Gold, Silver, GDX, GDXJ and the HUI

Commodities / Gold and Silver 2012 Oct 09, 2012 - 06:39 AM GMTBy: Bob_Kirtley

The embattled mining sector is breathing a little easier of late as gold and silver mining stock prices show signs of improvement. In order to try and keep this latest flurry of activity in perspective we examine the progress being made at differing time intervals. This is a comparative analysis of gold and silver, a gold miners ETF, a junior gold miners ETF and an index which broadly represents those miners which do not hedge their production.

The embattled mining sector is breathing a little easier of late as gold and silver mining stock prices show signs of improvement. In order to try and keep this latest flurry of activity in perspective we examine the progress being made at differing time intervals. This is a comparative analysis of gold and silver, a gold miners ETF, a junior gold miners ETF and an index which broadly represents those miners which do not hedge their production.

For this exercise we are using gold and silver prices along with two ETF's which represent both gold miners and junior gold miners together with one mining index which are follows:

GDX

Market Vectors Gold Miners ETF (NYSEARCA: GDX)

Market Vectors Gold Miners ETF (the Fund) seeks to replicate as closely as possible, the price and yield performance of the NYSE Arca Gold Miners Index (GDM). The Index provides exposure to publicly traded companies worldwide involved primarily in the mining for gold, representing a diversified blend of small, mid and large-capitalization stocks. GDM is a market capitalization-weighted index, and provides exposure to publicly-traded companies worldwide involved primarily in gold mining, representing a diversified blend of small-, mid- and large capitalization stocks. The Fund’s advisor is Van Eck Associates Corporation.

GDXJ

Market Vectors Junior Gold Miners ETF (NYSEARCA: GDXJ)

Market Vectors Junior Gold Miners ETF (the Fund) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Market Vectors Junior Gold Miners Index (the Index). The Index provides exposure to a global universe of publicly traded small- and medium-capitalization companies that generate at least 50% of their revenues from gold and/or silver mining, hold real property that has the potential to produce at least 50% of the Company's revenue from gold or silver mining when developed, or primarily invest in gold or silver. The Fund will normally invest at least 80% of its total assets in companies that are involved in the gold mining industry. The Index is the exclusive property of 4asset-management GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. The Fund’s investment advisor is Van Eck Associates Corporation.

HUI

The AMEX Gold BUGS (Basket of Un-hedged Gold Stocks) Index represents a portfolio of 15 major gold mining companies. The Index is designed to give investors significant exposure to near term movements in gold prices - by including companies that do not hedge their gold production beyond 1 1/2 years.

Now, take a look at the following three charts which compare the percentage change for each of our five investment vehicles:

Chart No 1: A comparison over 3 years:

Chart No 2: A comparison over 1 year:

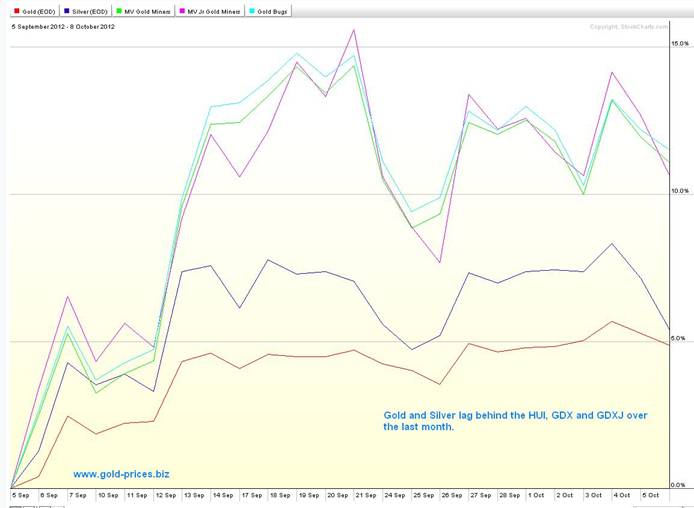

Chart No 3: A comparison over 1 month:

Conclusion:

We can see that silver and gold have been the best performers over the last three years and also over the last one year period. However, both of these two precious metals have lagged behind over the last month.

So the question that we must wrestle with is whether or not this is the start of a rally by the stocks that will see them outperform the metals or not. As we see it 'one swallow does not make a summer' and at the risk of missing out on the start of any rally by the miners we will wait a tad longer before becoming bullish on them.

The reason we would invest in the mining sector would be in the belief that it offered us a superior return over that of the metals. That superior return is required as compensation for taking on the risks that are inherent in the mining industry. The additional leverage is your reward. Now, over the last few years that leverage hasn’t been there, so for those wanting to obtain a leveraged return, options on gold and silver could well be the vehicle for you. You will need a robust stomach as the oscillations can be a tad nerve racking to say the least. However if you deploy a well thought options strategy the profits can give your portfolio a real boost. When you purchase a Call option it is comforting to know that the amount you paid is the maximum that you can lose and that the profit potential can be many times greater your purchase price.

As always it’s your cash and it’s your call so go gently with your investments and keep some cash on hand for that 'one off' event that could rock the markets and present you with a wonderful opportunity to capitalize on it.

Have a good one.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.