Gold Stocks: Bottom, Re-Test, Launch?

Commodities / Gold & Silver Stocks Jul 16, 2012 - 03:42 AM GMTBy: Adam_Brochert

Though I favor physical Gold held outside the banking system that can't get MF Global'd over those paper Gold derivatives known as Gold stocks, there are times when a speculative opportunity presents itself that cannot be ignored (at least not by me). Now is such a time in Gold stocks. In my last post, I welcomed a new cyclical Gold stock bull market. I continue to believe a new cyclical Gold stock bull market has already begun and we are now completing (if we haven't already) the re-test of the mid-May, 2012 lows. What comes next? The launch!

Though I favor physical Gold held outside the banking system that can't get MF Global'd over those paper Gold derivatives known as Gold stocks, there are times when a speculative opportunity presents itself that cannot be ignored (at least not by me). Now is such a time in Gold stocks. In my last post, I welcomed a new cyclical Gold stock bull market. I continue to believe a new cyclical Gold stock bull market has already begun and we are now completing (if we haven't already) the re-test of the mid-May, 2012 lows. What comes next? The launch!

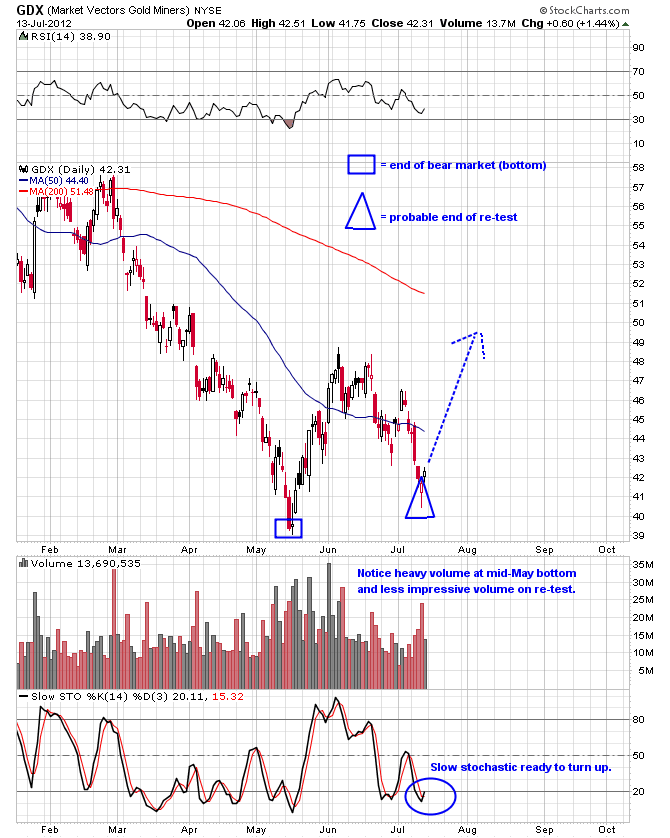

Here's a 6 month daily chart of the GDX ETF thru Friday's close to show you my thoughts:

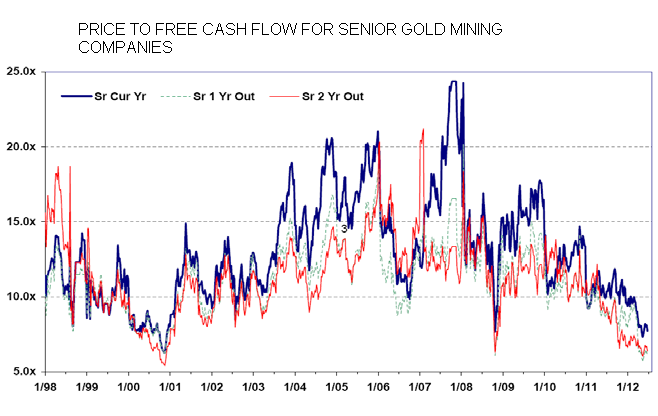

It is important to understand that fundamental valuations and "bigger picture"/longer term technical analysis both support a bottoming process here. My last post discussed some of these factors. And here is yet another important fundamental piece of data courtesy of the Tocqueville Gold Fund 2nd quarter 2012 investor letter (there are many other great data points at this link and the chart below is apparently courtesy of BMO Capital Markets):

The dark blue line in the chart above demonstrates that the price of senior Gold mining stocks relative to their current year cash flows is at levels last seen at the depths of the 2008 crash and the beginning of the current Gold stock secular bull market at the end of 2000. The Gold stock bears keep screaming about the rising costs of Gold mining. They are right about rising costs, but they neglect to mention the other side of the argument, which is more important: margins are RISING for large cap Gold miners, not falling, because the price of Gold is rising faster than costs are. And we are entering another coordinated global recession (no, there won't be any decoupling this time, either), which means the price of general commodities (like oil) should fall relative to Gold. This will further improve margins for Gold miners.

