Plunge in Family Net Worth Supports Portfolio Gold Diversification

Commodities / Gold and Silver 2012 Jun 18, 2012 - 12:10 PM GMTBy: Pete_Grant

The Fed’s triennial Survey of Consumer Finances (SCF) came out last week and the results were nothing short of astounding. The data show that the Great Recession wiped out nearly 40% of the typical American family’s net worth.

“Data from the 2007 and 2010 SCF show that median income fell substantially and that mean income fell somewhat faster, an indication that income losses, at least in terms of levels, were larger for families in the uppermost part of the distribution. Overall, both median and mean net worth also fell dramatically over this period—38.8 percent and 14.7 percent, respectively.”

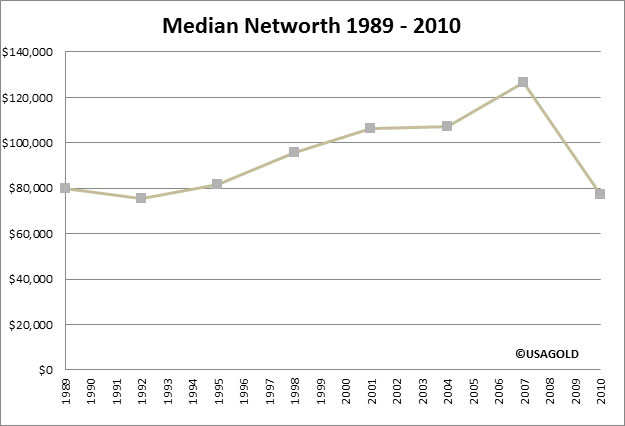

Median family net worth plunged from $126,400 in 2007 to $77,300 in 2010, close to levels not seen since the 1992 survey. The median, as the Los Angeles Times pointed out is “the point smack in the middle of those richer and poorer.” In other words, the middle class bore — and continues to bear — the brunt of the Great Recession, largely because the vast majority of middle class wealth was wrapped up in the family home and the stock market; either through direct investment in shares or through retirement plans.

According to the Fed, another key contributor to the erosion of wealth over the period, was the marked decline in “business equity”. This may be of particular interest to the business owners and professional practitioners that comprise a very large percentage of our client base.

A Washington Post article summed it up thusly: “Over a span of three years, Americans watched progress that took almost a generation to accumulate evaporate. The promise of retirement built on the inevitable rise of the stock market proved illusory for most. Homeownership, once heralded as a pathway to wealth, became an albatross.”

Certainly some are no-longer among the ranks of homeowners, and some have unquestionably reduced exposure to equities, either as a strategic move or out of necessity. However, perhaps unsurprisingly, investors remain dominantly allocated to the traditional asset classes.

Case in point: A recent article featured on the website of the American Association of Individual Investors (AAII) on the topic of asset allocation suggested “the three most important asset classes for individuals are stocks, bonds and cash.” Talk of diversification focused on sub-asset allocation; “diversifying among growth and value, large cap and small cap, U.S. and international, and so on.”

While the piece concedes that institutional portfolios “have a range of up to 12 asset classes,” all-too often (beyond real-estate in the form of the family home) stocks, bonds and cash are presented as the only options for individual investors.

Despite a myriad of extraordinary measures on the part of Congress and the Fed, a true US economic recovery remains elusive to this day. Yet, the Fed’s über-easy monetary policy has contributed to a rebound in the stock market, commencing with the announcement of QE1 in 2009. Such policies lured investors right back into one of the asset class that had just bitten them badly, by pushing yields on bonds and cash below the rate of inflation.

In fostering a negative real interest rates environment, the Fed has succeeded in discouraging saving, and pushed investors out along the risk curve. Rather than losing money in real terms with cash deposits and bonds, investors seem willing to take their chances with equities once again.

What the Fed survey data said to me was that the portfolios of US families — and particularly those of middle class families — were improperly allocated and could have benefited from diversification into an alternative asset such as gold. From the beginning of 2007 until the end of 2010, the price of gold rose 122%. Over the longer period noted in the chart below (1989 to 2010) gold is up 243%. Even a relatively small allocation to physical gold (we recommend 10% to 30% of net assets) could have significantly mitigated the devastating impact of the Great Recession on the family balance sheet. Yet, physical gold remains a grossly under-owned asset.

Egon von Greyerz, the managing director of Matterhorn Asset Management AG in Zurich says “Less than 1% of investors own gold.” The most recent Erste Group study puts a finer point on it:

“The global equity markets are currently valued at USD 56 trillion according to Bloomberg, while the fixed income segment amounts to USD 91 trillion according to BIS. If we assume that only 20% of the gold reserves are investable (i.e. come in the form of bullions, ETFs, or coins), this would translate into a value of USD 1.4 trillion (at USD 1,500/ounce) and into an allocation of close to 1%. In comparison with bonds, gold holdings are small: bond holdings worldwide amount to almost USD 14,000 per capita, whereas gold reserves per capita are less than USD 1,180.”

In the May issue of our newsletter, USAGOLD president Michael J. Kosares wrote an excellent article in which he suggested, "just as we inoculate our bodies against disease, we should inoculate our portfolios." The devastating plunge in the net worth of American families in recent years clearly indicates that families would be well served to heed that advice. With gold trading near the midpoint of the 6-month range, arguably the medicine for beleaguered portfolios is pretty reasonably priced right now. __

Peter Grant spent the majority of his career as a global markets analyst. He began trading IMM currency futures at the Chicago Mercantile Exchange in the mid-1980's. Pete spent twelve years with S&P - MMS, where he became the Senior Managing FX Strategist. The financial press frequently reported his personal market insights, risk evaluations and forecasts. Prior to joining USAGOLD, Mr. Grant served as VP of Operations and Chief Metals Trader for a Denver based investment management firm.

This special report is distributed with the understanding that it has been prepared for informational purposes only and the Publisher or Author is not engaged in rendering legal, accounting, financial or other professional services. The information in this newsletter is not intended to create, and receipt of it does not constitute a lawyer-client relationship, accountant-client relationship, or any other type of relation-ship. If legal or financial advice or other expert assistance is required, the services of a competent professional person should be sought. The Author disclaims all warranties and any personal liability, loss, or risk incurred as a consequence of the use and application, either directly or indirectly, of any information presented herein.

By Pete Grant , Senior Metals Analyst, Account Executive

USAGOLD - Centennial Precious Metals, Denver

For more information on the role gold can play in your portfolio, please see The ABCs of Gold Investing : How to Protect and Build Your Wealth with Gold by Michael J. Kosares.

Pete Grant is the Senior Metals Analyst and an Account Executive with USAGOLD - Centennial Precious Metals. He has spent the majority of his career as a global markets analyst. He began trading IMM currency futures at the Chicago Mercantile Exchange in the mid-1980's. In 1988 Mr. Grant joined MMS International as a foreign exchange market analyst. MMS was acquired by Standard & Poor's a short time later. Pete spent twelve years with S&P - MMS, where he became the Senior Managing FX Strategist. As a manager of the award-winning Currency Market Insight product, he was responsible for the daily real-time forecasting of the world's major and emerging currency pairs, along with gold and precious metals, to a global institutional audience. Pete was consistently recognized for providing invaluable services to his clients in the areas of custom trading strategies and risk assessment. The financial press frequently reported his expert market insights, risk evaluations and forecasts. Prior to joining USAGOLD, Mr. Grant served as VP of Operations and Chief Metals Trader for a Denver based investment management firm.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.