This Is What Real Stock Market Bubbles Look Like

Companies / Liquidity Bubble May 30, 2013 - 11:56 AM GMT With the stock market currently doing so well, numerous articles are popping up playing the bubble card. Personally, I don’t believe we are anywhere near bubble levels for equities, at least in the general sense. I do think there are certain stocks that are currently overvalued, but very few that I would describe as dangerously so. To me, the true definition of a bubble is when prices have become so ludicrously high, that the dangers of a catastrophic loss large enough to be considered almost permanent become imminent or at least quite obvious.

With the stock market currently doing so well, numerous articles are popping up playing the bubble card. Personally, I don’t believe we are anywhere near bubble levels for equities, at least in the general sense. I do think there are certain stocks that are currently overvalued, but very few that I would describe as dangerously so. To me, the true definition of a bubble is when prices have become so ludicrously high, that the dangers of a catastrophic loss large enough to be considered almost permanent become imminent or at least quite obvious.

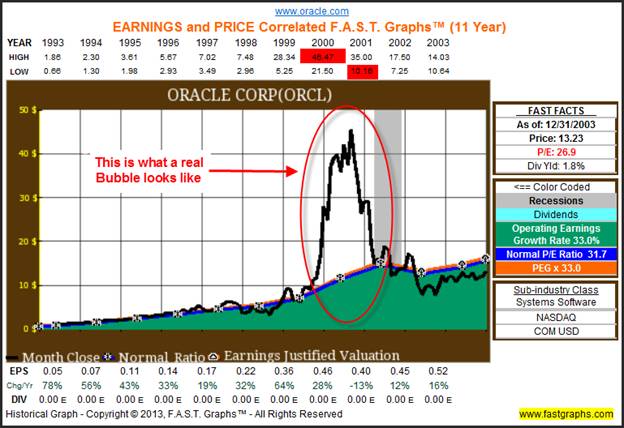

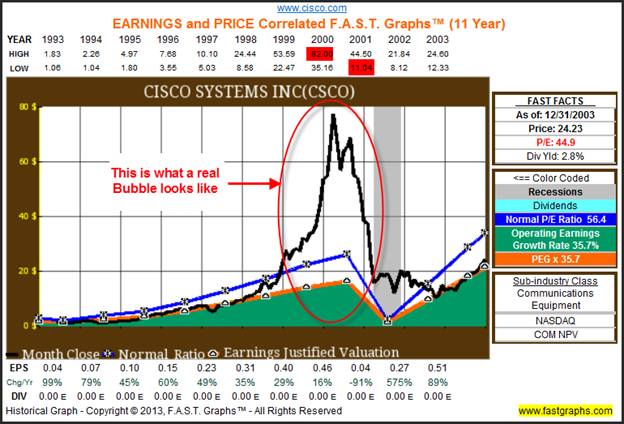

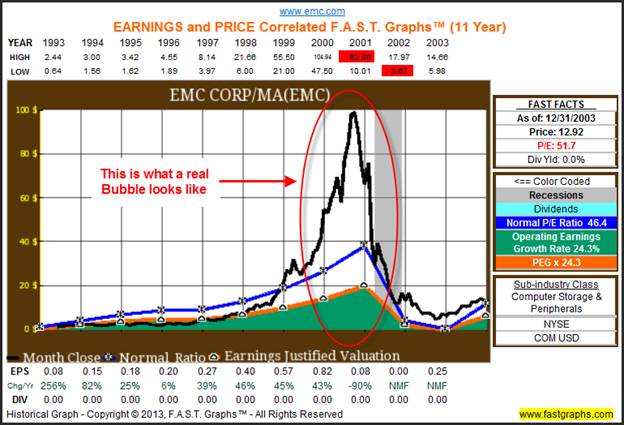

Starting in calendar year 1999 and then peaking in calendar year 2000, we saw a true bubble emerge and inevitably burst in technology stocks. The following F.A.S.T. Graphs™ on three prominent technology stalwarts, Oracle Corp (ORCL), Cisco Systems Inc (CSCO) and finally EMC Corp (EMC) provide quintessential examples of a true bubble. To clarify what they are depicting, we see the stock price closely correlate and track earnings both before and after the bubbles. However, during the bubble periods we see clear and undeniable insane valuation that fundamentals do not justify.

