Will The Euro Survive?

Currencies / Euro Jun 08, 2012 - 06:52 AM GMTBy: Puru_Saxena

BIG PICTURE - Europe's debt problems are driving the world's financial markets and investors are trying to figure out whether the single currency will survive. Furthermore, the mainstream media is currently awash with scary forecasts about the impending collapse of the Euro and many pundits are now predicting a Greek or Spanish default.

BIG PICTURE - Europe's debt problems are driving the world's financial markets and investors are trying to figure out whether the single currency will survive. Furthermore, the mainstream media is currently awash with scary forecasts about the impending collapse of the Euro and many pundits are now predicting a Greek or Spanish default.

Although nobody possesses a crystal ball and anything is possible, we are of the view that the establishment will not let the Euro fail. Quite the contrary, we believe that ultimately the 'solution' to this crisis will be further fiscal and economic integration within Europe. In the interim, it is conceivable that the European Central Bank (ECB) may extend its Long Term Refinancing Operation (LTRO) and it may recapitalise Europe's banking system. Last but not least, it is probable that the International Monetary Fund (IMF) may intervene and assist the debt plagued nations.

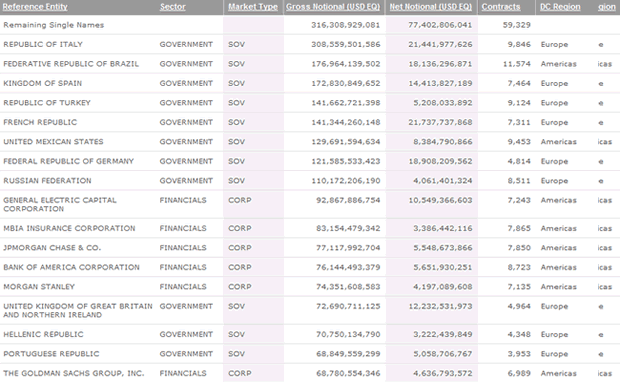

Despite the fact that there is a lot of speculation about Greece abandoning the single currency, we are of the view that the wealthy Greeks will not want to go back to the Drachma. After all, such a move will cause widespread wealth destruction due to the Drachma depreciating against all major currencies. Moreover, Greece's sovereign default will open a can of worms and trigger Credit Default Swaps, thereby forcing the banks to pay out tens of billions of dollars (Figure 1, see data for Hellenic Republic). Finally, if Greece is allowed to default and walk away from its obligations, then who is going to prevent Spain or Italy from doing the same?

Figure 1: Credit Default Swaps exposure

Source: Depository Trust and Clearing Corporation

Look. We are not saying that offering more debt to an insolvent entity is a sane way of solving a debt crisis. Neither are we claiming that austerity is going to provide economic relief and somehow solve Europe's problems. Nonetheless, if nothing is done to prevent a systemic collapse, the consequences will be catastrophic. Therefore, we find it hard to believe that the world's policymakers will simply stand back and let the single currency unravel.

Remember, a disorganised breakup of the Eurozone will create shockwaves across the world's financial system, credit markets will freeze up and global trade will come to a screeching halt. More importantly, the death of the Euro will shatter investor confidence and a deflationary depression will surely follow. Bearing in mind these dire consequences, we happen to believe that eventually, France and Germany will agree to save the single currency. Unfortunately, we do not know the exact details of the bailout, but we will not be surprised if Eurobonds came into existence. Although the Germans may not like the idea of issuing collective debt, we suspect that in the interest of the region, they will be forced into action.

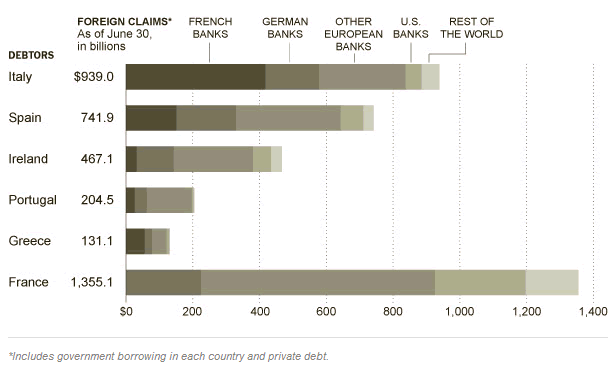

At this stage, we want to make it absolutely clear that we do not subscribe to Keynesianism and firmly oppose to monetary inflation, taxpayer sponsored bailouts and 'stimulus'. However, in this instance, given the magnitude of Europe's problems, we do think a policy response is warranted. Given the foreign debt exposure (Figure 2) we are concerned that if nothing is done promptly and a sovereign default occurs, the post-Lehman financial collapse of 2008 will feel like a picnic on a sunny day.

Figure 2: Foreign debt exposure to various Eurozone nations

Source: Bank for International Settlements

In our view, the only permanent solution to the ongoing crisis is debt pardoning. In fact, we believe that an organised form of debt restructuring will solve Europe's problems, but under this scenario, the creditors and bondholders will have to absorb some losses. So far, the bondholders have been unwilling to accept their losses and this is why the European debt drama is still hounding the world's financial markets. The quicker the bondholders write off some of the loans, the sooner Europe will be able to stand on its own feet.

