Stocks Bull Market Confirmed by MWA Set to Continue?

Stock-Markets / Stocks Bull Market Sep 10, 2013 - 12:40 PM GMTBy: Marc_Horn

On the 3rd December 2012 MWA confirmed the long term bull market. How the DAX on 3 December at 11:24 confirmed a long term bull market.

On the 3rd December 2012 MWA confirmed the long term bull market. How the DAX on 3 December at 11:24 confirmed a long term bull market.

Is this bull set to continue? There is a lot of conflicting views currently about how the world is coming to an end - hyperinflation, sovereign debt crisis, unemployment, war, US government NSA spying scandals, G20 global tax hunt, oh and I must not forget Al Qaeda.

So starting with MAP Wave Analysis what clues do we have?

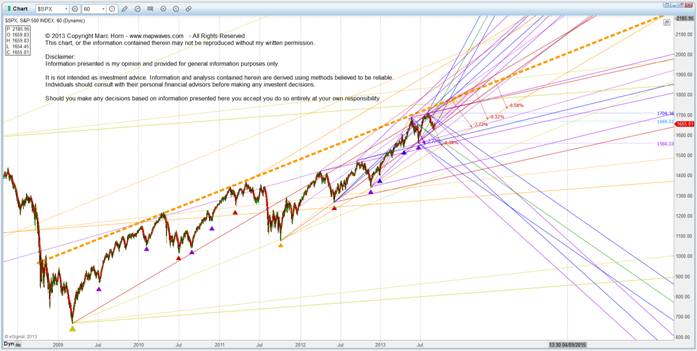

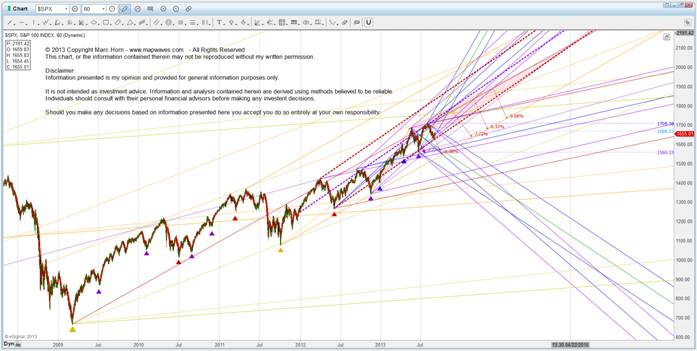

We are approaching strong resistance as we approach the QMLU as shown below;

Quarterly support is QMFMLL as shown below;

To be able to see if we are going there now we need to look for completed wave structures on the smaller fractal wave scale. So going down one fractal wave scale to the monthly pivot scale we have the following resistance;

Support is the M012MLL;

We can also see that despite all the QE by brain dead Western governments that will do anything to stay in power EXCEPT the right thing has not even been able to propel the markets above the M012ML!!! This equates to the law of diminishing returns - QE1 managed to get us to the QML, however everything since mid 2011 has been getting less effective - in simple English - you can bull@#$T most of the people most of the time, some of the people some of the time, but not all the people all of the time!

Capitalism and free markets are about letting non productive capital being replaced by productive capital - innovation driven by want of success - to generate productive wealth, rather than subsidizing old out of date crony capitalism!

But that is not how you get re-elected - you need to make empty promises to buy votes and be able to keep the elite ruling class in power by controlling the press and pricing the population out of quality education!

So how many of the people still believe the bull our Western governments put out through their propaganda machines - oops I mean the investigative free press???? To answer that we need to go down further fractal wave scales so looking on the weekly pivot scale resistance is as previously shown by the Quarterly MLU and the Monthly ML above.

On the previous chart look at the M012 ML - prices bounced off it, then managed to go through twice and on the fourth attempt have failed to get through! A fourth failure has an extremely high probability that prices will not make it through and W3 will not be made at the MLU which is typically expected. The fact that prices have remained in the bottom half of the M012 fork is a further indication of low momentum!

Below we can see the current Weekly fractal wave scale channel with WMF012 in which pivot W3 should fall;

Prices bounced off the ML and have bounced off the ML after making a new high - making this a valid possible top for W3 having met the MAP wave criteria. However confirmation is a weekly close below the MLL so combining the information we have so far - we have not yet tested the QMLU (often this would be with a pivot two fractal wave scales down, followed by one wave scale down - so that could be W3 followed by M3), the monthly resistance has not been tested 4 times and WMF012 MLL was penetrated followed by supporting and now again supporting lows it is highly probable that we will get 2 more highs before we have failure on the 4th attempt.

