The U.S. Dollar and the Real Inflation Story

Currencies / US Dollar Mar 25, 2013 - 11:01 AM GMTBy: Toby_Connor

I can’t tell you how many talking heads I've watched in the media recently touting the strong dollar. Sometimes I really wonder whether Homo sapiens are an intelligent life form. Remember, this is the same species that created the Tulip mania … and the tech, and real estate bubble.

I can’t tell you how many talking heads I've watched in the media recently touting the strong dollar. Sometimes I really wonder whether Homo sapiens are an intelligent life form. Remember, this is the same species that created the Tulip mania … and the tech, and real estate bubble.

Folks, in the real world it just isn't possible to have a strong dollar if you are counterfeiting 85 billion of them a month. That’s just basic common sense, which seems to be an extremely rare commodity in the world today.

Yes, markets can be irrational because humans are driven by emotions. When something goes up or down for a long period of time, our emotions invent reasons for why it’s happening. We convince ourselves that a tulip bulb really is worth more than a house. We justify skyrocketing housing prices far above average income levels by inventing a fantasy that we are running out of land. Of course no amount of fantasy means we can escape reality, just that the longer the illusion extends the bigger the bubble grows before is pops. But there is never any doubt it is going to pop.

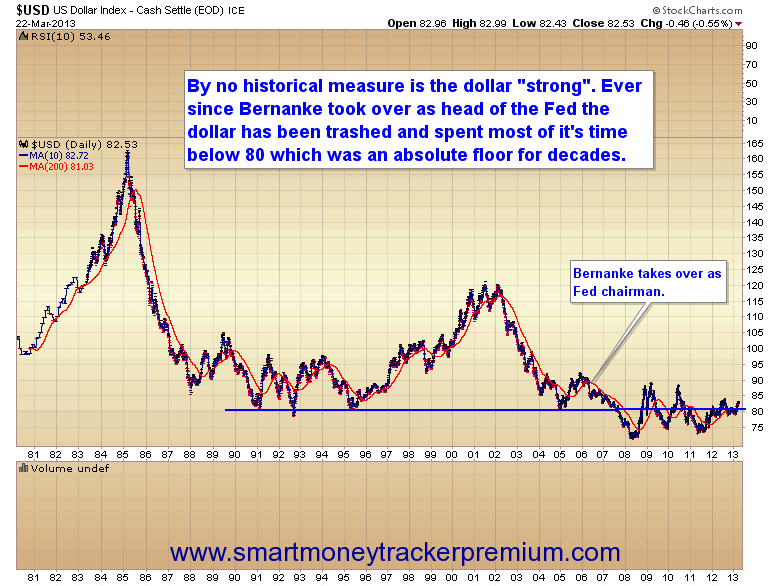

There is one reason and one reason only why the dollar index has the illusion of being strong (let’s face it, at 82 the dollar is hardly strong. In 2000 the dollar index was at 120).