But perhaps most importantly, we see what happens when the bubble inevitably bursts. Even after all these years have passed, none of these companies have seen their stock prices return to their bubble highs. This is the great danger of a true bubble, devastating losses that never recover. At least they never recover in a timeframe that would be considered even close to acceptable. Only true bubbles create this type of devastating loss.

Oracle Corp

Cisco Systems Inc

EMC Corp

10 Stocks Approaching Bubble Territory

As I previously stated, even though we’ve had a decent run in the market, I don’t believe we are anywhere near close to bubble territory on most equities. I recently published an article, found here, illustrating that even after achieving all-time highs, there were very few stocks in the Dow Jones that were overvalued.

On the other hand, as I screen the major stock universes such as the S&P 500, the S&P 400, the S&P 100 the NASDAQ 100, and the Fortune 500, I was hard-pressed to find 10 companies that I felt were anything close to bubble territory. The following portfolio review of 10 stocks approaching bubble territory compares their current P/E ratios to their estimated earnings per share growth, and their historical earnings per share growth. Based on these metrics, all 10 of these companies appear to be overvalued, and some even dangerously so. Later, when I examine each of these 10 companies individually, I will let you, the reader, decide whether or not any of them are in truth trading at bubble territory levels.

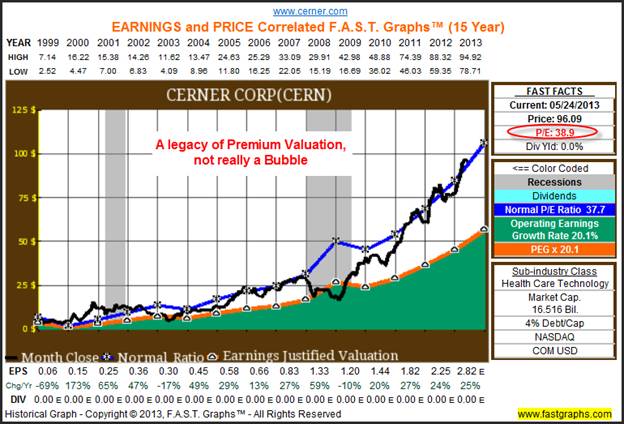

Cerner Corp

Cerner Corp (CERN) is a healthcare technology company with a legacy of trading above earnings justified values. However, we also see that each time the stock has risen above earnings justified levels in the past, that it inevitably returns to its earnings justified valuation (the orange line). On the other hand, because this company has such a consistent history of earnings growth above 20%, the power of compounding allows the company stock to achieve new highs within reasonable periods of time once each of its little mini bubbles burst. Perhaps this will once again prove true from today’s levels.

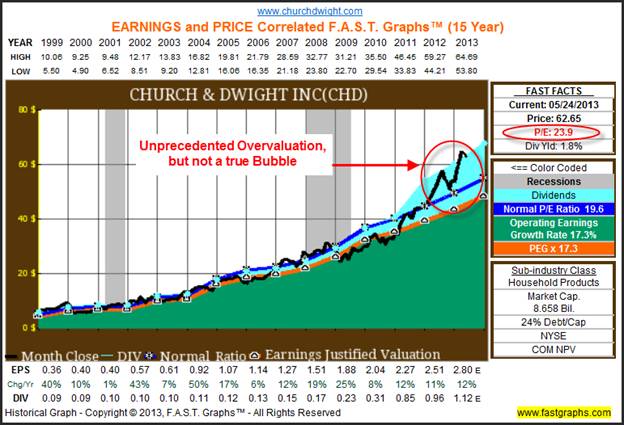

Church & Dwight Inc

Church & Dwight (CHD) is another example of a company with a strong and consistent record of above-average earnings growth. Historically, stock price has closely tracked this superior operating record. However, at current levels Church & Dwight’s stock price is clearly trading at unprecedented valuations. The question is, is it at bubble levels yet? The answer would be determined by how long it would take stock price to recover if this mini bubble burst.