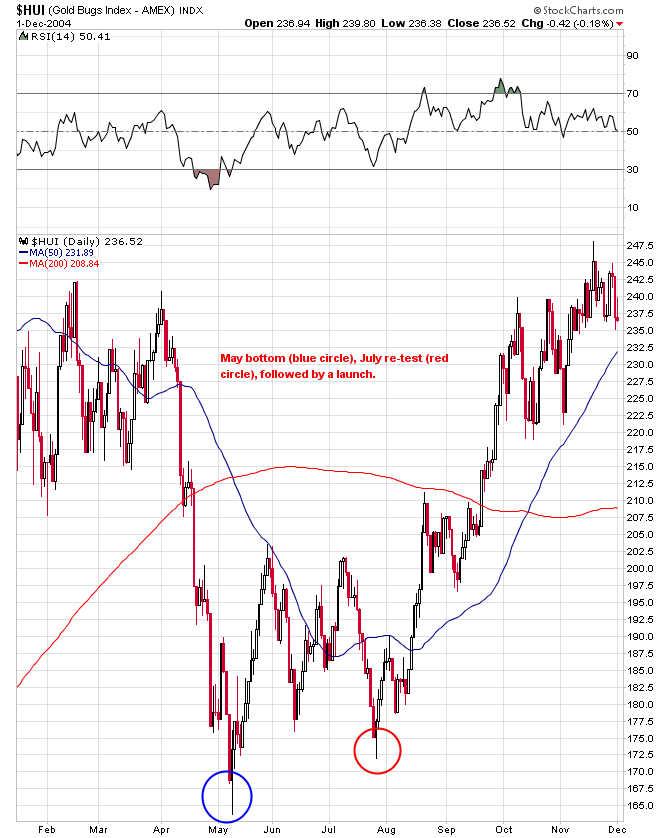

We have seen several bottoms in Gold stocks in the past that resemble the current set-up. Here are some examples of the "bottom, re-test, launch" sequence that I believe is repeating right in front of our eyes. First up, the 2004 bottom, using the HUI Mining Index ($HUI):

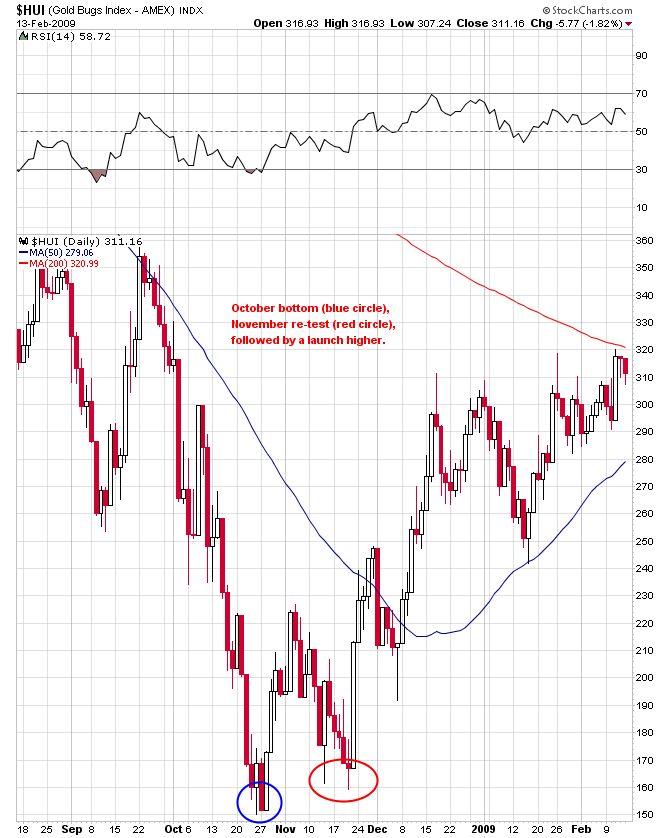

Next up, late 2008, also using the HUI mining index:

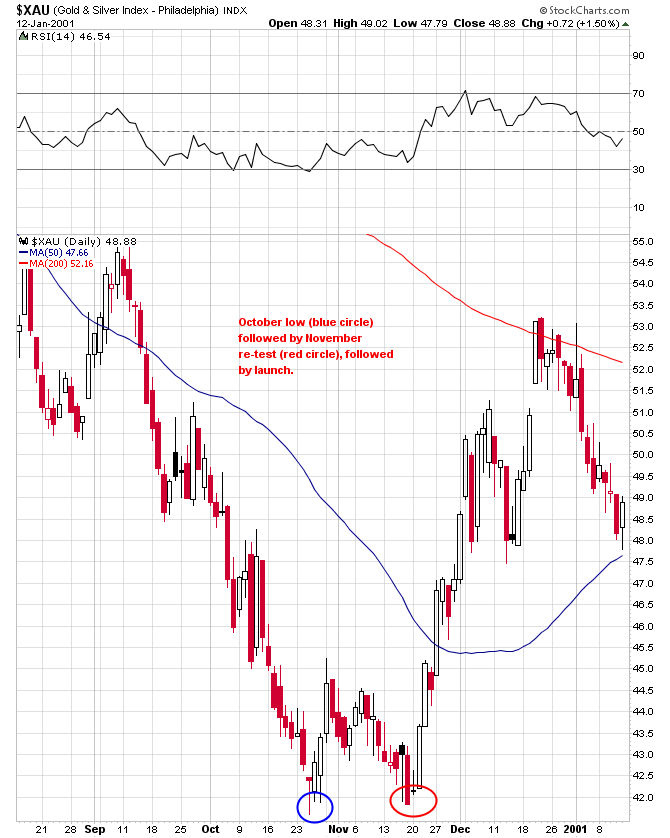

Or even way back in 2000 to start the secular Gold stock bull market using the XAU mining index:

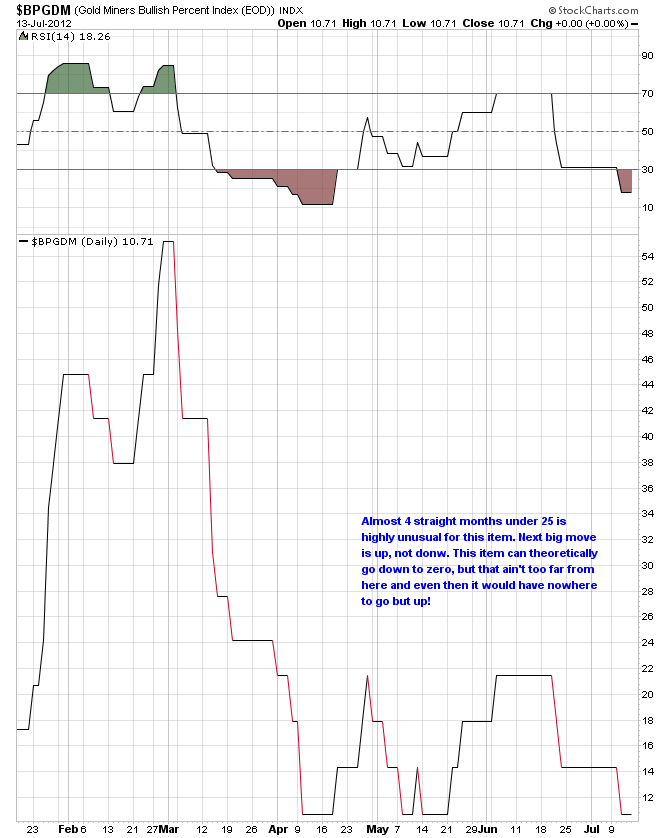

Could this time be different? Sure, anything is possible in markets. But given the low valuations in Gold stocks by multiple measures, recent 40% bear market in Gold stocks (2nd worst of the last 12 years in percentage terms and longer than average duration), and suicidal sentiment in the PM sector, the odds are now heavily favoring the Gold stock bulls here. Here is a chart of the "bullish percent index" for the GDM (the index that backs the GDX ETF) over the past 6 months to also show how beaten up the senior Gold stocks are ($BPGDM):

Gold stocks are a speculation for me while physical Gold is my way of protecting my savings from the ravages of a financial and bureaucratic system out of control. Until the Dow to Gold ratio gets to 2 (and we may well go below 1 this cycle), it is silly to be overly bearish on the precious metals sector. While traders bicker over whether Gold is about to break up or down right now, they miss the "forest": by the time we reach December 31st, Gold is likely to be up in percentage terms for the year, which would mark its 12TH YEAR IN A ROW. Is Gold a bubble or are there just a lot of sour grapes out there from those that have either missed the move so far or are desperately trying to prevent the inevitable "official" return of Gold as the anchor for a new international monetary system?

Hold onto your Gold. This thing is far from over. If you'd like to try speculating in the paper PM sector once you've established a core physical metal position, consider giving my low-cost subscription service a try. A one month trial subscription is only $15.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2012 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.