How to Save Your Wealth From U.S. Government Retirement Heist

Stock-Markets / Pensions & Retirement Nov 20, 2012 - 06:33 AM GMTBy: Jeff_Berwick

Here at TDV we have the unfortunate role of being the messenger—and you know what happens to the messenger. The monkeys in pants always jump on him, stones in hand, and try to bash his brains out for bringing them a little bit of reality.

Here at TDV we have the unfortunate role of being the messenger—and you know what happens to the messenger. The monkeys in pants always jump on him, stones in hand, and try to bash his brains out for bringing them a little bit of reality.

In December, 2010, we penned a dispatch called “Americans Retirement Funds at Serious Risk” wherein we concluded by stating: “Keeping retirement funds inside of tax-sheltered accounts, which the US government will soon look to as the next source of funds to try to pay off its mountain of debt and keeping retirement funds in US dollar-based 'assets' is putting your retirement and future at great risk.”

We were summarily laughed at by the masses.

What’s that old saying from the early 19th century German philosopher Arthur Schopenhauer about the truth? “All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident.”

Well, if that’s true, this article will be violently opposed. And soon the truth will become self-evident. Unfortunately, by that time, most people will still have not caught on and their retirement funds will have been stolen.

You see, the National Seniors Council has announced that “Obama (has) Begun to Push for a New National(ized) Retirement System”. According to them, a recent hearing sponsored by the Treasury and Labor Departments marked the beginning of the Obama Administration’s effort to nationalize the nation’s pension system and to eliminate private retirement accounts including IRAs and 401k plans.

An immoral, thieving representative of the liberal Pension Rights Center, Rebecca Davis, testified that the government needs to get involved because 401k plans and IRAs are unfair to poor people. She demanded the Obama administration set up a "government-sponsored program administered by the PBGC (the governments’ Pension Benefit Guarantee Corporation)." She proclaimed that even "private annuities are problematic."

In essence, the US Government is pushing to have all retirement funds nationalized to protect the poor people. But, before we get into some more details of how your IRA or 401k will be spirited away, let’s look at the basis upon which they are saying this is necessary.

THE BASIS FOR THEFT OF YOUR RETIREMENT FUNDS

According to the US Committee on Sickness, Indoctrination, Enslavement and Ponzi Schemes, or as they call themselves, the Department of Health, Education, Labor and Pensions, “...stagnant wages and rising costs are making it harder and harder to build up a nest egg through a retirement savings plan (e.g., a 401(k) or IRA) or otherwise.”

You see, productivity has increased, but wages have stagnated, and yet prices are rising. This is the “middle class squeeze” that is at the core of the so-called retirement crisis. People are simply not able to save enough to one day live without a wage. But it's not because of the decline in pensions. After all, the idea of a pension is in itself very 20th century, based on the assumption that an individual will spend most or all of his working years at one company and therefore have a chance to build up significant pension benefits. This idea does not fit the new, much better economy in which an individual is likely to have a plethora of employers over his working lifetime.

Both the pension and Socialist Insecurity legs of the “three-legged stool” are bound to falter. It's simple savings that people will need to rely on. Yet saving is impossible because of rising prices in the face of stagnant wages, while what can be saved constantly loses purchasing power over the years. But what could possibly cause rising prices when the people doing the buying don't have any money with which to bid up the general prices? The central bank, of course. This is how inflation works over time. Wages may rise, but prices tend to rise more quickly.

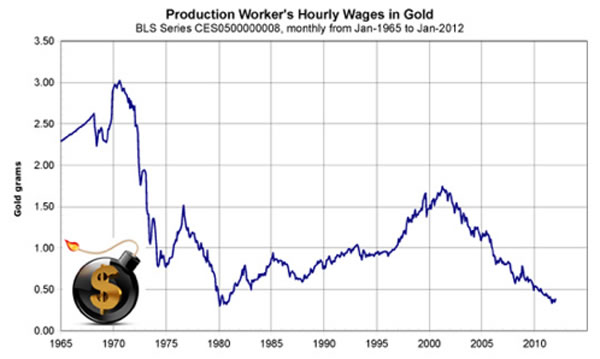

Just look at wages in real terms (vis-à-vis gold, not vis-à-vis the floating abstraction called the Federal Reserve Note):

The government is calling for a remedy to a problem that the central bank creates in the first place. Declining pensions aren't the problem. Currency debasement is as can be shown by the massive drop in worker wages ever since Richard Nixon removed the lest vestige of gold from the dollar in 1971.

Because of this problem, which was caused by the government and central bank, the politicians and their pet economists are proposing the creation of a new kind of private retirement fund: Universal, Secure, and Adaptable Retirement Funds (USA Retirement Funds).

