Iran's Notice to Crude Oil Importers Results in Monetary Contraction of $500 billion of PetroDollar Reserves

Commodities / Global Financial System Jan 30, 2008 - 12:50 PM GMTBy: Rob_Kirby

Much was made of Iran's announcement back in December, 2007 – that they would no longer be accepting U.S. Dollars as payment for their chief export, crude oil:

Much was made of Iran's announcement back in December, 2007 – that they would no longer be accepting U.S. Dollars as payment for their chief export, crude oil:

Iran stops selling oil in dollars - Tehran moves closer to confrontation with U.S.

Posted: December 8, 2007

12:46 p.m. Eastern

By Jerome R. Corsi

© 2007 WorldNetDaily.com

Iran today announced a decision to end all oil sales in dollar transactions, moving one step closer to confrontation with the United States…..

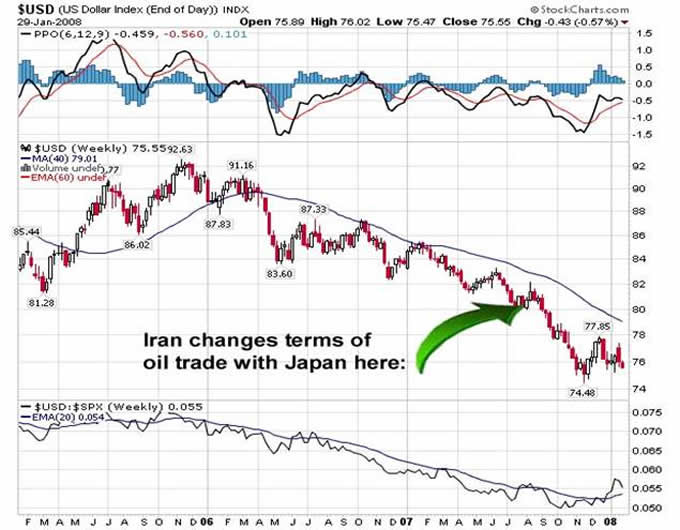

Perhaps fewer people would remember a pre-cursor to this announcement – back on July 13, 2007 – when Iran put Japan [its largest oil trading partner] on notice that they would only conduct their crude oil trade in Yen going forward:

Times Online

July 13, 2007

Iran demands oil pay in yen not dollars

The dollar fell against the yen this afternoon on reports Iran has asked Japan to stop paying for its oil in dollars

Robert Lindsay

The dollar was driven down against the Japanese yen this afternoon, hit by the news that Iran had asked Japan to pay for its oil purchases in the Japanese currency and not in dollars.

Iran has sent a letter to Japanese refiners, signed by Ali A Arshi, the general manager of crude marketing and exports for Iran's national Iranian Oil Company, according to a report by Bloomberg.

The letter asks for yen payments "for any/all of your forthcoming Iranian crude oil liftings." The request is for all shipments "effective immediately".

One might logically think this would have quite an impact on countries that buy Iran's 2.5 million barrels per day of exported oil.

So let's take a look at which countries, or just who buys Iranian Oil:

Iran Economy - 2007

http://www.theodora.com/wfbcurrent/iran/iran_economy.html

SOURCE: 2007 CIA WORLD FACTBOOK

Oil - exports:

2.5 million bbl/day (2004 est.)

Exports - partners:

Japan 16.9%, China 11.2%, Italy 5.9%, South Korea 5.8%, Turkey 5.7%, Netherlands 4.6%, France 4.4%, South Africa 4.1%, Taiwan 4.1% (2005)

