Whole Foods' "Detroit Plan" Keeps Growth Rates Fresh

Companies / Investing 2013 Sep 24, 2013 - 03:15 PM GMTBy: Money_Morning

David Mamos writes: The organic foods business is a $60 billion global industry, and no other grocery chain has profited from this boom as much as Whole Foods Market Inc. (Nasdaq: WFM).

David Mamos writes: The organic foods business is a $60 billion global industry, and no other grocery chain has profited from this boom as much as Whole Foods Market Inc. (Nasdaq: WFM).

Whole Foods is leading the charge of supplying organic, natural, and locally grown foods to the health-conscious eater. Founded in 1980, it now has a count of 355 stores in 40 states and 3 countries.

WFM stock has shown astronomic growth as well, with shares up nearly 500% in five years.

The growth will continue. According to the U.S. Food and Drug Administration, organic food consumption has gone up 9% per year over the last five years. Future growth rates could be greater than 8% annually.

That's why competition is increasing. A slew of competitors are taking a page out of Whole Foods' book and expanding rapidly.

Can Whole Foods' industry dominance - and WFM's stock tear - continue?

Let's dig in and find out.

Whole Foods Clear Advantage

Whole Foods is doing something that may seem impossible - it is thriving in troubled economic times. Profits rose 20% in the most recently reported quarter, with earnings per share of 38 cents and revenue rising more than 12%.

Whole Foods sales of $11.7 billion in 2012 account for only 2% of the U.S. supermarket industry. To capitalize on this still-growing industry, Whole Foods has laid out plans to increase its store count to 1,000 over the long term.

One advantage Whole Foods has over the competition: the shopping experience. It's not one that other stores have duplicated.

Loyal Whole Foods patrons love the trained and educated personnel that range from experienced butchers, fishmongers, dietitians, and cheese connoisseurs to the sandwich makers and checkout clerks.

That's why same-store sales - although slightly slowing in the most recent quarter - have been increasing.

But other stores want to steal away the Whole Foods consumer...

WFM Stock Faces More Competition

Sprouts Farmers Market Inc. (Nasdaq: SFM) offers nearly the same type of products and produce as Whole Foods. It was rewarded handsomely by Wall Street with its extremely successful initial public offering (IPO) last month when it closed 120% up on its first day of trading.

Sprouts currently has 160 stores and looks to expand its number of stores by 12% annually, thanks to capital provided by the IPO.

The Fresh Market Inc. (Nasdaq: TFM), Natural Grocers by Vitamin Cottage Inc. (NYSE: NGVC), and privately held Trader Joe's are others crowding into the field.

In fact, even traditional grocery stores such as The Kroger Co. (NYSE: KR) are carving out large portions of their stores' floor spaces to accommodate the demand for organic and natural products.

But it's not just the growth rates that have lured grocers to the organic market...

They also enjoy higher profit margins than general grocery stores, which have to engage in price wars to attract customers.

Whole Foods, meanwhile, benefits from health-conscious consumers' willingness to pay more for healthy eating - which is why the store has the nickname "Whole Paycheck."

Whole Foods reported operating margins of 7.5% last quarter and expects them to be between 6.1% and 6.2% next quarter due to costs associated with store expansion. These types of numbers are the envy of many in the grocery business, but they are a direct result of charging higher prices for higher quality.

Lately, however, the chain has had to lower prices to compete. That's why Co-Chief Executive Officer (CEO) Walter Robb said "the perception is that Whole Foods is far more affordable than it was a few years ago."

These price reductions have not yet been reflected in WFM's profit margins. Investors should watch for when - and if - they are.

Something else WFM stock investors need to watch - a new demographic...

Whole Foods Breaks New Ground

In the past, this Whole Foods "lifestyle" was tailored to the affluent crowd who are not as price sensitive and can withstand the economic slowdown.

But that idea is changing - Whole Foods recently opened a store in the middle of bankrupt Detroit.

Many skeptics are wondering what Whole Foods is up to with this opening. But CEO Robb is committed to making a success of this venture. Keeping in mind his past successes, I am willing to give him the benefit of the doubt.

Robb has said that the Detroit store is "exceeding our wildest expectations."

Although the proof may not be in the "pudding" just yet, Whole Foods is committed to this new strategy, and it recently announced plans to open a new store in Englewood, IL - a poverty-stricken neighborhood in Chicago's south side.

If these stores succeed even modestly, this will give us a good indication that future stores in less-than-affluent areas will be equally successful, thus making the prospect of 1,000 more stores even more appetizing to investors.

What's Ahead for Whole Foods Stock

In addition to being in a good position to serve health-conscious consumers, the company has posted double-digit growth on both the top and bottom lines.

However, WFM stock's run has pushed its price to earnings (P/E) ratio into the upper 30s, and that introduces a note of caution into an otherwise positive outlook.

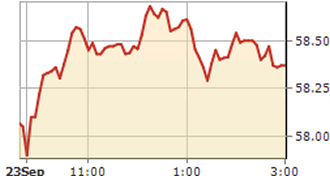

NASDAQ: WFM

Sep 24 01:40 PM

Price: 58.83 | Ch: 0.59 (1.0%)

Bottom line for Whole Foods (Nasdaq: WFM) stock: Although I am a buyer of Whole Foods stock, with economic conditions and the market at lofty levels, I would be wary of buying a full position at this time. A better approach may be to dollar-cost average into a position over the next few months.

Note: In yield-poor times like these, every investor should have at least a few dividend stocks in their portfolio. We've identified five dividend stocks that are stable and have particularly attractive yields...

Which stock do you want us to analyze? Send us a note in the comments section below and we'll add your pick to our list.

About the Author: David Mamos brings nearly 15 years of analytical experience to the table, with a background ranging from big-picture fundamental analysis to highly technical trading decisions. He began his career working as a financial advisor with Royal Alliance in 2001 and helped clients with portfolio management as well as buy-sell decisions before transitioning to the development, implementation, and execution of trading strategies for aggressive investors.

Source :http://moneymorning.com/2013/09/20/whole-foods-nasdaq-wfm-is-the-envy-of-peers-but-is-it-a-buy/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.