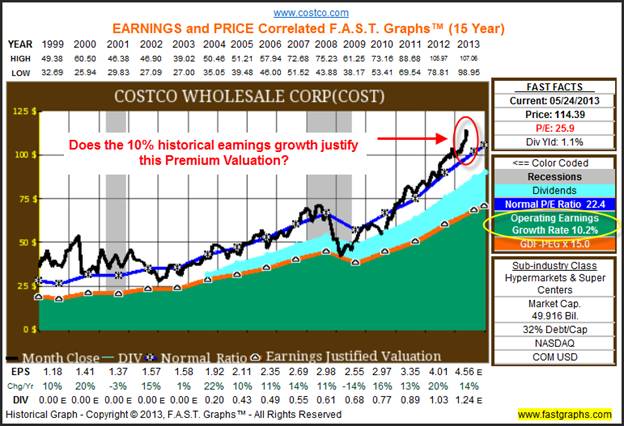

Costco Wholesale Corp

Costco Wholesale Corp (COST) is yet another example of a company with a legacy of its stock price trading at nosebleed valuations. Earnings growth has not been spectacular, in truth significantly weaker than our previous two examples. The company has been paying a dividend since 2004, but only offers an average yield. Nevertheless, the market has typically seen fit to price the stock at significantly above-average valuations. However, today’s overvaluation is even higher than normal. But can we call this a bubble?

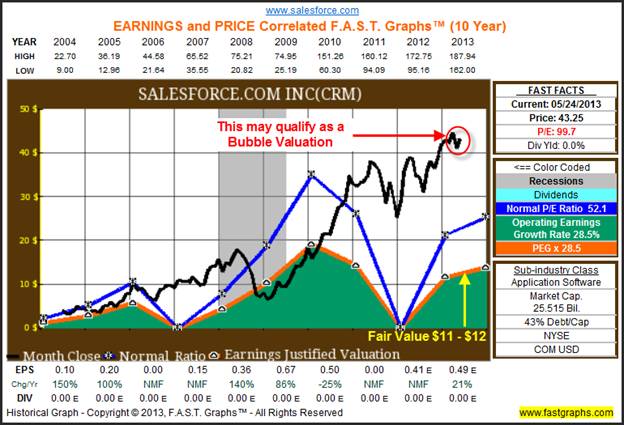

Salesforce.com Inc

Salesforce.com Inc (CRM) appears to be the first example of what I would truly classify as a stock in true bubble valuation territory. The company does generate substantial cash flows, but its inability to bring those cash flows to the bottom line should be a cause of concern, at least in my opinion. If the stock were to trade at earnings justified levels, its share price could fall to between $10-$12 per share. I would classify that as a bubble.

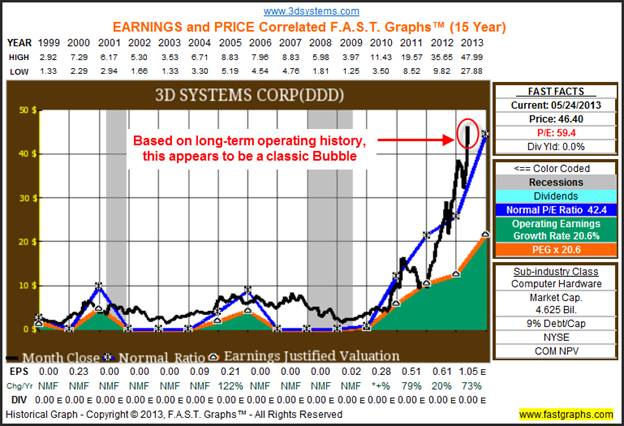

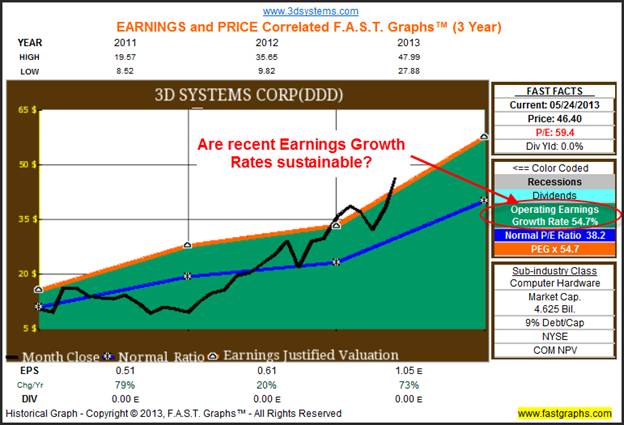

3-D systems Corp

3-D systems Corp (DDD) is another example of a stock that I believe is in bubble territory. Although the company has had very strong earnings growth post-great recession, I find it hard to believe that a 50% plus earnings growth rate is sustainable long-term.