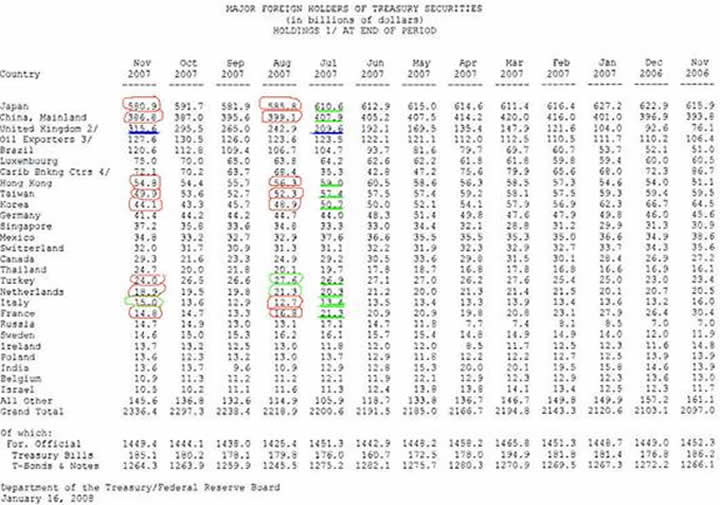

Now, let's take a look at the U.S. Dollar reserve positions of Iran's primary crude oil trading partners [ TIC data compliments of the U.S. Treasury]:

What the table above clearly shows is this: Countries that import Iranian crude oil clearly “took notice” and made dramatic adjustments to their foreign reserve holdings [for the most part] – beginning immediately after July 13, 2007 – when Iran put Japan “on notice” that they would be required to pay for their crude in Yen.

Adjustments To U.S. Dollar Reserve Holdings July / August 2007

[Iran's Crude Oil Trading Partners]

Japan -24.8 B

China + Hong Kong -10.7 B

Italy - .7 B

South Korea - .8 B

Turkey + .7 B

Netherlands +1.0 B

France - 4.5 B

Taiwan - 4.9 B

Net Change -44.7 B

The with-drawl of U.S. Dollar reserves in one month - on this scale – was almost certainly a contributing factor to the “liquidity event” that gripped the U.S. banking system in August, 2007.

Remember Rothbard's Explanation as to How Fractional Reserve Banking Works:

Let's see how the fractional reserve process works, in the absence of a central bank. I set up a Rothbard Bank, and invest $1,000 of cash (whether gold or government paper does not matter here). Then I "lend out" $10,000 to someone, either for consumer spending or to invest in his business. How can I "lend out" far more than I have? Ahh, that's the magic of the "fraction" in the fractional reserve. I simply open up a checking account of $10,000 which I am happy to lend to Mr. Jones. Why does Jones borrow from me? Well, for one thing, I can charge a lower rate of interest than savers would. I don't have to save up the money myself, but simply can counterfeit it out of thin air. (In the nineteenth century, I would have been able to issue bank notes, but the Federal Reserve now monopolizes note issues.) Since demand deposits at the Rothbard Bank function as equivalent to cash, the nation's money supply has just, by magic, increased by $10,000. The inflationary, counterfeiting process is under way.

What we experienced last summer – namely, the with-drawl of U.S. Petro-Dollar Reserves from the banking system created the “reverse” of the expansionary multiplier effect outlined above by Murray Rothbard.

This means that a 44.7 B with-drawl of U.S. Dollar reserves from the U.S. Dollar-centric banking system had the predictable cause / effect of close to a ½ Trillion monetary contraction event.

This extremely destabilizing event sent the U.S. Dollar into a tail-spin – with the U.S. Dollar Index breaking major support at 80:

Not surprisingly, this also marks the same time that the price of gold takes off:

The response [to date] of the Anglo / American banking axis that rules this earth is clearly illustrated in the bloating of the United Kingdom's [Bank of England] U.S. Dollar reserve account in an attempt to take up the slack, or better stated, re-inflate the banking system. Since July, 2007 – U.K Dollar reserves have swelled from 209 to 315 billion – quite a trick for a deeply indebted country, ehhh?

This clearly illustrates Central Bank resolve to “inflate” this problem away.

You see folks, what is really at risk that officialdom will not speak of is this: the same Old European names that have been historically associated with owning the Bank of England are also the principal owners of the Federal Reserve. Their real business is a GLOBAL MONOPOLY on creating fiat money out of thin air.

This is why anyone [hello Iran?] and anything [hello gold?] that competes, or poses an alternative, to their U.S. Dollar-centric view of the world is the object of scorn and ridicule.

This is reality.

By Rob Kirby

http://www.kirbya nalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research.

Many of Rob's published articles are archived at http://www.financialsense.com/fsu/editorials/kirby/archive.html , and edited by Mary Puplava of http://www.financialsense.com

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.