Inflation Is The Lifeblood Of A Healthy Economy

Stock-Markets / Inflation May 21, 2013 - 04:41 AM GMTBy: I_M_Vronsky

Inflation Is To An Economy What Blood Pressure Is To The Human Body

Inflation Is To An Economy What Blood Pressure Is To The Human Body

It is a well-known medical fact that more people die from LOW BLOOD PRESSURE then from high blood pressure.

Therefore, if one accepts the premise that Inflation is to an Economy what Blood Pressure is to the Human Body, it then logically follows that low inflation rate over a protracted period will eventually and inevitably destroy a heretofore healthy economy.

The best, most effective 'medicine' to combat DEFLATION is inflation. This is what democrat President Franklin D Roosevelt did from 1934 to pull the nation out of the devastating morass of the GREAT DEPRESSION.

We Need More Inflation

It looks like we’ll be stuck in a low-growth, high-unemployment economy for many more years, but there is a way out of our troubles if only we’d be willing to buck 35 years of conventional wisdom that’s taught us that inflation is always and everywhere bad for the economy.

The truth is, right now the U.S. economy needs a little more inflation, not less. It’s sacrilege, I know, but our heretofore slavish devotion to low-inflation policies is keeping us mired in a SLOW GROWTH ECONOMY.

Already, politicians have demanded that the Federal Reserve cease and desist from any recovery efforts, arguing that inflation might explode out of control. Never mind that the dire and immediate emergency is an unacceptably high 7.5% Unemployment Rate.

RECENTLY HOWEVER, we have started to hear more voices characterizing higher inflation as a solution, rather than as a problem. Charles Evans, president of the Federal Reserve Bank of Chicago, spoke recently about the dangers of “fighting the inflation ghosts of the 1970s.” Instead, Evans is worried about “repeating the mistakes of the 1930s.”

As well he should be worried. Our difficulties resemble the depression of the 1930s much more than the stagflation of the 1970s.

Why We Need Inflation

Some economists believe some modest, sustained inflation is just the tonic for our global recessionary hangover.

That’s no typo. Some serious people believe a modest, sustained inflation is just the tonic for our global recessionary hangover, starting with Japan’s new prime minister. After winning last fall, Shinzo Abe has pursued a campaign promise to expand the money supply and trigger higher prices. The markets have applauded: the Nikkei stock index has been galloping, while lenders are rewarding Japan with low interest demands.

http://cognoscenti.wbur.org/2013/03/06/why-we-need-inflation

HISTORY IS TESTAMENT THAT INFLATION IS GOOD

And what does history have to say? Inflation helped slay both the Great Depression of the 1930s (the worst in history) and the runner-up for worst economic calamity, the depression of the 1890s. Moreover, one must remember President Franklin Roosevelt called for higher prices to fight the deflation of the 1930s. Specifically, it was President FDR's inflationary policies that paved the way for the nation rising out of the depths of the 1930s Great Depression.

US INFLATION FROM 1927 TO 1934

The USA from 1927-1930 was sowing the seeds of its self-destruction by allowing the US Inflation Rate to flat-line below ZERO percent. Subsequent to the Stock Market Crash of 1929, the US government compounded its error by allowing the Inflation rate to ‘feed’ the 1930s Great Depression , when it plummeted to -10% by 1932. See chart:

Finally in 1933 the new democrat President Franklin D Roosevelt made the decision to stimulate the nation’s economy by fostering an accelerating Inflation Rate. Although FDR used several policies to achieve this, by far the most effective was when he decreased the value of the US dollar by increasing the value of gold by 69% from $20.67 to $35.00/oz.

From this historic date the US economy began to climb out of the 1930s Great Depression. ..fueled mostly by a growing inflation. To be sure the US Inflation Rate remained POSITIVE from 1934 through 1937. And the rest is history (see study “DOLLAR DEVALUATION IS INEVITABLE…just like in 1934” at the end of this editorial).

As history is indelible testament, INFLATION is good and vitally necessary for a healthy, growing economy.

Dr Janet Yellen To The Rescue...DEVALUATION IS THE GOAL

Meet Janet Yellen, Who Will Probably Replace Ben Bernanke As Fed Chair.

Yellen says lower US dollar has helped narrow deficit.

http://www.huffingtonpost.com/2013/04/25/janet-yellen-fed-chair_n_3154852.html

Yellen emphatically asserts in support of continued Quantitative Easing:

• Significant part of US budget deficit is due to weak economic growth

• Fed has tools to remove stimulus when needed, can pay interest on bank reserves

• Will rely heavily on interest on reserves during eventual exit from stimulus

• Fed could even take losses if it decides to sell securities

In the Fed taking 'forceful action' on economy, Yellen says:

The Federal Reserve's aggressive easing of monetary policy is warranted given the still-battered state of the U.S. labor market, Fed Vice Chairman Janet L. Yellen said recently.

In an address to the politically influential AFL-CIO, Yellen bemoaned the unusually weak nature of the economic expansion.

http://blogs.cfed.org/cfed_news_clips/2013/02/fed-taking-forceful-action-on.html

Paul Krugman's Approval of Dr Janet Yellen

Good News: Janet Yellen is now the Fed’s new #2. She’s open-minded, a good counterweight to the inflation hawks who think that any day now we’ll be partying like it’s 1979. She’s also a distinguished scholar with much of her work in New Keynesian macro. In fact Dr Yellen is proudly well-known as An Inflationist.