On the other hand, when you evaluate the company’s earnings and price correlated graph since calendar year 2011, you do discover some justification for the current lofty valuation. But once again, I believe this growth rate is temporary, and therefore, unsustainable long-term. With that said, the consensus of nine analysts reporting to Standard & Poor’s Capital IQ, are expecting a five-year earnings growth rate of 26%. However, even that strong level of growth would not justify a current P/E ratio of approximately 60.

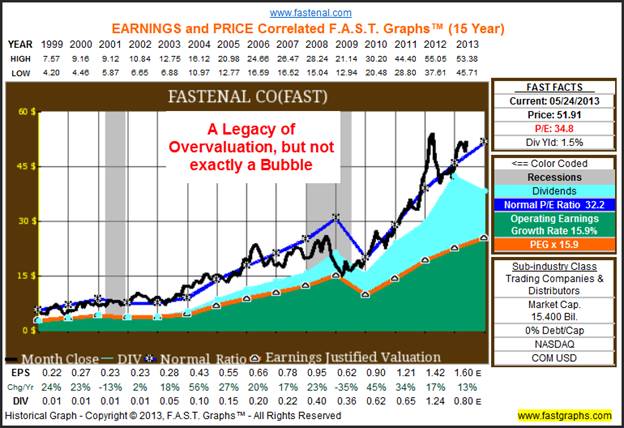

Fastenal Co

Fastenal Co (FAST) is another example of a company that the market has routinely applied a premium valuation to. Consequently, based on historical norms, it could be argued that the stock is not terribly overvalued. On the other hand, based on earnings justified levels, the current P/E ratio of approximately 35 would not seem justifiable. There are plenty of companies with earnings growth rates as high and as consistent as Fastenal that can be purchased at much more reasonable multiples of earnings.

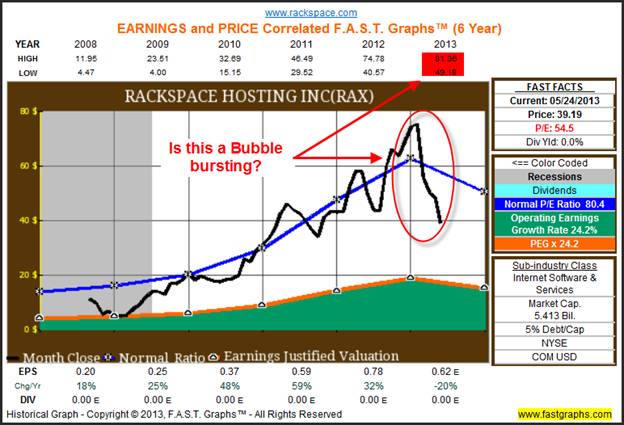

Rackspace Hosting Inc

Rackspace Hosting Inc (RAX) might be the one true example of a stock trading in bubble territory that I have uncovered in today’s market. Although the market has historically priced the stock and a premium, a recent drop in earnings per share has already caused the stock price to be virtually cut in half as it has fallen from a high of $74.78 to under $40 per share. Nevertheless, I believe there is the potential for the stock to drop by even as much as another 50% if it were to move in alignment with its earnings power.

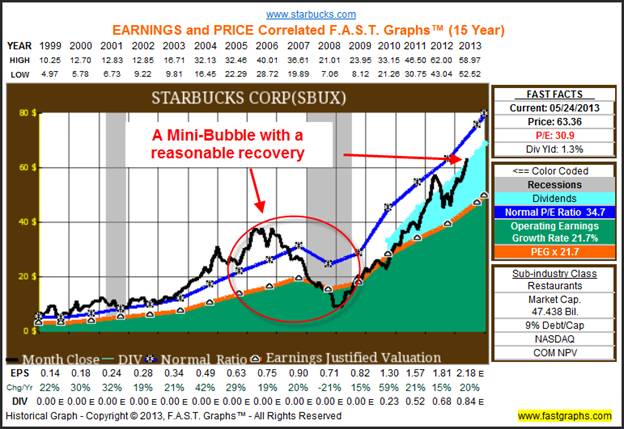

Starbucks Corp

Just prior to the great recession of 2008, Starbucks Corp (SBUX) was a company with a legacy of the market placing a premium valuation on their stock. One thing that should be clear from examining these earnings and price correlated graphs is the undeniable reality that when stocks are priced to perfection with lofty PE multiples, they are very vulnerable if anything at all goes wrong. In the case of Starbucks, we saw the price fall from an all-time high of $40.01 a share in 2006 to a low of $7.06 in the throes of the great recession.

