How to Profit From America's Rust Belt

Companies / Sector Analysis May 08, 2013 - 11:04 AM GMTBy: Investment_U

David Fessler writes: I want to introduce you to a company the mainstream media has completely ignored. But don’t let the lack of attention fool you. It’s the largest and best company in its sector.

David Fessler writes: I want to introduce you to a company the mainstream media has completely ignored. But don’t let the lack of attention fool you. It’s the largest and best company in its sector.

It’s the perfect Rust Belt Revival pick-and-shovel play.

We’ll get to the company in a moment. First, let’s take a close look at its industry. It’s called logistics.

Boring, right? Not so fast…

Remember, logistics is the business of moving stuff. It can be physical materials such as oil and other liquids, food, equipment, and materials. It also can be abstract things such as particles, energy, information and time. The company I’m excited about deals only in the logistics of physical materials.

It’s a business that’s growing faster in the Rust Belt than anywhere else.

Location, Location, Location

According to David W. Holt, chairman of the Conexus Indiana Logistics Council, the reasons for the fast-paced growth are straightforward. “One reason we are attractive for logistics is location,” he said. “We are in the middle of the country, with a lot of interstates. Our state is also in good fiscal shape, in addition to being a low-tax state.”

Chicago and its surrounding region is also a big area for logistics growth. The world’s seventh-largest container shipping company, APL Ltd., recently completed an intermodal container terminal in Joliet, Ill.

Gene Seroka, APL’s president of the Americas for Container Shipping, explains why APL decided on Joliet. “The terminal is located in CenterPoint Intermodal Center, the largest inland port in the U.S.

“[It's] adjacent to the rail ramps of the main U.S. east-west railroads. It is located close to the Union Pacific and BNSF Intermodal Rail Terminals, as well as numerous customer warehouses and distribution centers.”

Intermodal shipping is a major driver of the Midwest logistics boom. Another huge reason is the boom in oil and natural gas in Middle America.

In recent survey of trucking firms, 95% of respondents said they expect their businesses to grow this year. When asked if the growth of unconventional shale energy would have an effect, 97% indicated it would.

In fact, shale energy production is expected to be responsible for 16% of all future growth in the trucking business.

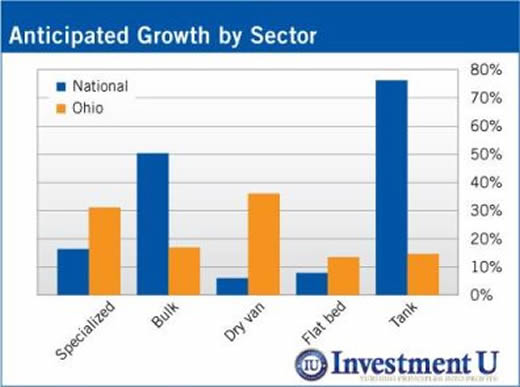

The graph below, courtesy of the Ohio law firm Benesch, depicts anticipated sector growth in Ohio and across the nation.

It’s clear the shipping sector is going to benefit from all of the new companies moving into Middle America. But it will also benefit from existing firms reshoring and expanding their operations in the booming Rust Belt.

We’ve written about this phenomenon for the last three weeks. You can read about it here, here and here.

The Best in the World

Like I said, the best third-party logistics company in the United States also happens to be the world’s largest.

C.H. Robinson Worldwide (Nasdaq: CHRW) works with 56,000 transportation companies. These include railroads, trucking companies, ocean carriers and airfreight companies.

Last year, C.H. Robinson handled about 11.5 million shipments from more than 42,000 customers.

But what makes C.H. Robinson a great investment? No other third-party logistics company comes close to the size and scale of C.H. Robinson’s operating network.

The company has kept a long-term compound annual growth rate (CAGR) target for revenues, income and earnings-per-share (EPS) of 15% since its formation.

But talk is cheap. Any company can set lofty goals. The hard part is reaching those goals.

For the last decade, C.H. Robinson’s performance has mostly met or beat its targets. Its revenues, income and EPS grew at an average CAGR of 13.5%, 17.1% and 18.2%, respectively.

Nice.

As if that isn’t reason enough to buy the stock, the company currently boasts a dividend yield of 2.4%. Over the last five years its annualized dividend growth rate is 9.6%. Plus, the company has a long history of buying back its stock.

The booming Rust Belt Revival in Middle America bodes well for this Eden Prairie, Minn., logistics powerhouse. The stock currently trades about 10% off its 52-week high.

It’s one more example of the kind of moneymaking potential flowing out of our Rust Belt Revival.

Good investing,

Dave

P.S. There are six companies leading what I call the Rust Belt Revival in Middle America. If their plans are successful it could end the deficit, bring unemployment back to 4%, send the Dow to upward of 20,000, and place $8,000 in the pocket of every American.

Best of all, even small shareholders in these companies are on course for huge payouts.

For more about this bold $1.2 trillion plan, click here.

Source: http://www.investmentu.com/2013/May/best-rust-belt-revival-stock.html

Copyright © 1999 - 2011 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.