Gold Parabolic Bull Market Rise, On the Verge of a New Monetary Order

Commodities / Gold and Silver 2013 Apr 25, 2013 - 08:19 AM GMTBy: Hubert_Moolman

The last three major bull markets of the Dow were followed by some type of economic crisis and a major bull market in gold. This is no coincidence, since these massive bull markets have been mostly driven by the huge expansion of the money supply. When this expansion of credit is exhausted, which always happens, the confidence in all things (like stocks) inflated by this expansion of credit fails, causing a massive economic crisis and a rush to gold. We are still in the midst of last one's crisis.

The last three major bull markets of the Dow were followed by some type of economic crisis and a major bull market in gold. This is no coincidence, since these massive bull markets have been mostly driven by the huge expansion of the money supply. When this expansion of credit is exhausted, which always happens, the confidence in all things (like stocks) inflated by this expansion of credit fails, causing a massive economic crisis and a rush to gold. We are still in the midst of last one's crisis.

It is the Dow's last two bull markets that are of interest due to the significance, of how they relate to the current monetary system. In 1944 a new global monetary order was established with the Bretton Woods agreement. The world had just come out of the Great Depression, and was completing the Second World War.

The creation of the new global monetary order as well as the new world order that came as a result of the war was indeed a fresh start. The Bretton Woods system brought about an international basis for exchanging one currency for another. It also led to the creation of the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (World Bank).

The member states tied their currency to the U.S. Dollar which was in turn pegged to gold at a rate of $35 per ounce. The U.S. Dollar became the world's reserve and premier currency. The Dow had just started a bull market, and it was with this new created order that it would rise to new highs.

Below is a comparison of the two Dow bull markets since the beginning of the global monetary order created in 1944 (charts from Yahoo Finance):

The top chart shows the Dow from 1980 to 2013, and the bottom chart shows the Dow from 1944 to 1982.

The Bretton Woods agreement was in full use during the majority of the first bull market. It was altered only in 1971, when the link between the dollar and gold, at a fixed $35 per ounce, was severed. Also, by 1973, the fixed exchange rate system created by the Bretton Woods Agreement became a floating exchange rate system.

During this bull market (1944 to 1970s) interest rates were rising, until it peaked in 1981. The Dow rose 7.5 times in value from 1944 to 1973. The gold bull market started toward the end of the Dow bull market, taking gold from $35 to $850 in 1980 - a 24 fold increase.

The second (of the last two) bull market started at about 1980, and took place during a time of falling interest rates and an altered Bretton Woods Agreement. With more favourable conditions than the previous bull market, the Dow was able to rise 18 fold from 1980 to the current high.

Gold' high of $1920, for this bull market is 7.68 times the low of $250.Will gold have a more significant increase compared to its 24.8 fold increase, due to the fact that the Dow's increase was more than its previous bull market increase? Furthermore, will gold increase more it did during the 70s, given the fact that the conditions for the current bull market (especially as regards to debt levels) are far more favourable. If gold only matches its 1970s bull market increase, it could go to $6 200 ($250*24.8).

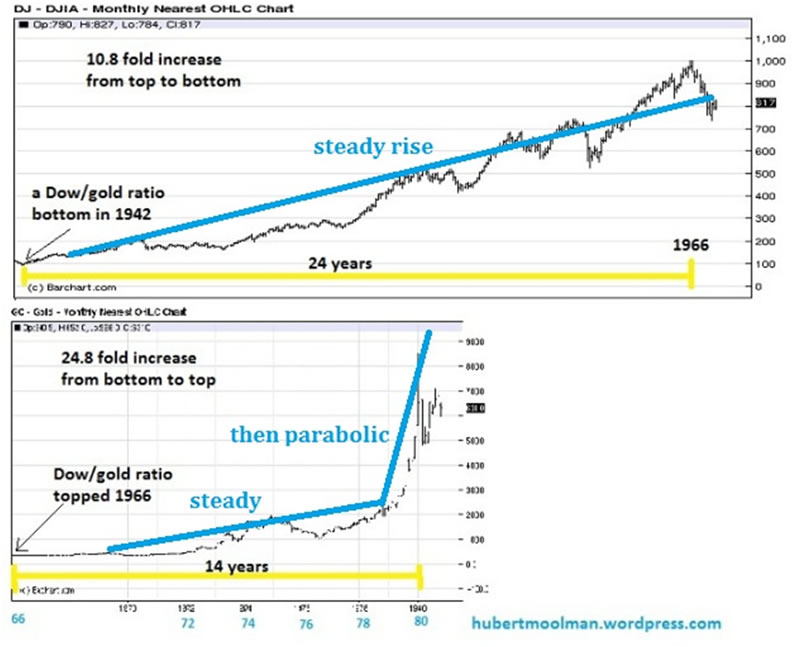

Consider that the Dow had a fairly steady rise throughout its entire bull market (that started in the 40s), whereas the gold price rose violently towards the end of its entire bull market of the 70s, with a parabolic blow-off top. See chart, below:

This indicates the likelihood that we are still missing a parabolic blow-off before we can call the end of this bull market; a type of rally that doubles the price of gold, as a minimum, during a 6-month period.

This cycle since about 1944, started with the creation of this global monetary order, and will likely end with the collapse of it. In fact, 2014 will be exactly 70 years since the creation of this dishonest system. We might have a perfect cycle of judgement, if the current monetary order collapses next year. Due to the imminent threat of collapse, it is essential to be invested in physical gold, since it is the perfect alternative to the current monetary regime.

It appears that we are on the verge of the worst part of this crisis. Our attention has to be on the stock markets. When the Dow reaches that "tipping-point" it will signal the start of the end. Previously, I have shown how it appears that the Dow is coming to that critical point.

There is a major risk aversion coming, and in the short-term this is likely to put downward pressure on gold. However, gold will find a footing, and will be driven higher by this very risk aversion. In other words, there is a deflation coming, and gold will prove to be the currency of choice.

"And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved"

For more silver and gold analysis and guidance, see my Long-term Silver Fractal Report or subscribe to my Premium Service.

Warm regards and God bless,

Hubert

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2013 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.