Why Florida's Housing Market is Set to Boom

Housing-Market / US Housing Feb 28, 2013 - 03:36 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: "I got off the plane in California last January and felt the warmth and the sunshine... in the depth of my New Jersey winter.

Dr. Steve Sjuggerud writes: "I got off the plane in California last January and felt the warmth and the sunshine... in the depth of my New Jersey winter.

"I thought to myself, 'You don't have to live like this.'"

My friend wants out of New Jersey... for a warmer, more business-friendly state, like my own state of Florida. He will certainly not be the only one making such a move.

I predict a massive migration of people will follow my friend's lead in the next few years. The facts are just too darn attractive to ignore.

Any rational person with the ability to move should move.

You should move because – relative to the northeastern U.S. – Florida today offers three huge benefits...

• As my friend noted, it has warm weather in the winters.

• Florida has no state income taxes, as I explained earlier this month. New Jersey's highest state income tax rate is roughly 9%. So you give yourself a raise of roughly 9% just by moving from New Jersey to Florida.

• And right now, it has fantastic real estate values. That's starting to change. But in terms of what I expect, you ain't seen nuthin' yet.

My friend told me he's paying more than $1,000 a month for a one-bedroom apartment in New Jersey.

My Florida colleague Brett Eversole told him: "I pay less than you do in rent... and I have a three-bedroom, two-bath home a half-mile from the beach with a fenced-in yard and a two-car garage."

And I told my friend that the median home price in Orlando is dirt-cheap – just $128,000. My friend couldn't believe it – $128,000 – for a house? That had to be something unique to Orlando, right?

Wrong... I live closer to Jacksonville. The median price in Jacksonville a year ago was $110,000.

But prices are moving...

Prices are up $20,000 from a year earlier in Orlando. That is an extraordinary move in prices... but I believe even more price "jumps" are coming... That's because the number of homes on the market now in Orlando is at an eight-year low. Prices rise when there's no supply.

In Jacksonville, the median price is $136,000. Prices have jumped by $26,000 in just the last year. But $136,000 is still extremely reasonable by Northeast standards... and you get much more home for that price, too.

If you're a regular DailyWealth reader, you know that I have been POUNDING THE TABLE, urging you to buy Florida real estate. At first, I felt like the only voice out there saying the real estate boom would return.

Our True Wealth Systems databases told us that very moment was the greatest moment in American history to buy a house. We knew that homes in America were more affordable than they've ever been in our lifetimes.

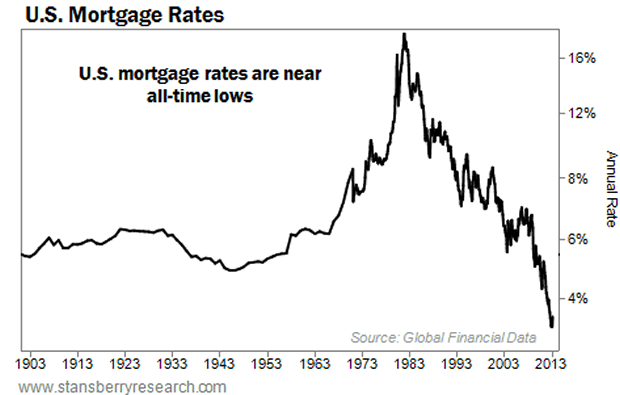

This was because of two things: 1) the greatest housing bust in our lifetimes... and 2) mortgage rates at all-time lows. Take a look at this 100-year chart of mortgage rates from our True Wealth Systems database to see what I mean...

Sure enough, the gains in Florida home prices have been phenomenal over the last year... But you ain't seen nuthin' yet.

That's because, again, relative to most of the northeastern U.S., Florida offers three huge benefits today: warm weather in the winters, no state income taxes, and fantastic real estate values.

These three facts will compel millions of Americans like my friend in New Jersey to get OUT of colder, high-tax states like New Jersey... and move to warm-and-cheap states like Florida.

This "migration" will push home prices in Florida up to all-time highs in years to come.

This week, I went standup paddle surfing near my home in Florida... wearing just a pair of shorts. Now that is the right lifestyle in February!

You might think that you'd have to pay a premium to live this lifestyle. But you don't... Real estate is in the $130,000 range in major Florida towns.

If you're sitting in a cold, high-tax state, thinking about buying Florida real estate... STOP thinking and do something about it.

Prices are moving up. And as I've explained, they will keep moving up. Get on it!

Good investing,

Steve

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.