Will Russia Lose Its Crude Oil Grip on Europe?

Commodities / Crude Oil Sep 26, 2013 - 02:41 PM GMTBy: Marin_Katusa

Vladimir Putin is on a roll. Ever since the Russian president-turned-prime-minister-turned-president got into office 13 years ago, he's been deftly maneuvering Russia back into the ranks of global heavyweights. These days, he's averting cruise missiles from Syria before breakfast.

Vladimir Putin is on a roll. Ever since the Russian president-turned-prime-minister-turned-president got into office 13 years ago, he's been deftly maneuvering Russia back into the ranks of global heavyweights. These days, he's averting cruise missiles from Syria before breakfast.

For a strategy to return Russia to superpower status, Putin had to look no farther than his own doctoral thesis, Mineral Natural Resources in the Development Strategy for the Russian Economy.

To say that Russia is rich in natural resources would be an understatement. In 2009, the former heart of the Soviet Union surpassed Saudi Arabia as the world's top oil producer—largely because Putin put reviving Russia's aging, neglected oil industry at the top of his priorities list.

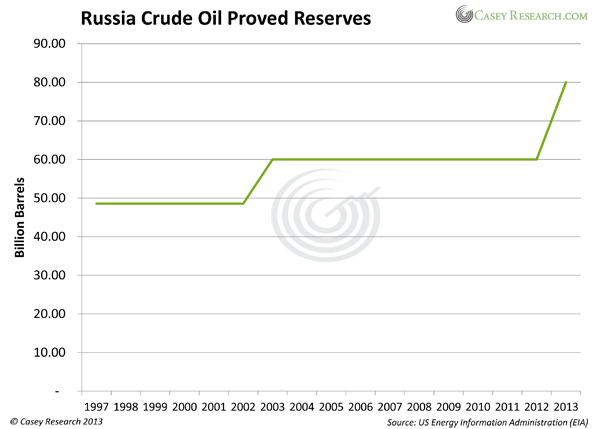

The chart below shows proven oil reserves from the pre-Putin era to now. In just 16 years, they have risen by more than 30 billion barrels—which may still be too low, because it's not yet clear how much of the 90-odd billion barrels of undiscovered oil in the Arctic is actually recoverable. And in addition to new discoveries, the rising price of oil has made many formerly uneconomical deposits worth a second look.

As a result, about half of the more than 10 million barrels of oil per day (bopd) that Russia produces are exported… only to return as cash and, increasingly, a fistful of clout.

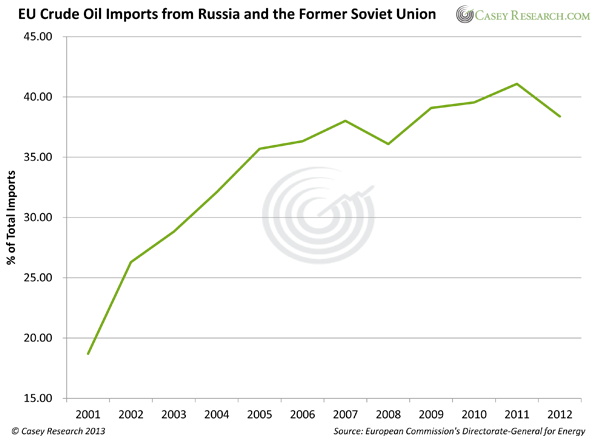

With Putin's monster deposits being the closest and most conveniently accessible, many European nations rely heavily on oil and gas imports from Russia and the former Soviet states:

In a world where "he who has the energy wields the power," Russia's European customers find themselves in a very uncomfortable situation. How fragile their position is became clear in January 2009, when Putin, enraged over a price and debt dispute with Ukraine, shut off the natural-gas spigot, leaving customers in 18 European countries literally out in the cold.

Now the Russian vise grip on Europe is about to tighten even more as new energy markets are opening up to Moscow.

In January of this year, Russia's pipeline company, Transneft, completed the $25 billion, 4,700-kilometer-long East Siberia-Pacific Ocean (ESPO) pipeline, and in June, Putin signed one of the world's biggest oil deals ever.

For the next 25 years, Rosneft, Russia's state-controlled oil company, will deliver about 300,000 barrels per day to China—raising Russian oil exports to the Chinese by 75%. Besides China, the pipeline is also conveniently located for Japan, South Korea, and even the US West Coast.

This advantageous situation allows Putin to play hardball with Europe: If its customers there don't ante up what Moscow wants in price or pound of flesh, its income from ESPO customers could enable the country to twist the EU's taps closed.

It comes as no surprise that Europe is desperately trying to find a reasonably priced replacement for Russian oil. And in the very near future, it might just get its wish.

Hidden deep below Central European soil may be one of the largest oil deposits in the world, comparable in size to the legendary Bakken formation in North America. I call it the "next Bakken."

The full extent of this oil colossus is still unknown, but the final result could be one for the record books. And a small company with 2 million acres of land in the "next Bakken" is hard at work to prove up the reserves and make itself and its shareholders rich in the process.

This is not a stab in the dark; there's no doubt that the oil is there. In the past, 93 million barrels of oil have been produced on the land the company owns now. But thanks to the company's state-of-the-art technology, management expects to be able to unlock many more millions or billions of barrels of to date inaccessible or uneconomical oil.

In fact, all of management is invested heavily in the company, which is always a good sign—one of its directors, for example, owns more than 1.2 million shares.

(By the way, the country where this deposit is located is forced to import more than 700,000 barrels of oil per day from Russia, a balance of power that could shift dramatically with this new windfall—so chances are good that the government will enthusiastically support the new oil production.)

Since our initial recommendation, Casey Energy Report subscribers already made gains of up to 66.4% from this company—but this is not a one-hit wonder whose fame fades as fast as it started. If the deposit indeed has what we think it does in recoverable reserves, the company could generate exceptional profits for years on end.

You can get my comprehensive special report "The Next Bakken… and the Small Company Best Positioned to Take Advantage" free if you try the Casey Energy Report today, for 3 months, with full money-back guarantee. Click here for more details on the "Next Bakken."

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.