Charts to Provide Perspective for Gold Bulls

Commodities / Gold and Silver 2013 Apr 05, 2013 - 07:11 AM GMTBy: Jordan_Roy_Byrne

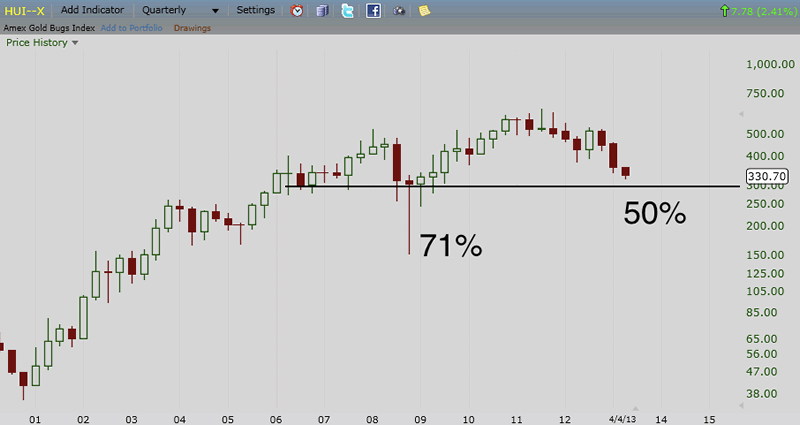

Most chartists use daily or weekly charts. Few look at monthly charts. I don’t know of anyone (myself included) who pays any attention to quarterly charts. We decided to take a look at the quarterly chart of the HUI gold bugs index. It is below and we note the two big downturns in the market. Also note the importance of 300 which has been support for the past seven years.

Most chartists use daily or weekly charts. Few look at monthly charts. I don’t know of anyone (myself included) who pays any attention to quarterly charts. We decided to take a look at the quarterly chart of the HUI gold bugs index. It is below and we note the two big downturns in the market. Also note the importance of 300 which has been support for the past seven years.

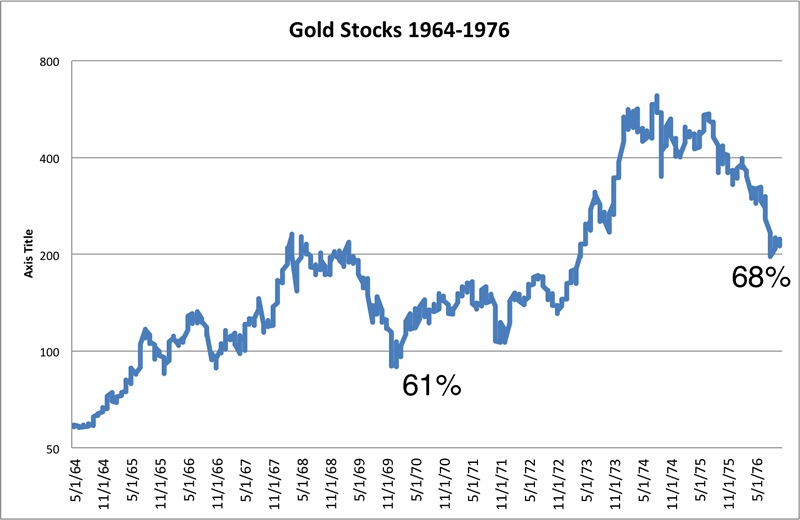

Some have chided your humble author for saying that the gold stocks are still in a bull market. After all, these two big downturns invalidate any assertion of a bull market. Right? Well, the previous bull market in gold stocks also included two large downturns. Within the 1960 to 1980 bull market, the first correction was 61% and lasted about two years. The next correction was 68% and also lasted about two years.

Even more intriguing is the similarities between the gold stocks over the past five years and the Nasdaq from 1987 to 1990. Both markets crashed and then quickly recovered to a new marginal high. Furthermore, note the price action in the Nasdaq during late 1989 to 1990 and compare it to the price action of the gold stocks over the past 15 months.

Like the Nasdaq, the HUI formed a bullish double bottom (A,B) and advanced quickly and strongly. Both markets then fell apart. The Nasdaq declined 31% in only a few months. That was almost as bad as the first crash! The gold stocks have declined about 40% in the last six months.

After its bottom in 1990 the Nasdaq gained nearly 16-fold over the next 10 years. Following its second massive downturn within the 1960-1980 secular bull market, the Barron’s Gold Mining Index advanced nearly 7-fold in the next six years. This is not to say that the gold stocks are likely to repeat the same pattern. This is to show that there is a strong historical precedent for the current downturn to occur in the context of a major bull market.

Ok, I know what you thinking. Jordan, why didn’t you provide this analysis weeks or months ago? The answer is, we’ve been aware of these charts and that is one of many reasons why we’ve slowly “scaled into” positions. We’ve told premium subscribers what our favorites are and how we plan to scale into and build those positions over the spring and summer months. On March 1 we wrote: As for the short-term, we began scaling into positions last week but maintain plenty of cash to be deployed (potentially) at our strong targets of HUI 336 and HUI 300.

Currently, the market remains in a bottoming process. We don’t know if Thursday’s low at 317 marked the bottom or not. Judging from the quarterly chart it looks like we could see a test of 300 or a temporary break of that level. On the other hand, Wednesday’s selloff occurred on record volume and Thursday’s reversal was quite strong. There is a chance a small head and shoulders bottom could be developing. Strong follow through on Friday would certainly raise the odds that 317 was an important low.

In any event, we are moving closer and closer to a major bottom and a large rebound in percentage terms. Weeks ago we noted the extreme pessimism in Gold was beyond the 2008 low by most metrics. Sentiment towards gold stocks is even worse. Traders and momentum players think the sector is one big joke. Mainstream funds who have the slightest interest in the sector are focusing on the metals and not the shares. I can’t recall a sector that has ever been this hated within a secular bear market. It is quite amazing. That aside, we are quite confident that the sector is days to a few weeks away from the start of a very strong rebound. Be advised that there are hundreds of mining stocks and stock selection is critical to achieving strong returns.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2013 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.