Has Gold Price Hit Bottom, and What Will Drive it to $10,000?

Commodities / Gold and Silver 2012 May 31, 2012 - 06:49 PM GMTBy: Nick_Barisheff

The macro-economic conditions that have supported gold's bull run over the past decade have not changed; in fact, they've become progressively worse. This is the calm before the storm, and last week's intra-day low of US$1,535 an ounce may well have been a bottom.

The macro-economic conditions that have supported gold's bull run over the past decade have not changed; in fact, they've become progressively worse. This is the calm before the storm, and last week's intra-day low of US$1,535 an ounce may well have been a bottom.

Figure 1: Currency Decline

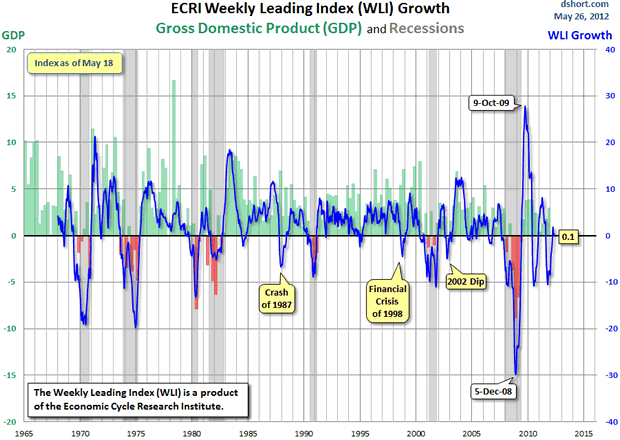

In Europe, a good storm-watch indicator is the Bloomberg Europe 500 Banks and Financial Services Index - down around 35 percent over the last year. In the United States, according to a recent interview with Lakshman Achuthan, COO of the Economic Cycle Research Institute (ECRI), "The question is not whether there will be a [US] recession, but when there will be a recession. We are very clearly on record for forecasting a recession to start by the middle of this year."

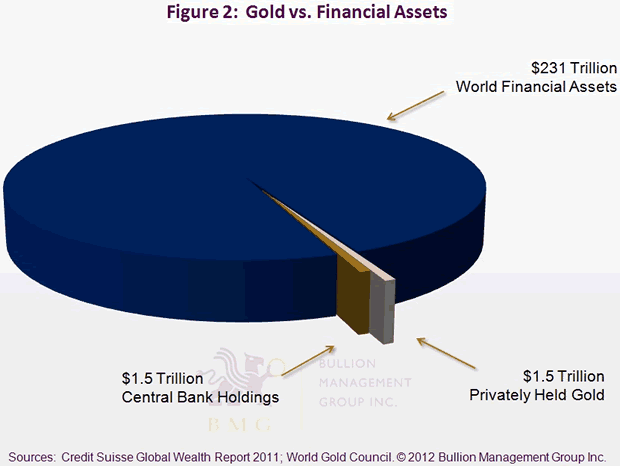

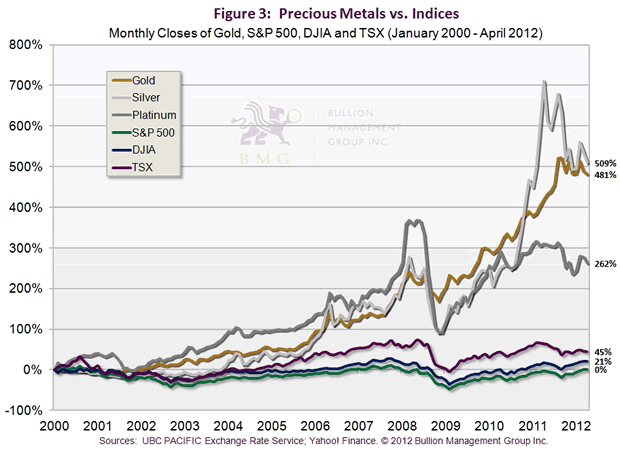

Gold is universally under-owned by everyone, including institutional portfolio and pension fund managers (Figure 2). Pension fund managers have a fiduciary responsibility to meet liabilities. They use asset allocation to achieve diversification in order to reduce risk, maximize performance and thus responsibly manage their funds. To ignore the best-performing asset class year after year could conceivably expose managers and trustees to legal liabilities (Figure 3).

Figure 3: Precious Metals vs Indices

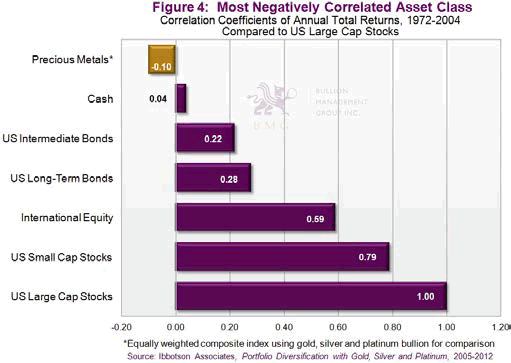

The traditional view is that three asset classes (stocks, bonds and cash) are sufficient to achieve diversification. But Figure 4 shows that only precious metals offer negative correlation to stocks, bonds and cash; a portfolio that consists of only positively correlated asset classes is not balanced or diversified.