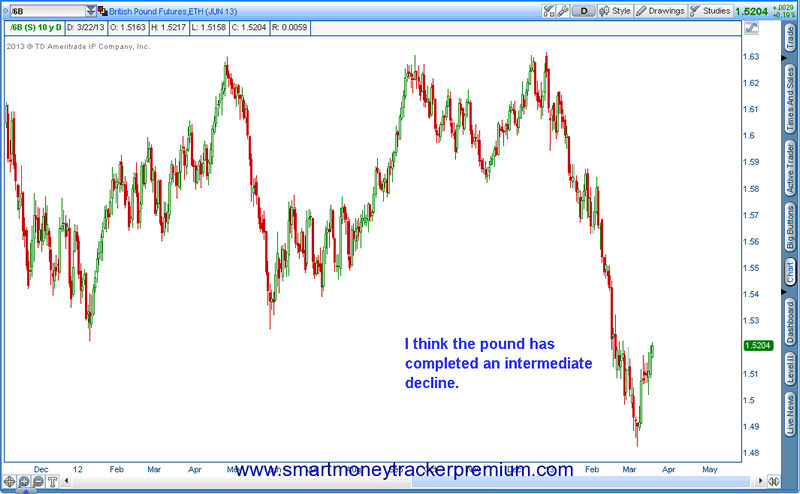

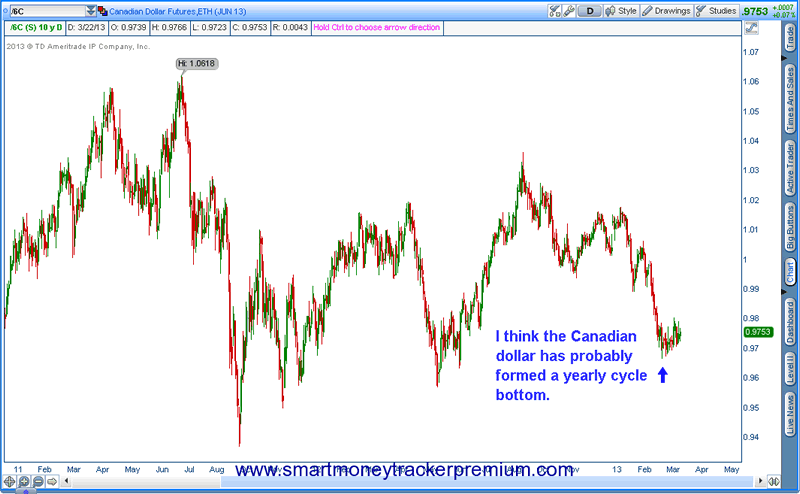

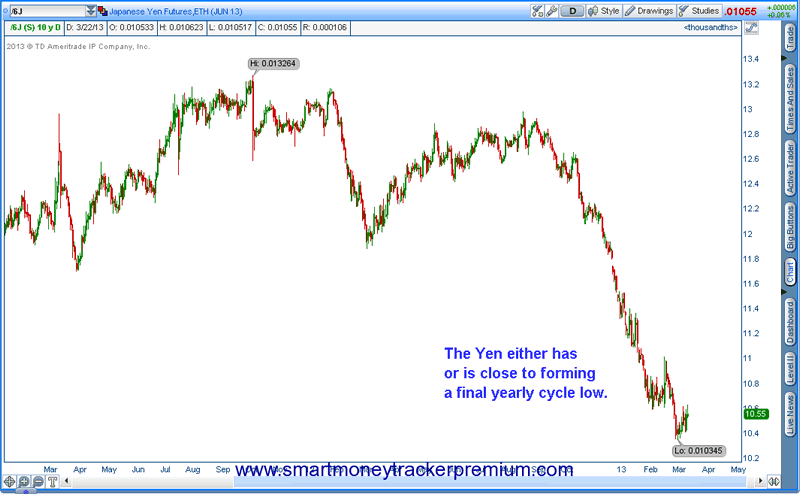

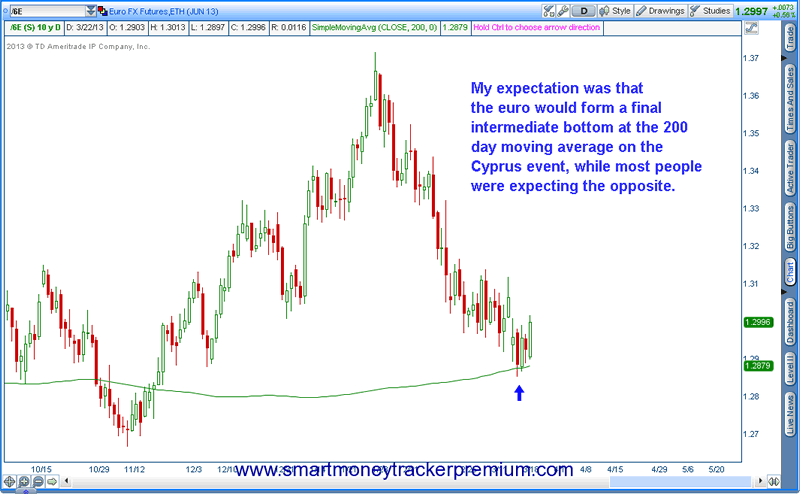

The dollar is strong lately because the yen, pound, euro and Canadian dollar have all been dropping sharply into major intermediate and yearly cycle lows.

This is pushing the dollar index up. It doesn't mean the dollar is strong, just that most of the currencies that the dollar index is measured against are exceptionally weak at the moment. But that may be changing.

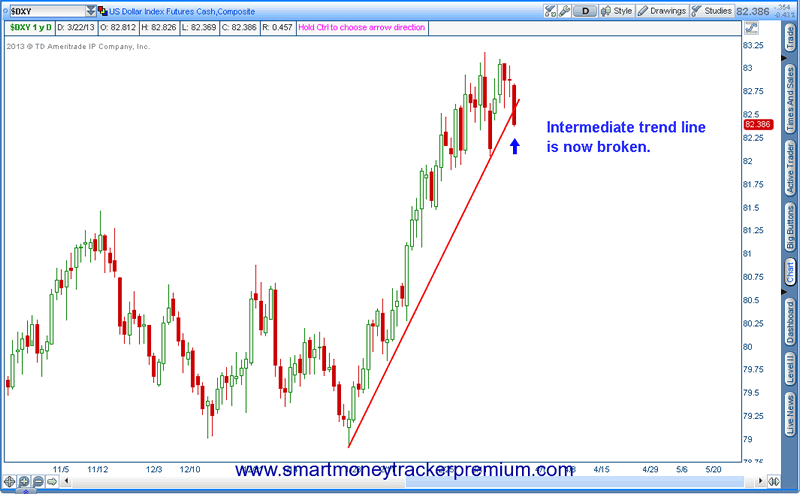

On Friday, the dollar broke down and breached the intermediate trend line. This is often the first warning sign that an intermediate cycle has topped.

