follow the advice of Chicken Little and the Street's forecasters.

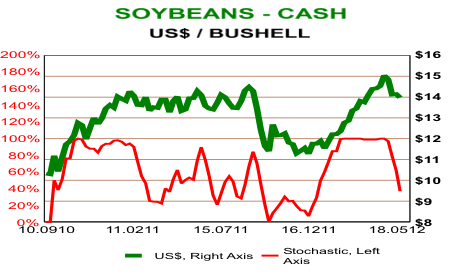

Soybeans are one of those Agri-Commodities that seems to be immune to the gyrations arising from the Greek problem. Cash U.S. soybean prices are portrayed in the chart that follows. This market is a real one, not a fantasy market as exists with derivatives and stocks like Facebook. When China imports those beans, they disappear either into animals or other foods.

Soybean prices began to rally late last year as drought problems with South American production developed. As a consequence of production issues there, U.S. export sales have improved dramatically. While soybean prices have traded down since climbing to $15, as would be expected, little reason exists for a move significantly lower.

Supply is facing two constraints. Northern Hemisphere production will not be available till

harvest season in about three months. Another South American crop will not be produced until early 2013. That is the reality of soybean production. What happens in Greece is irrelevant to what happens in the fields where crops are grown. Soybean plants do not read the frantic ravings of economists.

Sectors of the investment world are less sensitive to some events, and in particular the wild forecasts of Chicken Little's fan club. Agri-Commodities and Agri-Equities are far less vulnerable to Greece's problems, real or imagined, than many parts of the global economy. Yes, demand for grape leaves may suffer, but China will still be importing soybeans and corn. Investigating an economic sector such Agri-Foods when the Street is running around like a chicken with its head cut off often is a good idea. Remember, that is the group that thought Facebook was a sure winner.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2012 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.