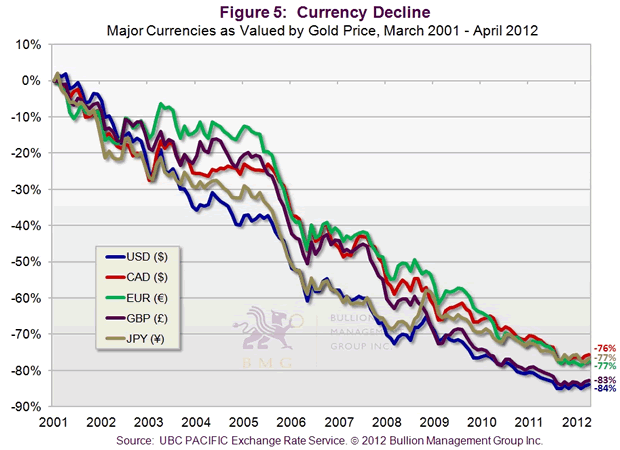

Holding cash for portfolio protection does not work either. Figure 5 shows the dismal performance of five major currencies versus gold since 2001.

More funds and fund managers are now stating that allocations between 5 percent and 10 percent to bullion are prudent. Kevin O'Leary, Chairman of O'Leary Funds and star of ABC's Shark Tank and CBC's Dragon's Den has owned gold for decades and maintains a 5 percent weighting. When the price dips and his weighting drops, he says he buys into weakness.

US-based Wainwright & Co. Economics Inc. studied the allocation of gold required to protect against inflation and found that "a US-equities portfolio in which 15 percent of the assets are diverted to gold bullion would be effectively immune from damage due to a rising gold price and that is, we believe, equivalent to immunity from inflation."

Emerging market demand for gold continues to grow, with China asserting a dominant role. The World Gold Council reported that, for Q1 2012, China's gold demand was up 10 percent year-over-year, despite a 22 percent increase in average prices. Inflation concerns and government attempts to cool off the housing market continue to drive Chinese gold demand and, before long, China will overtake India as the top global gold consumer. Chinese demand for goods, services and, yes, gold, will shape the global economic and investment environment for the balance of the 21st century.

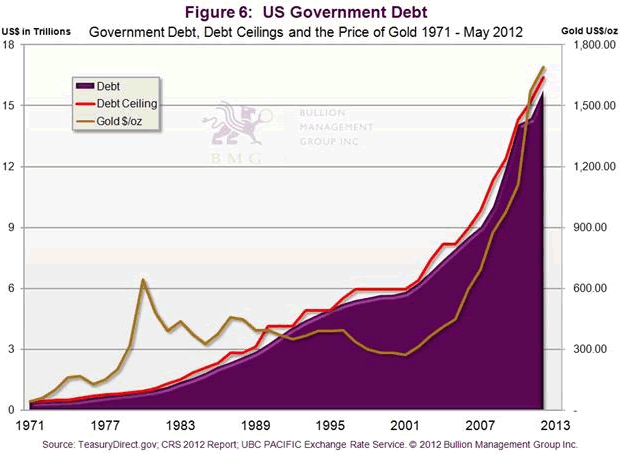

Gold has been a store of value and wealth preservation for more than 3,000 years, while ALL fiat currencies have reverted to zero value after around 30 years. The clock is ticking on the US dollar; it has been 41 years since President Richard Nixon abandoned the gold standard in 1971.

In a recent Capitol Hill hearing, Treasury Secretary Timothy Geithner was asked: If he could request just one final debt ceiling increase, how much would it be? "It would be a lot," he said. "It would make you uncomfortable." The Treasury Department's own projections have US debt at $23 trillion by 2015 - a 64 percent increase to the current debt limit. Given gold's close correlation to US government debt, a gold price in the $2,750 range in two to three years' time seems to be a worst-case scenario. Now is the time to buy gold, not to sell.

Fund managers, advisors and investors must realize that not all bullion investments are created equal. Uncompromised gold that offers liquidity, no counterparty risk, and allows unitholders to own their bullion outright is hard to find, yet well worth the effort, particularly in an era of increasing risk to the very foundations of the financial system.

Due to extensive and increasing risks facing the global economy, gold is poised to proceed in its bull market to a conceivable target of $10,000 an ounce - a topic I deal with at length in my upcoming book to be published by John Wiley & Sons: $10,000 Gold: The Inevitable Rise and Investor's Safe Haven. How best to participate in the upside is open to debate, but we at BMG feel that ownership of uncompromised bullion is the most reliable way of preserving wealth.

By Nick BarisheffNick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

© 2012 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.