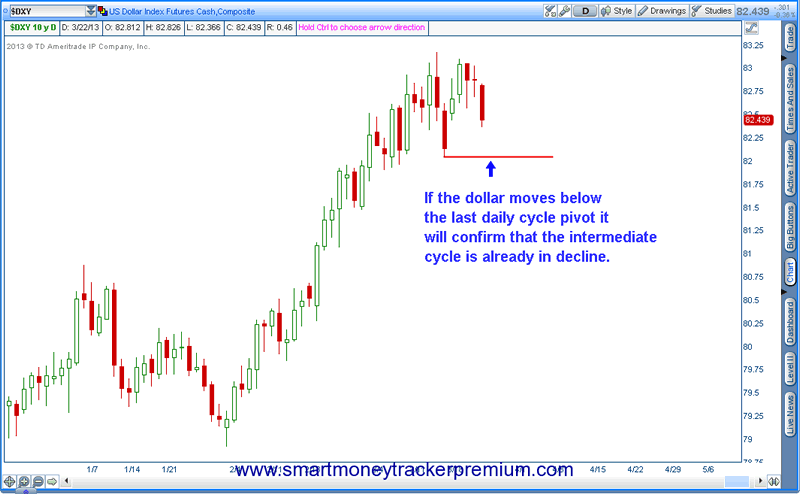

If the last daily cycle pivot is broken (lower low) it will almost certainly confirm that the dollar has begun an intermediate decline.

There is now extreme risk that the second daily cycle has topped on day 2. That is one of, if not the most extreme left translations I can remember, and is likely to lead to a very large decline over the duration of this daily cycle. Keep in mind there should be another 2 or 3 daily cycles down after this one before the final yearly cycle low sometime in June or early July.

If the dollar daily cycle has topped on day two, then the dollar is setting up to take a real beating over the next couple of months. I’m afraid reality is about to return to the dollar, and the consequences of printing a trillion dollars a year are about to be begin.

Next I want to discuss another subject that should be easily visible, but again a lack of basic common sense prevents most people from seeing what’s right in front of them.

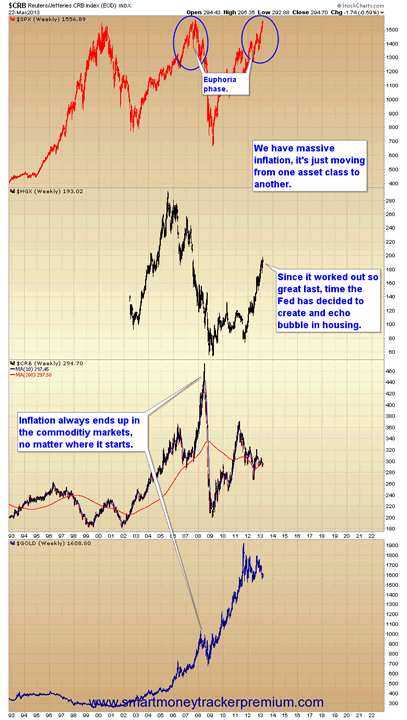

I’m talking about inflation. Now if you believe the government's ridiculous CPI numbers, or the talking heads on TV, you might come to the conclusion that printing 85 billion dollars a month has no long term side effects. You would of course be 100% wrong. It causes inflation. Money printing always has, and always will cause inflation. This time is no different than any other time in history. I can assure you that Bernanke hasn't been able to repeal the natural laws of the universe. As a matter of fact, we have had massive inflation ever since the bottom in 2009.

Because the Fed targets asset prices, it tends to start in those areas that we don’t normally associate as inflationary. Let’s face it, no one is really going to freak out about a rising stock market, but that is the first sign of inflation. The Fed’s liquidity has to land on something, and it usually starts in the stock market first. Unfortunately it always eventually ends up in the commodity markets.

Folks, no matter what anyone one tries to tell you, it’s not possible to print 10+ trillion dollars and not get inflation. The Fed would like the inflation to stay in the stock and real estate markets, but as we all know it’s not possible to escape reality, and the reality is that eventually that liquidity is going to leak out of the stock market and real estate markets and find it’s way into the commodity markets. It happened in 2008 and it’s going to happen again.

As you can see in the long term chart above inflation began in the stock market and real estate markets in the early 2000′s. It culminated in a massive parabolic spike in commodity prices in the summer of 2008 that destroyed the global economy and spiked oil to $147 a barrel, and gold above $1000 an oz.

This time will be no different. We have massive inflation in stocks, and even an echo bubble forming in the real estate markets. Ultimately the story is going to end the same way as it did in 2008, with a stagnating stock market, a second crash in the housing market, and another parabolic move in commodities. It absolutely will drive another C-wave advance in gold just like it did in 2008 and 2011. Only this time the move will be even bigger. As I've noted in several past reports, I’m confident that gold is forming a midpoint consolidation in a very large T1 pattern that should ultimately target about $3200-$3300 at the next C-wave top.

It doesn't matter whether sovereign central banks impose short term manipulation or how irrational the short term movements get, nothing is going to alter reality, and the reality is that printing a trillion dollars a year is going to drive another C-wave in gold’s secular bull market. End of story.

This is a sample of the weekend report. For a more detailed analysis of where I think currencies, stocks, oil and gold are headed I've made a one week trial subscription to the nightly newsletter available. Click on the link below.

$10.00 one week trial subscription.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2013 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Toby Connor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.