U.S. Fed Meeting Did Not End Gold Bull Market

Commodities / Gold and Silver 2013 Jun 23, 2013 - 04:48 PM GMTBy: Bob_Kirtley

This week’s Fed meeting saw members putting forward a provisional timetable for the tapering and the end of QE3. This triggered a sharp decline in gold prices, as additional QE has been a major driver of higher prices in recent years. One question we are getting asked is did this FOMC meeting end the gold bull market?

This week’s Fed meeting saw members putting forward a provisional timetable for the tapering and the end of QE3. This triggered a sharp decline in gold prices, as additional QE has been a major driver of higher prices in recent years. One question we are getting asked is did this FOMC meeting end the gold bull market?

Our answer is no, this Fed meeting did not end the gold bull market.

What Bull Market?

Gold is more than 30% below its all-time highs, made nearly two years ago, and the yellow metal is down 23% this year so far.

The gold bull market ended more than six months ago, when US economic data started turning, particular in employment, which drastically reduced the probability of further easing by the Federal Reserve. The Fed meeting this week merely confirmed what has been evident for months.

Let us clarify that we are a trading operation, and we are not commenting on the validity, accuracy or future direction of US economic data. Nor are we commenting on whether quantitative easing is the right path of monetary policy. We have been merely making the point that the data has improved in the eyes of the Federal Reserve, therefore the Fed was not going to pursue any more QE, and therefore gold prices would fall. We reacted by taking short positions in gold and mining stocks. We are a trading operations and our goal is return on capital, nothing more. Year to date for 2013 our portfolio is up over 50% as a result of this trading and up 655% since inception. This contrasts to some gold and silver funds that are down nearly 50%. So regardless of your original view, we simply ask that you read on and consider our view in your decision making progress.

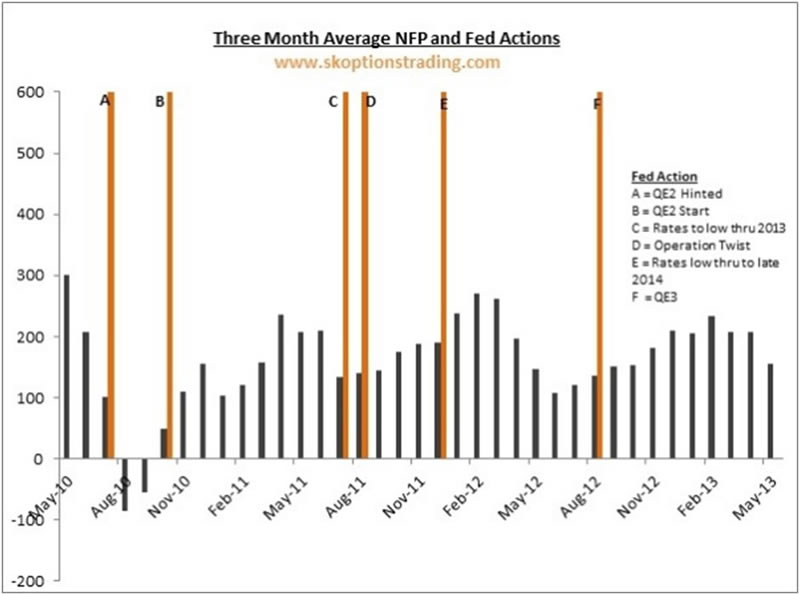

This chart below is crucial and a major factor in what policies the Fed decides to pursue. The three month average change in US employment has been consistently positive, which is negative for gold. It is no coincidence that gold prices peaked in December, just as the data exhibited signs of sustainable improvement.

Delayed Reaction

One thing that is somewhat puzzling is, why did it take so long for gold prices to fall to where they are now? Surely gold prices should have been here three months ago, if we presume the data is correct and the Fed wasn’t going to pursue more QE?

This is a valid point, and we will offer a couple of reasons for why it took so long for gold prices to fall.

Firstly, the Fed was always going to err on the side of caution and wait for a run of good data before altering their stance on QE. Therefore the market was nervous that the data may just have been a flash in the pan, so gold was still a good hedge against the data turning sour again and additional QE coming back on to the table.