She’ll provide exactly the kind of intellectual flexibility the Fed needs. Furthermore, Dr Yellen is first in line to succeed Dr Bernanke as Fed Chairman, when his term ends in 2014.

WASHINGTON — In July 1996, the Federal Reserve broke the metronomic routine of its closed-door policy-making meetings to hold an unusual debate. The Fed’s powerful chairman, Alan Greenspan, saw a chance for the first time in decades to drive annual inflation all the way down to zero, achieving the price stability he had long regarded as the central bank’s primary mission.

But Janet L. Yellen, then a relatively new and little-known Fed governor, talked Mr. Greenspan to a standstill that day, arguing that a little inflation was a good thing. She marshaled academic research that showed it would reduce the depth and frequency of recessions, articulating a view that has prevailed at the Fed. And as the Fed’s vice chairwoman since 2010, Ms. Yellen has played a leading role in cementing the central bank’s commitment to keep prices rising about 2 percent each year.

http://www.nytimes.com/2013/0...

DEFLATION IS THE DEATH KNELL FOR ANY ECONOMY

It is self-evident that DEFLATION is the antithesis of INFLATION.

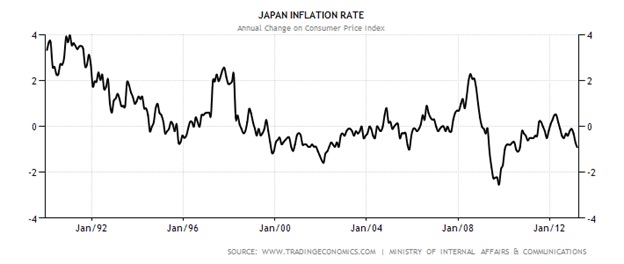

It is also intuitive that the absence of INFLATION in any economy will relentlessly cause its own decline. Ergo, PROTRACTED DEFLATION IS THE DEATH KNELL FOR ANY ECONOMY. The most outstanding example of this lethal phenomenon is JAPAN from 1990 to 2010.

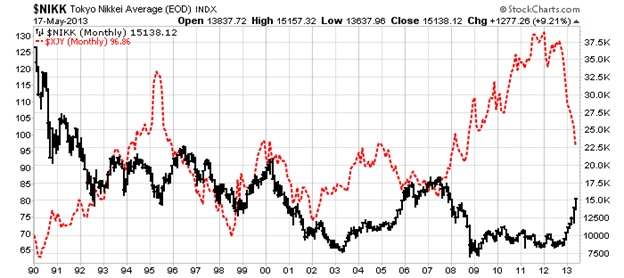

From 1990-2012 Japan’s Inflation Rate had relentlessly fallen from nearly +4% to a low of -2% in 2010…and it still grovels below zero percent today. Consequently, the once vibrant Nippon Economy has suffered horrific DEFLATION, as demonstrated and caused by two factors: The relentless appreciation of the Yen currency; and the equally dogged decline of the NIKKEI Stock Index. Specifically, from 1990-2012 NIKKEI Stock Index unremittingly fell from 37,000 to only 7,500 (-80%), while their Yen currency appreciated +90% in the same time period…almost a 1:1 inverse relationship. ..for more than two decades.

Here is the actual Price basis (1990-2013):

http://tinyurl.com/b7xywdv

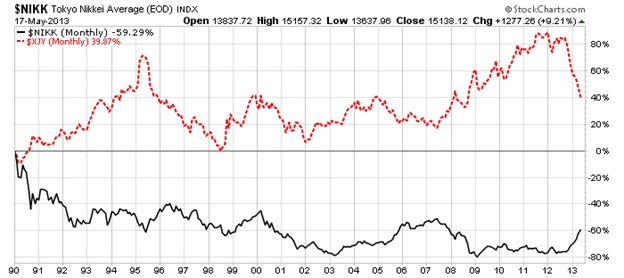

Here is the Performance (percent basis 1990-2013):

http://tinyurl.com/a8qexx5

In December 2012 Shinzô Abe became the new Prime Minister of Japan via a landslide victory. His savvy monetary policy was to INCREASE INFLATION by devaluating the Yen. He is achieving this glorious goal via an aggressive program of Quantitative Easing (QE), whereby the Bank of Japan (BOJ) is buying the country’s Treasury Bonds. The BOJ earlier this month committed to open-ended asset buying to nearly double the monetary base to 270 trillion yen ($2.72 trillion) by the end of 2014 to end 15 years of deflation and in order to achieve its 2 percent inflation target in two years.

AND HERE ARE THE SPECTACULAR RESULTS OF JAPAN's QE YEAR TO DATE:

NIKKEI Stock Index has soared +45% (as of May 17, 2013) Yen Currency has fallen -17% (as of May 17, 2013)

http://tinyurl.com/axtjeg7

TWO DECADES of Japanese DEFLATION is out as The Rising Sun of INFLATION appears.

THREE CHEERS for Prime Minister Shinzô Abe and QE.

Would that our President Obama could learn from Minister Shinzô Abe.

********

"DOLLAR DEVALUATION IS INEVITABLE...just like in 1934"

http://www.gold-eagle.com/gold_digest_08/vronsky040209.html

By I. M. Vronsky

Editor & Partner - Gold-Eagle

www.gold-eagle.com

© 2012 Copyright I. M. Vronsky - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.