The Greatest Investment Opportunity Since 1984

Companies / Sector Analysis Mar 12, 2013 - 06:03 PM GMTBy: Investment_U

Andrew Snyder writes: There are three reasons investors absolutely must have their eye on the world’s booming unmanned aircraft market. Not one of them involves a 13-hour rant by Rand Paul or Obama’s ability to kill American citizens on American soil.

Andrew Snyder writes: There are three reasons investors absolutely must have their eye on the world’s booming unmanned aircraft market. Not one of them involves a 13-hour rant by Rand Paul or Obama’s ability to kill American citizens on American soil.

But the recent political brouhaha is proof that you need to move.

If you’ve followed the press, you’ve undoubtedly heard today’s drone market compared to the computer industry in the early 1980s. In fact, on January 25, Yahoo!ran a headline that read, “The private drone industry is like Apple in 1984.”

Hmmm…

It’s an interesting comparison, because that’s the year the budding marketers at Apple (Nasdaq: AAPL) spent a few bucks for a daring Super Bowl ad. The minute-long spot took a direct shot at a modern-day foe… Big Brother.

Leveraging the same sorts of emotions stemming from the current drone debate, Apple went on the offensive. With a simple message and some futuristic imagery, it dispelled the sorts of fears stirred by an all-powerful, all-knowing computer.

As the commercial rolled to a close, Apple hit us with its message:

On January 24, Apple Computer will introduce Macintosh. And you’ll see why 1984 won’t be like “1984.”

Simple. Effective. And uncannily pertinent to the rhetoric we heard from within the Beltway last week.

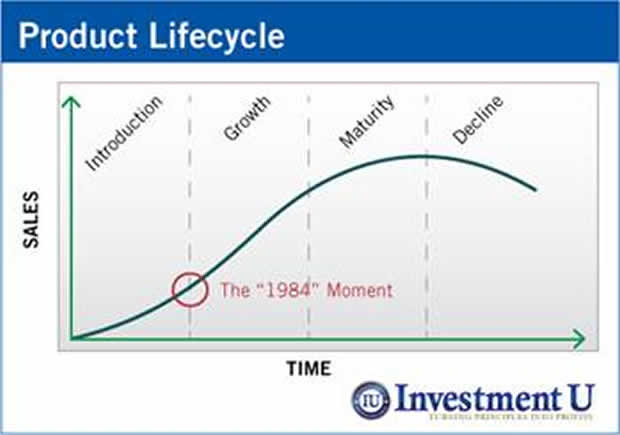

It’s proof that all breakthroughs go through the same lifecycle. In fact, the idea is so important they won’t put an MBA in your hand unless you can recite it by heart.

The curve is branded deep in my brain…

The hoopla over the nation’s booming drone industry in Washington last week represents the “1984” moment, when the product enters a fast-moving phase that leads to widespread adoption.

The move into this phase is the first reason you need to have an eye on the industry. It’s where the big money is made.

For Apple, the growth phases lasted nearly three decades, with many pundits saying Steve Jobs’ death last year marked the official entry into “maturity.” Many fortunes were made along the way.

I See You…

The second reason an investment in drones should be in your near future is the fact that most folks have no idea what’s going on. While blasting terrorists out of the sand gets all the press, drones have many valuable uses.

Let’s use the acronym I.C.U. to keep things simple…

First, the Intelligence industry has all sorts of uses for small, aerial robots.

I’m not talking about covert spying operations. Instead, think of your local law enforcement agency. Why send an officer into the woods to search for an armed bad guy when the shift sergeant can launch a drone from the back of his squad car?

Despite the rhetoric, the future of the domestic drone industry is not about proactive spying… It’s about reactive response. From search and rescue to tracking a kidnapped child, drones have already proven effective.

Next, drones have immense Commercial potential. I wish I could list them all. Commercial photographers are already buying drones to help them get incredible aerial shots. Search the web and you’ll find real estate listings featuring pictures taken with a drone.

Surveyors use the technology as a tool to measure large areas with reduced manpower. And, in the wake of Superstorm Sandy, utility companies are eager to dump big money into drones to aid post-disaster recovery.

Again… The largest potential for the industry is in small, easy-to-use drones no bigger than a small suitcase. The big, stealthy craft that most folks associate with the term “drones” are left for the military.

Unmanned aircraft is the future of war. The story has been reported ad nauseum. Even so, the figures are incredible. A decade ago, Uncle Sam spent just $550 million on drone technology. By 2011 that figure surged to nearly $5 billion.

But it’s not just an American phenomenon. Across the globe, 76 militaries have already harnessed drone technology. By the end of the next decade, analysts say the global industry will be worth as much as $95 billion in yearly spending. (The chart above shows what that growth will look like.)

In other words, as our enemies pour billions into unmanned technology, the friendly skies are about to get a whole lot less friendly. But investors have a huge opportunity.

The Best Kind of Advertising

Finally, the third reason to put drones on your radar comes thanks to our pals in Washington…

I’ve always been an event-driven investor. In other words, I look for events that confuse the so-called efficient markets and take advantage of the value that often follows. With the Federal Aviation Administration set to release the first set of firm rules for the civilian drone market by 2015, we’ve got a firm date to look forward to.

The FAA’s deadline will act as the invisible barrier that delineates early investors (the folks smart enough to own Apple shares in 1984) from the shareholders that enter during the “mature” phase of the product lifecycle.

Just as Apple’s computers have yet to take over the world, drones are not your enemy. The industry is a pathway to huge returns.

Use the fear and confusion stirred in Washington as your invitation to jump into a fresh opportunity.

Good Investing,

Andrew

Source : http://www.investmentu.com/2013/January/greatest-risk-to-your-wealth-in-2013-2.html

by Andrew Snyder,, Oxford Club Investment Director Chairman, Investment

Copyright © 1999 - 2012 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.