Secondly, the gold market often exhibits a trading pattern where it will not react aggressively to economic data releases, but will when the Fed acknowledges the data and confirms its intended reaction to the change. These past few weeks have been a classic example of this. We had US non-farm payrolls coming in at a solid +175k, which only sparked a minor reaction in gold. Then we had the Fed coming out and saying that due to the solid economic data they were indeed looking at tapering QE, which sparked a $100 fall in gold prices. This is an important feature of the gold market that should be noted for those trading the yellow metal since it creates potentially lucrative opportunities. We added to our short position on gold after the employment data, since we knew that it was bearish for gold prices, even if the fall was going to be somewhat delayed.

The Next Support is..

Let us take a look at the technical drivers of gold at the moment. It appears that every time gold prices take another leg lower, various perma-bulls are on the wires saying “Well the next support is $XYZ, so the downside is limited from here”.

First it was $1620, then $1550, then $1475, $1425, $1350, $1310.. hold on we are now more than $300 lower than the first support levels that were meant to provide limited downside!

Not to mention that all those support levels are now resistance, so forget the downside being the limited, the upside for gold prices is surely extremely limited given the myriad of former support levels that are now providing resistance to the topside.

We have acknowledged these support levels, and often taken profit on short positions as gold reached various support levels. However we knew that with the bearish momentum both technically and fundamentally, it was always a matter of when, not if gold broke down through the next support – as we pointed out two weeks ago with regard to the $1350 support.

It’s a similar story with silver, with the optimum trading strategy being to fade rallies and add to shorts on any strength. Silver has support around $20, and resistance at $22, so if it can rally above $21 then it becomes an attractive short and we will probably looking to place short trades at those levels. In our view silver prices are heading to teens over the next few months, potentially sooner.

In terms of how to execute short trades, we prefer being outright short or selling call spreads instead of buying put options. Volatility has been higher in gold, as the chart below shows, and this pushes up the prices of options, since an option price increases with the volatility of the underlying asset.

By being outright short (with no options involved) we can avoid paying this premium and by selling call spreads we can not only take advantage of a fall in gold prices, but also a decrease in the market volatility. For more details on these trades, please visit our website www.skoptionstrading.com to subscribe to our newsletter and receive trading signals and our model portfolio.

Last One Out The Mine, Please Turn Off The Lights

The mining stocks have put in an appalling performance this year, halving in price. They are still not a buy here; regardless of how “cheap” they make look on numerous metrics. Whilst there is still a strong chance of significantly lower gold prices, this sector should be avoided completely.

As dramatic as it may sound, gold mining stocks could still fall another 25-50% from here, as gold grinds closer to $1000. We set a conservative target for the HUI of 300 at the start of 2013, when the index was around 425. However we now think 150, which was around the low made during the 2008 Global Financial Crisis, is a more realistic target.

One can point to how few people are bullish on the miners (shown by the bottom index on the chart above) but the fact is that the sentiment was this low when the miners were twice as high, so this is not a reason to get bullish on mining stocks. We have strategic short positions on select mining stocks that we think are particularly vulnerable and we are certainly not buyers of any mining stocks at these levels. This sector has been badly beaten up and so any sustainable recovery will be slow, fragile and probably years away. In addition to this we feel that there are still many longs in these markets that have yet to throw in the towel. The fast money has long stopped out of gold, but there remains a sizeable retail component that is still trying to hold on to miners. This is evident by the volume of feedback we get following articles like this from frustrated bulls who attempt in vain to show us the error of our ways. Will the last perma-bull to stop out of their long positions please turn out the lights.

Big Picture

Whilst it may appear like we are all doom and gloom with regard to gold, remember that in today’s modern financial environment one can make money almost as easily being long than being short. Buy, hold and hope is not the only investment option. Thanks to the explosion of inverse ETNs and other products, even retail investors can profit from falling prices as well as rising prices.

Therefore we urge readers to consider the big picture and re-evaluate their position, whether it is long or short. With gold at $1300, do the risk-reward dynamics favour being long or short?

In our view $1100 is more likely than $1500, so the next $200 move in gold is most likely south. Therefore we remain short. We also think that levels such as $1800 are not going to be reached again in the foreseeable future. The upside in gold is limited here, and the real risks are still to the downside. To see what trades we are placing please visit www.skoptionstrading.com. We welcome any feedback, comments and questions from readers and can be reached via our website or @skoptions on Twitter.

Take care.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.