First prices need to give us an indication by breaking out of no man’s land – shown by the orange triangle below with the four most likely wave intersections for W3 and the projections for W4 before the bull continues to make M3, and confirm what wave scale the recent high was. Either way it looks likely we should have new high by the end of October followed by at least a drop off some 9% to 15% depending on the recent tops wave scale!

So looks like the government propaganda still has a ways to go yet! Slowly people are waking up that socialism does not work! Our Marxist socialist Western governments are rapidly approaching a crisis point where no matter how much they lie - who still believes that we need to give up our freedoms in the name of terrorism - Assange's courage to stand up for the freedom of speech and Manning and Snowden's exposure of the illegal activities of the US government deserve Noble Peace prizes for having the courage and standing up for the rule of law, unlike the war mongering Obama where if the Noble Prize committee wants to get back some lost credibility would strip him of his peace prize! The ICC should prosecute him for knowingly targeting and killing innocent people with every drone strike he signs off on! "There are estimates as high as 98% of drone strike casualties being civilians (50 for every one "suspected terrorist"). The Bureau of Investigative Journalism issued a report detailing how the CIA is deliberately targeting those who show up after the sight of an attack, rescuers, and mourners at funerals as a part of a "double-tap" strategy eerily reminiscient of methods used by terrorist groups like Hamas."

What the US and its Western allies are doing puts the Stazi to shame - they were mere amateurs!

Looks like for now there will not be an immediate unilateral attack on Syria – that is more likely after the end of October- a quick look at the sides here – Qatar a potential competitor to Russia for European gas with Saudi want to put in a pipeline through Turkey backed by bum chums the US and on the other side Russia and its buddies! I am sure this has nothing to do with it – if we evaluate the credibility that in the West we act on humanitarian grounds…. as opposed to what a central banker told me years ago…. FOLLOW THE MONEY!!! say no more!

However as stagflation worsens peoples quality of life more and more governments will become war mongering as there is nothing like a bit of nationalism to get people behind you to distract them from their troubles and the inevitable collapse of the Western style Marxism, as happened in the East, when they too run out of other people's money! It looks like war will wait for next year to end pivot M3 and take us down to the Q support shown previously for M4.

And if you think they don't know this why else do you think the NSA collects everything - not because of a few terrorists as their propaganda machines (oops - free investigative press) tells you, but so that they can trace down anyone with money - oh and now following the G20 meeting they are all going to share information in addition to all the back door crony schemes they use to protect outdated and non innovative companies like microsoft with windows 8 new gateway start screen so that they can download whatever they want form your computer to help them spy on everyone. Add to that the recent encryption revelations! All previous hardware you could put whatever version of windows on but buy a new computer with windows 8 and you need to find someone that can hack the bios to be able to use anything but windows 8 - funny how they don't tell you this when you buy a new computer????

Already many countries have banned cash sales of gold and put heavy restrictions on ownership, including reporting on the movement by miners as well as wholesalers and retailers to stop hiding cash in easily transportable forms. We have not seen the lows yet, but when the time is right gold will once again shine!

This is not what democracy or capitalism are about! Looking at history we will get forced loans - oops I mean war loans - where the government will take your money to retain power for as long as they can by giving you even more empty promises - ask the Cypriots! Then when the little man has nothing left either they will exterminate dissidents as they run out of space to lock them up or be overthrown through revolution!

MAP Wave Analysis, unlike Elliot Wave and Andrews Pitchforks are a systematic methodical rule based approach, details of which can be found either on my blog or here on The Market Oracle and data is archived and updated in a format that is traceable as shown in this SPX update, so that the system can be improved and used as a learning model. Additionally investors can evaluate its effectiveness when making investment decisions.

Click here to follow your duty of Use and copyright is described therein.:

Probabilities are derived from the MAP Analysis methodology described therein,

Click follow on my blog to receive regular FREE market updates and discussion.

For other articles published click here

For more information of how I do what I do http://mapportunity.wordpress.com/ . Comments and discussions very welcome! The statements, opinions and analyses presented in this site are provided as educational and general information only. Opinions, estimates, buy and sell signals, and probabilities expressed herein constitute the judgment of the author as of the date indicated and are subject to change without notice. Nothing contained in this site is intended to be, nor shall it be construed as, investment advice, nor is it to be relied upon in making any investment or other decision. Prior to making any investment decision, you are advised to consult with your broker, investment advisor or other appropriate tax or financial professional to determine the suitability of any investment.

© 2013 Copyright Marc Horn - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.