However, due to the power of compounding, the continued advance of above-average growing earnings enable Starbucks’ share price to reach its current all-time highs. Consequently, I might call Starbucks’ valuation in 2006 and 2007 as in mini-bubble territory. My reasoning for saying this is because valuation was not so high that Starbucks was not unable to recover within a few short years.

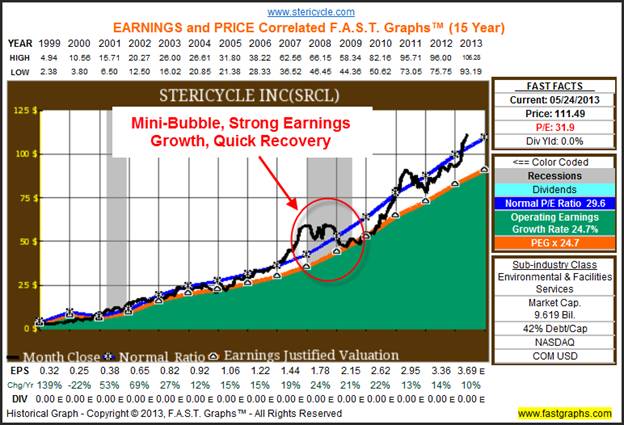

Stericycle Inc

Stericycle Inc (SRCL) represents yet one more example of the power of strong and consistent earnings growth. You could say that this company has experienced several mini-bubbles, similar to what Starbucks went through. However, due to the company’s exceptional record of earnings growth, even if investors purchased Stericycle at the heights of its overvaluations, they would have still earned attractive long-term returns. Perhaps the hidden message here is that the greater danger is all this talk about bubbles, rather than the reality of what bubbles might actually represent.

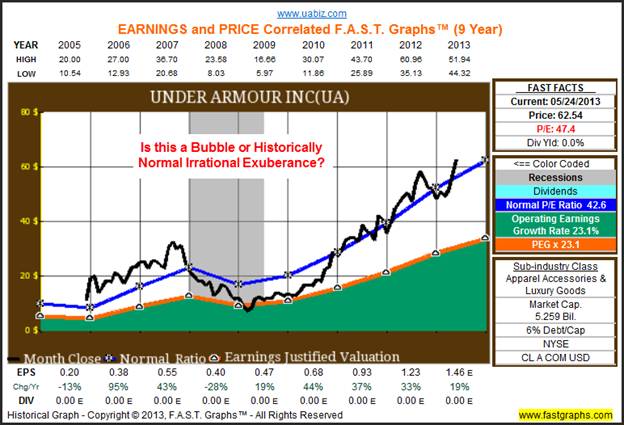

Under Armour Inc.

My final example looks at Under Armour Inc (UA), a very popular maker of luxury apparel. Although this company has consistently put up good numbers, you can see the vulnerability of high valuation that occurred with Under Armour shares as we entered the great recession. However, once again we see an example of how strong earnings growth, coupled with positive investor sentiment, has allowed the shares to continue reaching all-time highs. But my question is; does it make sense to trust that the market will continue to apply these premium valuations ad nauseam?

Conclusion

My true purpose for writing this article was to illustrate how silly that I believe all this talk of bubbles really is. Frankly, I had to work very hard just to find to a few examples of stocks that I considered truly dangerously overvalued. True, the market has been strong of late, but I’ve yet to see anything even remotely looking like a bubble forming in equities. There are some companies that I would consider fully valued or perhaps moderately overvalued. But there still remain many companies that are reasonably priced.

The reason for this is because earnings and dividends have continued to advance along with the stock prices of most of the very best-of-breed companies. Therefore, valuations have remained in alignment with their earnings justified levels. The message here is that investors need to be careful to consider all factors before making long-term decisions about investing. I’m afraid that many investors have begun to fear the stock market just because it’s been good of late. I don’t believe those fears are justified.

Disclosure: Long ORCL and CSCO at the time of writing.

By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm. Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2013 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Chuck Carnevale Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.