One-trick pony Ben Bernanke, Here Comes the Gold Stock Mania!

Commodities / Gold and Silver 2012 Sep 14, 2012 - 04:00 AM GMTBy: Jeff_Berwick

One-trick pony Ben Bernanke woke up this morning, hopped in his limo, and headed off to save the world! Or at least, in his own mind he did.

One-trick pony Ben Bernanke woke up this morning, hopped in his limo, and headed off to save the world! Or at least, in his own mind he did.

As many of us who are paying attention know, however, Ben Bernanke is an idiot-savante of memorizing statist and completely fallacious economic ideas born from an even more disturbed man named John Maynard Keynes. These and other Keynes Kool-aid drinkers like Paul "I look homeless" Krugman believe things like breaking windows improves the world because broken windows make more work for us slaves to do. They also believe that counterfeiting pieces of paper with dead criminals painted on them can improve the world... as it makes us all "feel" wealthier, even though we are poorer. They even believe that if the latest round of QE doesn't work that we may have to resort to burying the newly printed Federal Reserve Notes and then paying people to dig them up... or fake an alien invasion... to "improve" the economy!

And, if all that fails they'll blame it on things like "animal spirits". And if you don't take that as a suitable answer they'll just shrug and say, "Hey, well, in the end, we're all dead anyways".

Yes, this is what Ben Shalom Bernanke believes and so today he walked up to the microphone and announced that he will print up new money and buy $40 billion worth of mortgage backed securities for as long as it takes to get the unemployment rate down to 7%! Considering that the true unemployment rate (not the government hedonistically adjusted propaganda numbers) is closer to 23%, he's really got his work cut out for him! Especially because the biggest obstacle to a true reduction in real unemployment is Ben Bernanke's QE3 itself.

That's because printing up endless amounts of fiat currency units only has one real outcome... and that is the destruction of the economy as consumers, business people and entrepreneurs are all given false price signals caused by the onslaught of untraceable new money, and they therefore cannot make economic calculations to give the market what it wants properly. This is what caused the tech bubble... this is what caused the housing bubble... and this is what is likely going to cause the gold and gold stock bubble.

HERE COMES THE GOLD AND GOLD STOCK MANIA!

You may be scratching your head. We tend to pick on people like Helicopter Ben Bernanke and Barack "Nearly doubled the US National Debt in 4 year" O'Bomber all the time but all of their actions are going to foment a bubble in the very things in which we have a large holding at TDV. But there are some things more important than money... and the likes of Bernanke and O'Bomber are also continuing to impoverish billions and by the time it is all done, possibly kill billions as well. So, we take these profits with a very heavy heart.

But since there is not much we can do except take advantage of their and the great majority of the public's stupidity, then we'll just place our chips and front run the crowd... and watch as it all falls apart live over the internet from somewhere in Mexico or South America.

Ed Bugos, Senior Analyst of The Dollar Vigilante happened to be out on a hunting trip in Western Canada when the news came through so we couldn't get all of his input on this yet, but last we heard he was running through the forest as fast as he could back to his computer after hearing the news!

Vin Maru, Chief Editor of the TDV Golden Trader also was furiously going through his list of massively undervalued juniors looking to see which ones might be the type that go from $0.02 to $2.00 in this type of market.

If you've been waiting to get on board with some of these junior gold stocks, you just got your wake-up call.

QE TO INFINITY!

We've been on record as saying Quantitative Easing will never end. Here is Ed Bugos in the March 2011 issue of TDV talking about how people shouldn't be worrying about the "end" of QE2 in June of last year:

"So it is no surprise and rather amusing to hear the media and other pundits speculate about when QE2 will end. They will be the last to get it. It cannot end or the Treasury market is ruined. Even a traditional tightening will be difficult for the Fed to pull off this time around. Not only is the government so much in hock that it won’t be able to absorb the higher rate of interest itself, but also, since it pays interest on reserves now any attempt to push the target rate higher will cause those reserves to inflate even more...not to mention give banks the incentive to accelerate money creation."

Sure, exogenous events such as the crisis in Europe enabled them to pull back for a while... and the commercial banks continued to ensure that the pace of money printing never came below 10% the entire time, but it was absolutely baked in the cake that they'd return for more... and more... and more. Notice also that Ed said they could not even tighten interest rates either... and they've remained at 0%.

STAGFLATION

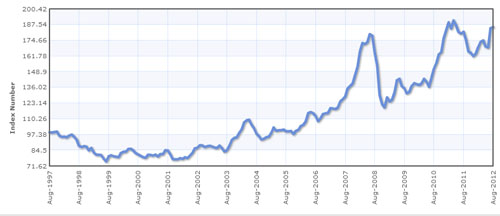

Perhaps the most bizarre part of all this is how the word "stagflation" hasn't started to crop up more. Here we have the Dow Jones Industrial Average at near alltime nominal highs, one in six US citizens don't get enough food because they can't afford it, food prices at near all-time highs (Commodity Food Price Index below).

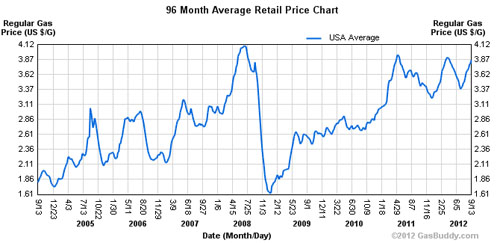

Gas prices near all-time highs in nominal terms (historical gas price chart from Buddy.com below).

And yet, all the people on CNBC natter on that there is no inflation?

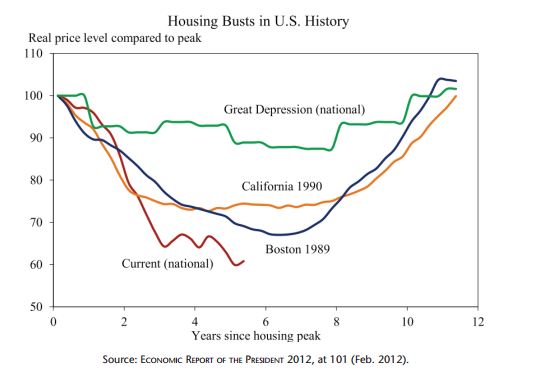

Meanwhile, real unemployment is closer to 23%. Meanwhile, the current US housing bust is making the Great Depression look like a weekend at Jay-Z and Beyonce's!

That's about as stagflationy as it gets. But this time, instead of Paul Volcker at the Fed, it's Helicopter Ben. Not that he'd want to be around anyway. Paul Volcker left Barack O'Bomber's economic council over a year and a half ago. He saw what was coming and knew there was no way out.

This isn't going to end well! Here at The Dollar Vigilante, our advice as always is to stick with precious metals, gold stocks, whether longer term with TDV Premium or trading in and out, with TDV Golden Trader. And make sure you register your shares (BulletProof Shares). Then, get a significant portion of your precious metals outside of your own country (Getting Your Gold Out Of Dodge), look to get a foreign company or bank account (TDV Offshore) and a second passport (TDV Passports). Then subscribe to TDV to keep abreast of all the latest developments of how to survive this coming shitstorm that Ben Bernanke just unleashed.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2012 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.