Iran’s Lying Currency Exchange Rates

Currencies / Iran Oct 10, 2012 - 01:52 PM GMTBy: Submissions

Steve H. Hanke writes: On September 24th, the Iranian government announced that it would adopt a three-tiered, multiple-exchange-rate regime. This wrong-headed attempt to exert more control over the price of domestic goods and combat inflation has failed (and will continue to fail). Since the rial began its free-fall in early September, international observers and the Iranian people have struggled to understand the implications of this exchange-rate regime.

Steve H. Hanke writes: On September 24th, the Iranian government announced that it would adopt a three-tiered, multiple-exchange-rate regime. This wrong-headed attempt to exert more control over the price of domestic goods and combat inflation has failed (and will continue to fail). Since the rial began its free-fall in early September, international observers and the Iranian people have struggled to understand the implications of this exchange-rate regime.

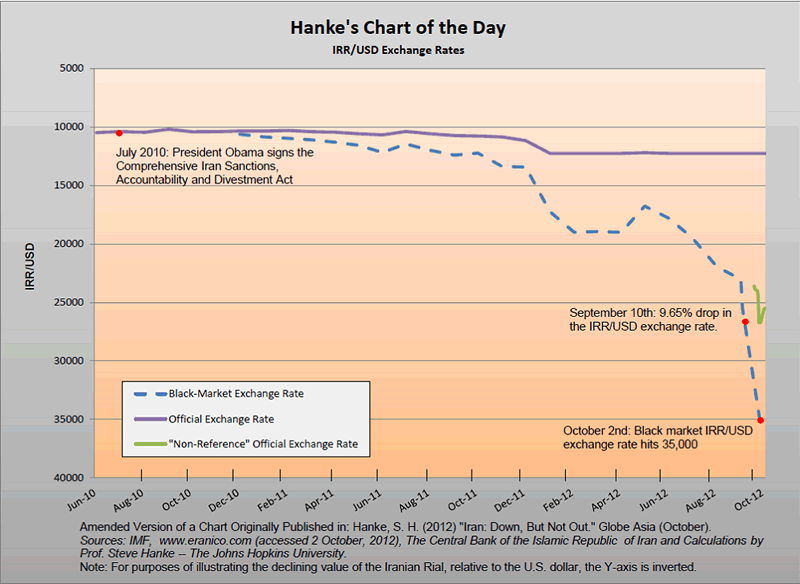

Iran has a history of implementing a variety of multiple-exchange-rate regimes – with mixed results, to say the least. Indeed, at its peak of currency confusion, the Iranian government set seven different official exchange rates. As the accompanying chart illustrates, the story of Iran’s hyperinflation has been one of divergence between the official and black-market (read: free-market) exchange rates.

This divergence is a product of the declining value of the rial – freely traded on the black market. In consequence, prices are rising dramatically in Iran – by almost 70% per month, according to my estimates. That said, in order to make sense of this phenomenon, it is necessary to understand the system whose failure we are witnessing.

Currently, Iran has three exchange rates:

- The Official Exchange Rate: 12,260 IRR/USD

- Available only to importers of essential goods, such as grain, sugar, and medicine

- The “Non-Reference” Rate: 25,480 IRR/USD

- Purportedly 2% lower than the black-market rate

- Available to importers of important, but non-essential goods, such as livestock, metals and minerals

- The Black-Market Exchange Rate: Approximately 35,000 IRR/USD

- The last freely-reported black-market rate was 35,000 IRR/USD (2 October 2012). The most recent anecdotal reports confirm this number as the current exchange rate.

- The Iranian government (read: police) has recently cracked down on currency traders and has also censored websites that report black-market IRR/USD exchange rates

This complex currency system results in lying prices that distort economic activity. By offering different exchange rates for different types of imports, the Iranian government is, in effect, subsidizing certain goods – distorting their true price. In consequence, any fluctuations in the black-market exchange rate – and, accordingly, in the price level – will be amplified to different degrees for different goods. The end result for Iranian consumers is confusion and mistrust, which, as we have seen, are feeding the panic that has been driving the collapse of the rial and Iran’s hyperinflation.

For the latest news on Iran’s hyperinflation, follow my Twitter: ;@Steve_Hanke

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2012 Steve H. Hanke - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.