Fed Money Printing Real Conundrum!

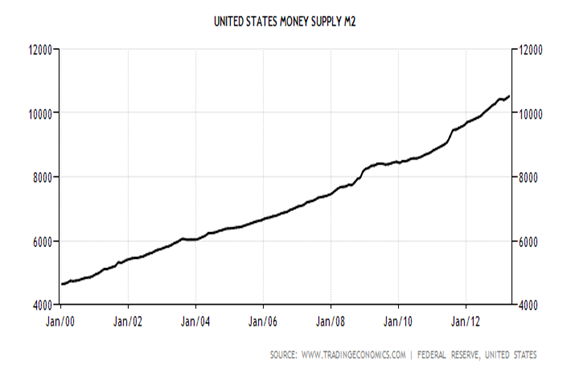

Interest-Rates / Quantitative Easing May 30, 2013 - 09:58 AM GMT Back in the heady days of Alan Greenspan, when you couldn’t identify a bubble until it was too late, the Maestro was busy printing. The money went into the tech stocks up until that train went off the tracks in early 2000. So the Fed started to print even more and that led to a housing bubble. As most of us are painfully aware, the housing blew up in 2007 so Greenspan’s predecessor, Ben Bernanke, had to put the printing press into a higher gear. The Fed then created mandates in order to justify the excesses and they included increased growth and employment. Unemployment must drop to 6% or less and growth must surpass 3% while keeping inflation at 2%. The end result of all this is a chart of the money supply that looks like this:

Back in the heady days of Alan Greenspan, when you couldn’t identify a bubble until it was too late, the Maestro was busy printing. The money went into the tech stocks up until that train went off the tracks in early 2000. So the Fed started to print even more and that led to a housing bubble. As most of us are painfully aware, the housing blew up in 2007 so Greenspan’s predecessor, Ben Bernanke, had to put the printing press into a higher gear. The Fed then created mandates in order to justify the excesses and they included increased growth and employment. Unemployment must drop to 6% or less and growth must surpass 3% while keeping inflation at 2%. The end result of all this is a chart of the money supply that looks like this:

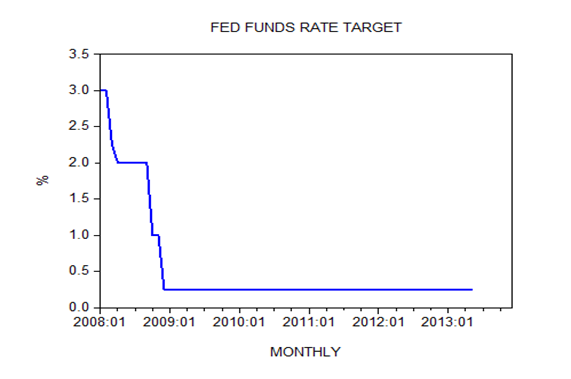

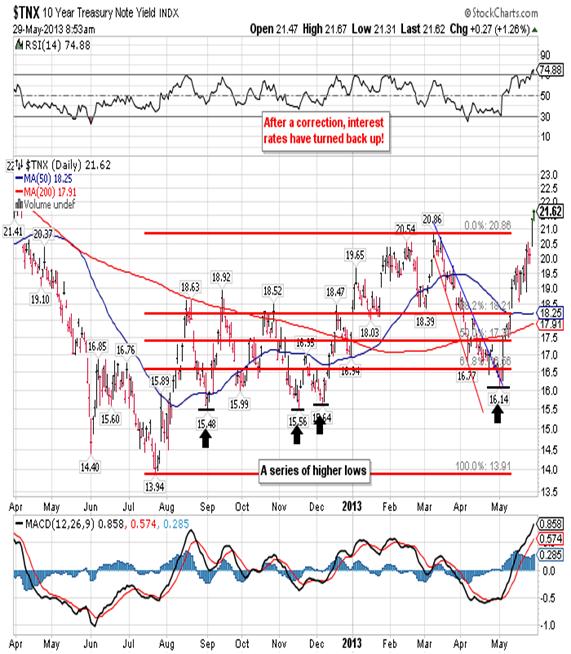

Of course the Fed had another tool, the interest rate, at their disposal and they leaned on that as well. Here’s what happened to rates:

Nominal rates dropped to almost zero in 2009 and have been stuck there ever since. In real terms interest rates are in fact negative!

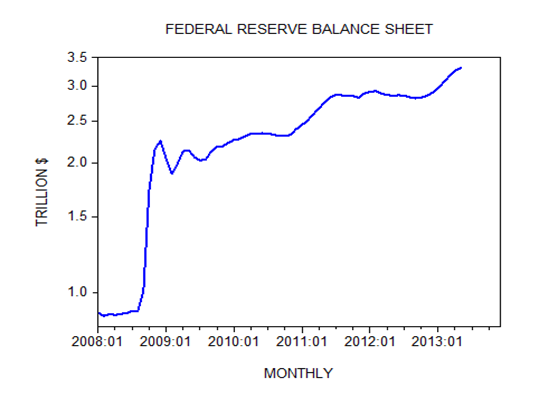

The reasons the Fed pushed rates down close to zero and prints excessively are twofold: to keep the government current and keep the banking industry from seizing up, although some would argue that it’s one in the same. Of course nothing is for free as we can see the effect this had on the Fed’s balance sheet:

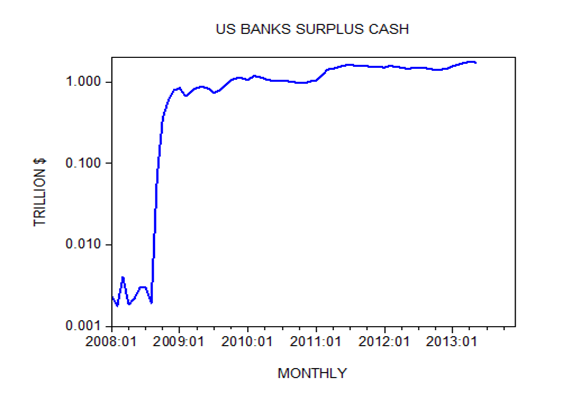

The Fed traded its fiat currency in exchange for a sordid assortment of worthless “assets” formerly held in the balance sheets of ‘too big to fail banks’. The banks in turn were supposed to take all of this cash and loan it back to the general public in order to facilitate growth and jobs. Instead they did what greedy bankers always do, they hoarded the cash and deposited it back into the Fed in order to earn interest:

You’d think the Fed would have figured this out after QE1, but somehow they missed it and went ahead with QE2, Operation Twist and QE3. A person of average intelligence might have wondered just why they would have done such a thing.

If you stop and think about it the US Federal Reserve is quite possibly the worst run organization in the history of planet earth. This is an entity that was put in charge of the world’s richest nation back in 1913. At that time the US was the industrial power and the world’s biggest creditor nation. Our currency was backed by gold and silver and our government was quite small. It was a world where cash was king! Yet somehow it was decided that we needed a Federal Reserve in order to smooth the bumps out. We should have figured out in 1929 that something was amiss with that idea, but the Fed marched onward. Along the way they jettisoned gold and silver as a currency, stopped auditing the Fed, and began to work in secret. By 1973 the US ceased being a creditor nation and turned into a debtor nation. Debt began to replace wealth and down we went.

When the Fed introduced the concept of QE in 2009 it was supposed to be a brave new step that would resolve all of our problems. In reality it was nothing more than the creation of more debt that supposedly would resolve a debt crisis! We’d spend US $ 700 billion (that was QE1) and the green shuts (remember the green shuts?) would create jobs and growth. Well that was never the intention. The intention was to bail out the financial system and at the same time inflate our debt away with a gradually falling dollar. It’s obvious that will no longer work and that’s the reason QE, at least in its current form, will cease to exist. All the unintended consequences have the dollar going in the wrong direction, raising the cost of debt and affecting the balance sheet of US companies that moved everything overseas, so we’ll have to go down a different road.

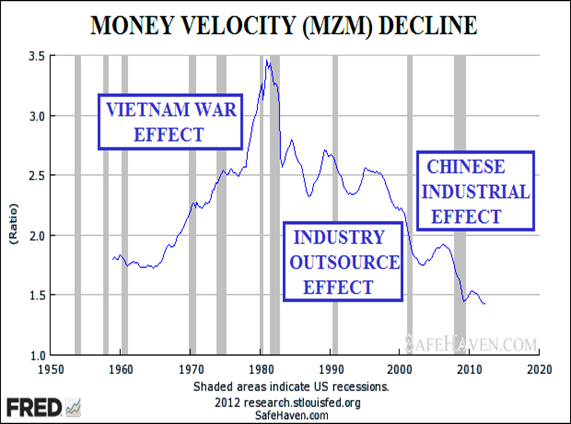

Aside from the obvious we have an economy screeching to a dead stop in what can only be described as a deflationary scenario. For confirmation of that, just take a look at the velocity of money:

It’s now at an all-time low and is falling at least as fast as the money supply is increasing. All the new money is going to the big banks in the form of bond redemptions, derivative coverage, and the salvation of the Fannie Mae’s of the world, and all under the US government supervision. The money is not finding its way into the economy for further circulation. The real plague of our generation is insolvency, soaked by endless applications of tainted money from central bank easing’s.

Finally, we have the straw that is breaking the camel’s back. The Fed publically promised to keep interest rates at or near zero well into 2015. The delusional Mr. Bernanke labors under the false belief that the Fed sets the interest rate, but in reality the bond market sets the rate and it’s not a pretty picture as you can see here:

Yields hit a new high last night for the entire leg down and were even higher this morning, so that raises the cost of just about everything. Hardly what you want to see in a stagnating economy!

So when you stop to add all of this up, there can be no doubt that QE will come to an end sooner rather than later. What comes next? More than likely we’ll see expropriation combined with a form of printing that does not require the creation of government debt. You’re IRA’s will be targeted and if your bank goes under, your deposits will be replaced with some form of stock that you won’t be able to sell during your lifetime. Of course there will be a negative public reaction to that so there will need to be something to distract the populace, along the creation of a scapegoat to blame it on. How will all that end? Use your imagination!

Robert M. Williams

St. Andrews Investments, LLC

Nevada, USA

Copyright © 2013 Robert M. Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Robert M. Williams Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.