Davos, Debt & Systemic Failure - When West Meets East

Stock-Markets / Global Financial System Jan 28, 2008 - 09:11 AM GMTBy: Darryl_R_Schoon

The preferred diet of most Davos attendees is a fusion inspired composition of individual, government, and corporate debt combined with a free-market frisee of lax regulatory oversight held together by a roux of central bank credit that dissolves instantly when paired with matching counter-party risk.

The preferred diet of most Davos attendees is a fusion inspired composition of individual, government, and corporate debt combined with a free-market frisee of lax regulatory oversight held together by a roux of central bank credit that dissolves instantly when paired with matching counter-party risk.

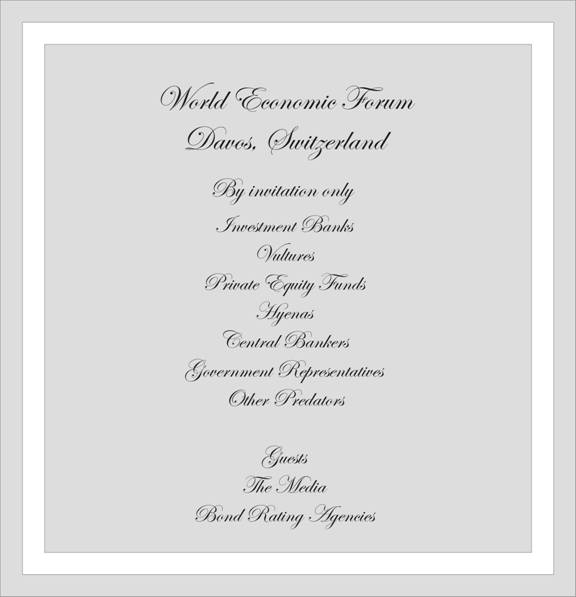

The January 2008 gathering in Davos , Switzerland at the World Economic Forum is similar to the 1957 meeting in Palermo , Sicily of American and Sicilian Cosa Nostra crime families who met to discuss mutual problems and opportunities. The notable difference being that those in the Cosa Nostra live outside the law; while those at the World Economic Forum in Davos make them.

Those in Davos, however, share with the Cosa Nostra a common problem—the success of both depends on inherently unstable systems. The Cosa Nostra model is based on violence and greed which is both its strength and weakness. Capitalism, the source of wealth for those in Davos, is based on greed and leveraged debt, a combination as powerful and effective as the system of the Cosa Nostra—and just as unstable.

WHEN SYSTEMS FAIL

Unstable systems can function for years without serious problems. But over time, unstable systems will always break down. We are witness to such a systemic failure today. Global credit markets are slowing and contracting. The capitalist system responsible for economic expansion and wealth is in disarray.

Debt, in capitalist systems, is a wondrous device. That is, until it can't be paid back. Under capitalism, credit fuels expansion but it does so at a cost. As capitalism expands, credit becomes debt and the greater the expansion, the greater the debt.

EXPANSION BEGETS DEMISE

Capitalism's fatal flaw is apparent only in its later stages. As capitalism matures, its inherent systemic instability manifests. The very expansion of capitalism sets in motion its demise. The Achilles heel of capitalism is its perpetual need to expand.

Only perpetual capital expansion can create sufficient capital flows to service and retire previously created debts, the amounts of which are always increasing because of the accruing compound interest being charged. While any slowdown is cause for worry, a contraction bodes far worse.

FEAR IN DAVOS

WHAT A DIFFERENCE A YEAR MAKES

One year ago, the mood at Davos was one of quiet, almost smug, confidence. The on-going economic expansion appeared to be endless, the profits of investment bankers skimmed off the top of productive enterprise was greater than ever. Private equity, the investment banker's equivalent of flipping real estate, was the hottest game in town.

It is no longer. Today in Davos, the scent of Armani is now mixed with the acrid smell of anxiety produced by falling markets and uncertain futures. Concern has replaced confidence. The major phernome in Davos today is fear.

WHEN WEST MEETS EAST

A year ago, the confidence of those gathered in Davos was based on the belief that if an economic slowdown occurred, it would be offset by (1) the expansion of Asian economies and (2) the ability of global markets to decouple from slowing American demand. Both assumptions have proved themselves wrong.

The recent expansion of Asia was made possible by the debt-based consumption of American consumers. Now that America 's consumers have run out of cash and credit, the economies of Asia — China , India , Japan , Korea , Taiwan , Malaysia , etc. will slow. When capital markets slow, you know what happens; and, if you don't, you soon will.

WHEN CREDIT MEETS SAVINGS

As capitalism expanded from the west to the east, western bankers hoped their success would be repeated. They were wrong. Asians responded to the new paradigm and their new found wealth by saving, not spending.

Western bankers were dismayed by this unexpected reaction. If Asian economies continued to save instead of spend, it would slow the expanding juggernaut of capitalism; and if capital expansion slows, like bicycles, capitalism doesn't do as well at slow speeds.

CHINA AND GOLD

As western bankers run out of markets to exploit, leaving behind tapped out and overextended borrowers, e.g. consumers, governments, corporations etc., it was hoped Asia would provide the new horizon needed for capital markets to expand.

Asia instead will be a conundrum to the west. Not the surrogate state, militarily and economically, that Japan is in danger of becoming, China will prove to be less amenable to the western bankers hoping to economically colonize the last great prize of imperialism's global puzzle.

While Chinese spend, they also, as do most Asians, save. They are currently holding $1.2 trillion in foreign savings—and this ingrained tendency to save will not give western bankers the acceleration they need to keep capital markets expanding as western markets contract.

At Davos, Dominique Strauss-Kahn, the Managing Director of the IMF, urged emerging economies with sound balance sheets to run fiscal deficits in order to offset a slowdown by US consumers. Will Asian economies choose to encumber their balance sheets in order to save the west's capital markets? It is not likely.

Asians, in times of fiscal stress, prefer the safety of gold to credit and debt; and, although gold is no longer viewed as a mainstream investment in the west, gold still retains its traditional appeal in the east:

In Caishikou Department Store, a popular physical gold dealer in Beijing, more than 100 people lined up to purchase bullion for the Lunar Year of the Mouse on Nov. 22, the first trading day of the products. More than 200 kilograms of the gold bars were sold within 1.5 hours. Moreover, the total subscription amounted to two tons . Xinhua, January 19, 2008

Gold will be the choice of Chinese seeking safety and profit in the coming year. India , another large emerging Asian economy, values gold as much, if not more, than China . This does not bode well for bankers in the west.

Davos will not be the same next year. If you're planning on going, be sure to take some air freshener.

Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

Note: I will be speaking at Gold Standard University Live in Dallas , TX , February 11-17 which is presented by Professor Antal Fekete . This is a unique opportunity to hear Professor Fekete who is an expert on gold and its role in monetary matters. Details are available at www.professorfekete.com .

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.