According to a publication recently put out by the Committee, “USA Retirement Funds would be privately-run, licensed, and regulated retirement plans. Each USA Retirement Fund would be overseen by a board of trustees consisting of qualified employee, retiree, and employer representatives. The trustees would act as fiduciaries and be required to act prudently and in the best interests of plan participants and beneficiaries.”

TERESA GHILARDUCCI TO THE RESCUE

Immoral, world-improver, Teresa Ghilarducci has been peddling her plan before Congress. In a recent New York Times op-ed she warns: “Almost half of middle-class worker, 49 percent, will be poor or near poor in retirement, living on a food budget of about $5 a day.”

We believe she is overestimating what they’ll have, but let’s not argue about the details.

At the heart of Ghilarducci's proposal lies the belief that it is simply impossible for nearly all individuals to prepare for retirement without centrally-planned, politically-backed “help.” As she writes, “Basing a system on people's voluntarily saving for 40 years and evaluating the relevant information for sound investment choices is like asking the family pet to dance on two legs.”

She seems to be directing her invective to those who hate the idea of government getting involved with the personal business of saving for retirement.

“The coming retirement income security crisis is a shared problem...My plan calls for a way out that would create guaranteed retirement accounts on top of Social Security...This is a sensible way to get people to prepare for the future. You don't like mandates? Get real. Just as a voluntary Social Security system would have been a disaster, a voluntary retirement account plan is a disaster.”

Ah, we'd like to point out that the involuntary Social Security system hasn't exactly not been a disaster. Sure it worked out great for the early investors, just like any Ponzi scheme. But its future is as dim as it is inescapable. It’s already far beyond bankrupt. That’s why the government wolves are eyeing the private retirement accounts of the sheep.

.jpg)

Here’s the bottom line:

a) Government creates a crisis. In this case the Federal Reserve, through the slow pickpocketing of inflation, destroys the ability of the average person to take the simple option of saving money for retirement, and instead forces them to take risks in the financial markets to get returns greater than the rate of purchasing power destruction caused by central bank inflating the money supply in the first place.

b) Government offers a solution that is really an excuse to either increase their power or steal more money. In this case the target is the roughly $4.5 trillion in retirement funds held in private defined contribution plans (as of the end of 2011).

The writing is on the wall. It’s been written for a while and only a few, such as we at TDV have been ringing the alarm bells. In 2011, with the federal debt ceiling about to be hit , Timothy Geithner (who is now calling to do away with the debt ceiling and have debt to infinity) was planning to borrow the pension funds of federal employees. Those funds are already within easy reach. And Obama's new pension plan will put all American's private retirement funds within easy reach, too.

It's not like there isn't precedence in the Western world for this kind of behavior from governments.

In late 2010 Hungary's government gave its citizens a choice: hand over all their savings to the government or lose all their state pension money. The government sought control over Hungarians' $14 billion in individual retirement accounts. The Bulgarian government did something very similar when it tried to transfer $300 million in private early retirement savings into a state pension scheme. They only managed to get roughly 20% of the funds they sought. Last year Ireland raided the private stash in the National Pension Reserve Fund with a 0.6% levy under the label of a “jobs plan” in order to bail out insolvent Irish banks.

LEAVE YOUR MONEY WITH THE GOVERNMENT IF YOU TRUST THE GOVERNMENT

We’ve said for a few years that this is where things are headed. It’s baked in the cake. The US government, and almost all Western governments are bankrupt. But before they die they will do what almost every nation state in history has done and try to confiscate as much wealth as possible from their tax cows before the collapse. Mark our words: US 401ks and IRAs will be nationalized in the next four years—maybe as soon as the next one or two years. They will be forced to invest in “Patriot Bonds” which will be the new euphemism Treasury bonds, which are more and more becoming a hot potato in financial circles.

Those bonds will continue to offer 0-3% interest rates while the monetary inflation rate will continue to be well above 10% (and rising), meaning that the true value of your retirement savings will be all but destroyed (stolen) in the next 5-10 years.

THERE ARE ONLY TWO OPTIONS TO SAVE YOURSELF

There are only two options to avoid this. The first is to de-register or take the funds out of your 401k/IRA. Unfortunately, this often means some sort of penalty, sometimes a very large one. But, based with what your other option is, it still seems pretty good.

The other option is to put your IRA into a self-directed IRA (see a self-directed IRA option here). By doing this you can move all your funds outside of the US, which we highly recommend. Secondly, you can then invest the funds in almost any asset, from precious metals in other countries to race horses to foreign real estate.

As we have always recommend, first get your assets outside of the control of your own country if you live in the West. And secondly, invest those assets into hard assets like gold or foreign real estate… or whatever else Ben Bernanke can’t print from his box seats while slurping on an ice cream cone at Washington National’s games.

Your enemy is the state and the central banks. The sooner you realize that and get your assets outside of their control or influence the safer you will be.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2012 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.