When Will U.S. Interest Rates Rise?

Interest-Rates / US Interest Rates Jan 10, 2013 - 03:25 AM GMTBy: Clif_Droke

Recently I was asked a question that I suspect has been on many investors' minds. Here's the question: "Is it possible that the bond market will be the market to tumble into 2014, and as it does, the general market decline is mitigated by the rotation of money out of bonds and into stocks?"

Recently I was asked a question that I suspect has been on many investors' minds. Here's the question: "Is it possible that the bond market will be the market to tumble into 2014, and as it does, the general market decline is mitigated by the rotation of money out of bonds and into stocks?"

Here's my answer: Anything is possible in today's upside-down world. As my late friend and mentor Bud Kress used to ask, "Does anything surprise you anymore?" But I'd have to say here - and I firmly believe Bud would echo this sentiment - if there's any validity to the 120-year Kress cycle, a sustainable rising interest rate trend isn't likely until after October 2014.

The 120-year Mega Cycle - and its 40-year and 60-year components - is deflationary whenever they're in the "hard down" phase, as they are between now and then. I make no claims to being an expert in bonds, but isn't the scenario described above (viz. rising rates) essentially part-and-parcel of an inflationary environment? With deflation still making its presence felt in the global economy, I can't see rising interest rates on a sustained basis until after 2014.

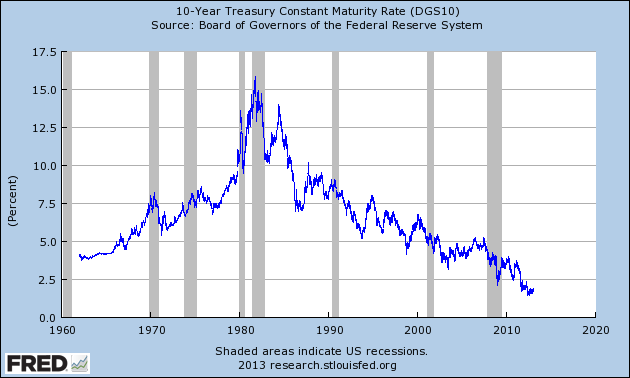

Structural deflation is chiefly characterized by three things: 1.) falling wages, 2.) falling interest rates, 3.) falling money velocity. One of the best illustrations of the deflationary long-term cycle can be seen in the graph of the 10-year Treasury rate shown here.

Note the peak in the interest rate in the early 1980s - exactly when the 60-year Kress cycle of inflation/deflation peaked. The next scheduled bottom of the 60-year cycle is for late 2014. To date, long-term interest rates have conformed to the deflationary implication of this cycle as you can see in the above graph.

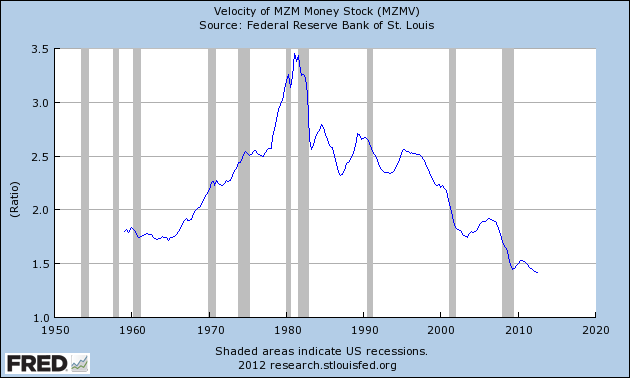

Money velocity (that is, the turnover in money within the domestic economy) also peaked around 1980 and has been declining ever since.

On a short-to-intermediate-term basis it may be possible to see rising interest rates, much as we did in the year 2007. Year 2007, you may recall, was an extremely volatile year and was a precursor to the credit crisis year of 2008. I strongly suspect 2013 will in some ways mirror 2007. In 2007, Treasury rates rallied in the first half of the year before collapsing heading into the hyper-deflationary year 2008.

Note the firmly established long-term downtrend channel in the interest rate below. Rates have recently fallen below the lower boundary of the channel, which constitutes a "channel buster." This in turn suggests an "oversold" condition and therefore suggests that rates could rise in the near term to recovery temporarily back inside the channel. I don't expect the rally (assuming it materializes) to persist for more than a few months.

Now the big question is what happens to all those hundreds of billions of dollars created in recent years - the record corporate cash pile, bank reserves, etc. - AFTER 2014? It doesn't take much imagination to foresee a period of hyper-inflation being stoked once the downside pressure of the 120-year cycle is lifted. Unless I miss my guess, it will be in 2015 and thereafter when we'll see rising interest rates and the corresponding long-term collapse in bond prices

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at:

http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.