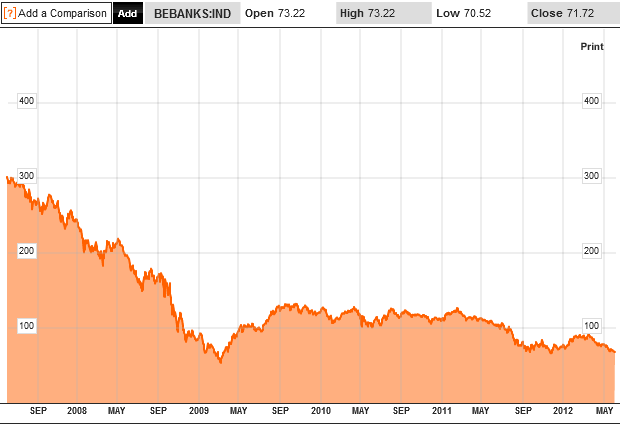

In any event, investors continue to be extremely fearful and they are fleeing the Euro like there is no tomorrow. It is interesting to note that the single currency has depreciated significantly over the past year and it is currently trading around 1.25 against the US Dollar. Furthermore, it is worth noting that Europeans continue to withdraw their savings from regional banks and this disaster is reflected in the dismal performance of the Bloomberg Europe 500 Banks and Financial Services Index. Figure 3 confirms that Europe's financial industry is in serious trouble and the bellwether index has already declined by almost 80% from its high recorded in 2007!

Figure 3: Bloomberg Europe 500 Banks and Financial Services Index

Source: Bloomberg

As far as European bank runs are concerned, it is noteworthy that in Greece alone, Euro 3 billion worth of deposits have been pulled out of the banking system since the recent elections. Unless the ECB provides a big bailout, Greece is now only Euro 21 billion away from a complete banking collapse.

Not to be outdone by the Greeks, anxious Spaniards have also been pulling money out of local banks. For instance, recent data from Bank of Spain reveals that Euro 66.2 billion was sent abroad in March alone and the flight of capital has not abated in the recent weeks.

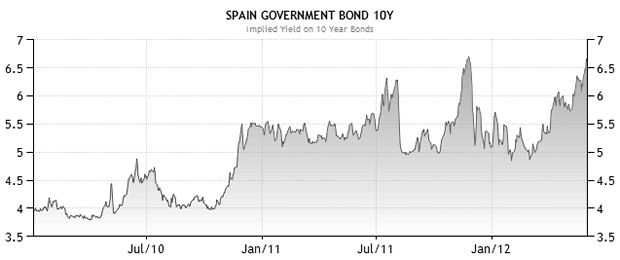

Unfortunately for debt plagued Spain, its sovereign bondholders are in panic mode and they are dumping their holdings. Figure 4 reveals that Spain's 10-Year Government Bond yield is surging and it is now very close to last autumn's level.

Figure 4: Spain's borrowing cost is rising!

Source: www.tradingeconomics.com

Given the rampant fear in the financial markets, we believe a meaningful policy response is around the corner. If our assessment is correct, then after some additional volatility in markets, risky assets should stabilise and stage a multi-month rally. However, until a concrete bailout is announced, investors should brace themselves for additional weakness.

For our part, we are watching the situation closely and if our trend following system flashes a 'sell', we will liquidate our holdings and defend capital. Under this scenario, once a policy response is unleashed, we will re-invest the capital in our preferred holdings. Conversely, if the markets stabilise around these levels and resume their uptrend, we will stay invested in our preferred holdings.

In terms of asset-classes, we are of the view that over the following decade, US stocks will outperform commodities as well most developing markets. Now, we are aware that this prognosis is contrary to the consensus view. However, after 12 years of sideways range trading and today's compressed valuations, we believe that Wall Street's next secular bull market could commence within 2-3 years.

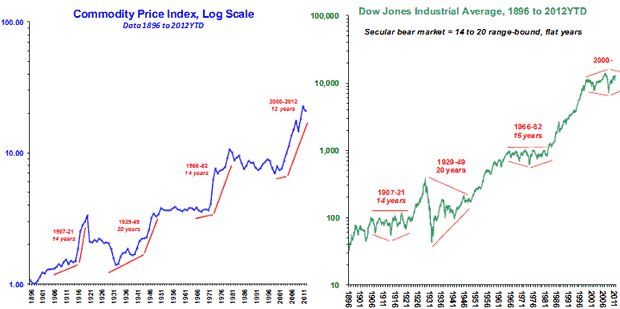

Figure 5 shows that secular bull markets for commodities (left panel) align with secular bear markets for large cap US stocks (right panel), and vice versa. Furthermore, strength in US stocks corresponds to flat commodities and a strong US Dollar. It is notable that over the past 12 years, commodities outperformed US stocks by a wide margin. However, this trend may have already reversed and if so, large cap US stocks will probably outperform commodities going forward.

Figure 5: Wall Street - waiting for the next secular bull market?

Source: Barry Bannister, Stifel Nicolaus

From a fundamental perspective, there can be no doubt that Europe's economy is struggling and China's growth is moderating. Thus, in this low growth environment, physical demand for commodities will remain muted and this lack of incremental usage should keep a lid on prices.

Bearing in mind these developments, for the first time in a decade, we have gained a large investment exposure to leading US stocks and eliminated our holdings in the commodities sector.

Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com.

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2012 Puru Saxena Limited. All rights reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.