How to Profit from a Changing China

Companies / Chinese Stock Market Oct 01, 2013 - 07:18 PM GMTBy: Frank_Holmes

"If you ask me, China's economy hasn't finished impressing the world with its strength." ~ Jim O'Neill

"If you ask me, China's economy hasn't finished impressing the world with its strength." ~ Jim O'Neill

More than a decade ago, the acronym, BRIC was coined. Most investors know the countries it stands for, but few remember the name or background of the man who came up with the term.

It was back in 2001 when Jim O'Neill, formerly of Goldman Sachs, grouped Brazil, Russia, India and China to represent the economic shift away from developed countries toward emerging nations. According to a 2010 story in the Financial Times, he came up with the bold prediction that "by 2041 (later revised to 2039, then 2032) the BRICs would overtake the six largest western economies in terms of economic might."

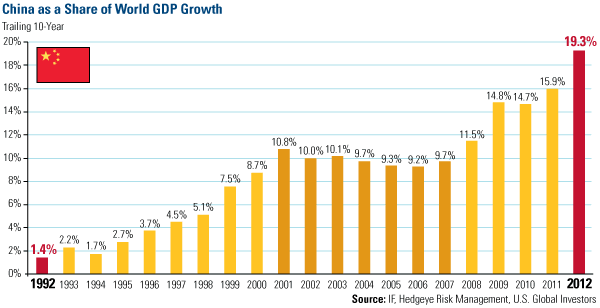

For China, it was an incredible call. Back in 2001, China's share of world GDP growth was only about 11 percent. Now, it's almost double that. As O'Neill points out, China's economy is three times France's and bigger than Brazil, Russia and India combined.

You'd have to rewind the clock another seven years to when I first began hunting around China for companies to invest in. At that time, the Asian country made up only a fraction of global growth.

Today, while the economies of Brazil, Russia and India may be disappointing to O'Neill, he remains staunchly bullish toward China. In a recent article on Bloomberg View, he put the Asian nation into perspective for perma-bears who believe that while China averted a crisis today, the country might not succeed next year. He writes:

"It isn't clear to me why China's economy must deteriorate next year. China's slowdown to its current 7.5 percent growth rate was well signposted by a sharp slowdown in leading indicators. Those measures, including monetary growth and electricity usage, are no longer flashing red."

Like we've recently published, China's purchasing manager's index is improving. Consumption measures such as retail sales have held up, and the current account surplus is down to about 3 percent of GDP, says O'Neill.

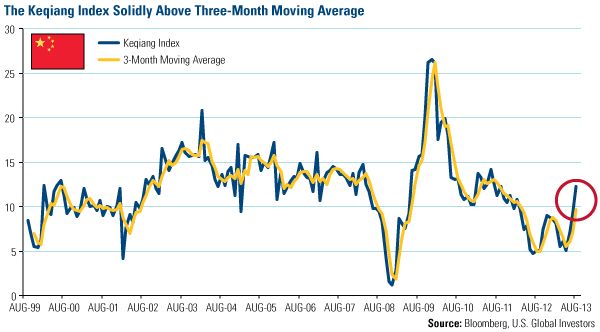

The three major indicators used by Chinese Premier Li Keqiang are also up. In August, on a year-over-year basis, power production increased 13.4 percent, which is the fastest rate of growth since June 2011. Rail freight volume is also up, rising 7.9 percent, the highest since September 2011. Bank loans outstanding climbed 14.1 percent. While bank loans are currently trending down, they are stabilizing.

Taking the weighted average of the year-over-year growth of 40 percent power generation, 35 percent total loans outstanding, and 25 percent rail freight volume, the "Keqiang Index" showed an increase of 12.3 percent. This is the fastest since September 2011 and solidly above the three-month average.

To us, the index is a very telling indicator, as the premier looks at railroad activity, energy consumption and the health of the banking sector to get a gauge on Chinese growth. Basically, he's paying attention to the biggest catalysts for creating jobs. It offers rare insights to what the premier will tolerate in terms of upper and lower limits for government policy intervention.

Portfolio Manager Michael Ding was at the CLSA Forum in Hong Kong and had a chance to listen to China Macro Strategist Andy Rothman, who provides one of the most balanced perspectives on the country. Andy has a local perspective, collecting numerous data on China, so he's able to separate the sensational doomsday stories from reality.

Andy says it is normal for the country to grow slower. His tone was similar to O'Neill's, in that the slowdown does not mean a crisis. He says that even if China's growth does slow, the absolute amount of growth is much more than in the past due to the higher base, which means investors should not be too bearish on China's demand for many products and materials.

Keep in mind that China is in the process of rebalancing its economy, moving from a reliance on exports to greater consumption and services. That's why the focus in November will be to reform the hukou system, which was the primary means for controlling migration throughout the country. Chinese leaders will also be looking at fiscal reforms, a modest financial sector reform, environmental protection, and the one-child policy.

This rebalancing means that the "winning investments will be quite different than before," says O'Neill.

We believe this is positive for investors who selectively invest in Chinese stocks. As O'Neill puts it, "When a country is embarking on a significant compositional change to its economy, stock-pickers rather than index-trackers have the upper hand."

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.