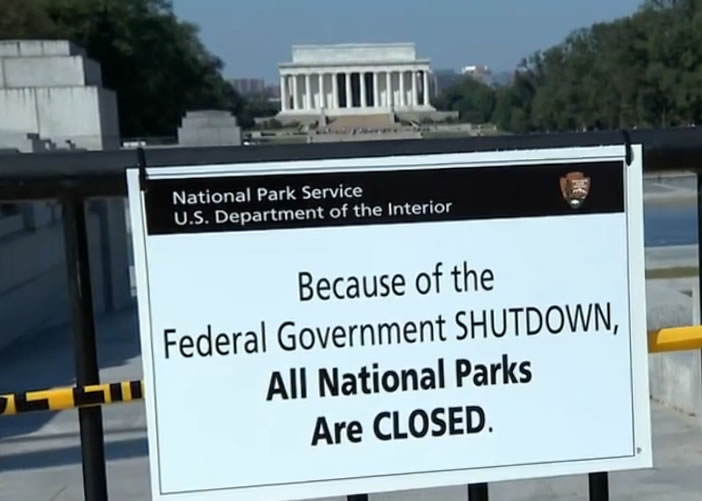

US Government Shutdown Theatre Of The Absurd

Politics / US Debt Oct 06, 2013 - 09:07 PM GMTBy: Andrew_McKillop

DEBT AND ANARCHY

DEBT AND ANARCHY

Claims in the US media, from left and right, that anarchy is rising and is being encouraged are easy to find. This is nothing more or less than a diversionary tactic to keep everybody's mind off the real subject which is out-of-control debt. Journalists as wide-ranging as arch-keynesian Paul Krugman to left wing senator Elizabeth Warren, and “moderates” like the collective Bloomberg Editorial Board or anonymous editorialists at Wall Street Journal work the anarchy theme.

They basically say that Republicans are becoming extremer than ever, while Democrats pussyfoot and refuse to govern. As a result, anarchy takes control.

One common claim is that the US Senate and Congress are now governed by extremes. And the extremes converge by peddling the anarchist theme that the government that governs best is a government that doesn't exist at all. Republicans do it proudly, Democrats by refusal to face the facts but one searing omission by these approved-vetted suppliers of correct opinion is they flagrantly ignore the reality of the debt crisis. Like Mr Obama and the others, they wilfully deform it to a partisan political issue, too arcane – or too boring – for ordinary mortals.

In most cases, the crowd of fit-to-print journalists agrees. Even right wing journalists will attack the slogans of the Tea Party – which seems to have made a final lurch to all-out anarchism, saying the American people want a future without government. No government – or no future? No doubt Lady Gaga would approve. But who pays the debt?

Everything is partisan and all is extreme. At the extremes, which is the only place to be, the Federal shutdown is great because it shows, yet again, we don't need government. You close down half the government but everything still works – sort of. Anarchists no longer have to call for regulators to go easy on companies that put lead in children's toys, to crack down on pesticides in food, or control what kinds of new medication is invented and dumped on the market. In fact, with about 92% of the IRS' employees furloughed by the shutdown, the government doesn't even need to collect taxes – or at least will find it difficult!

OBAMA'S OWN TEA PARTY

Being “resolutely partisan” is the Obama pitch. His closest allies say that only the Nanny Society plus the NSA can save us. Big government has to get bigger, there really is No Alternative. Don't mention George Orwell and above all keep quiet about the real cause of the shutdown – US debt and deficits – which are extreme and menacing, despite the fake reassuring numbers bandied around.

According to Obama's morality play, the key to the plot is a Republican Party increasingly at the mercy of the Tea Party. It used that set of anarchists to block ObamaCare and that was not fairplay and was inept, or just plain farcical, so Obama has no choice but to hang tough. This morality play's actors may be inept, to say the least, and the theatre might seem sumptuous if you don't look too hard – but the problem is the stage set is burning in debt!

Apparently, nobody even glanced at the most recent long-term budget outlook—published by the Congressional Budget Office. This non-anarchist entity seems to think the question is not if the United States will default - but when and on which one of its rapidly spiraling liabilities.

Maybe its the numbers soup the journalistic fraternity can't handle. Optimists will say the federal deficit has fallen to about 4% of GDP this year from its 10% peak in 2009. The bad news is that government spending has to rise much, much faster than any sane person dares forecast for the rate of GDP growth, both on debt servicing and on the magic category “entitlements”. So the annual budget deficit as a percentage of GDP will increase each and every year to 2038 according to the CBO. It doesn't go any further than that because it doesn't matter.

Long before 2038 something awful will have happened.

One striking feature of the latest CBO report, which nobody took any notice of (the report or its revised contents) is that 12 months ago the CBO's forecast scenarios for the federal debt fully in the hands of government projected it would be 52% of GDP by 2038. It now projects 100%. The slow, progressive, glide down-and-out of fully federal debt to service – to pay interest on and then increasingly pay down the debt - was supposed to dwindle to zero in the 2070s. Now its set at 200% of GDP by the year 2076. This isn't only due to “more realistic” that is lower estimates of annual economic growth and predictable rises in interest rates from their current artificial and absurd lows.

The media fraternity wasn't interested in this stuff. Why would anybody care about things like this when they can whine about ObamaCare and the rule of anarchy?

AT SOME STAGE

The CBO report said: "At some point, investors would begin to doubt the government's willingness or ability to pay U.S. debt obligations, making it more difficult or more expensive for the government to borrow money”. The report's writers don't say when that magic moment will come but give all kinds of figures and scenarios letting us draw the conclusion that its sooner – not later.

Just how negative that outlook is comes from the CBO's 13 different scenarios, only 3 of which do not include the potent mix of both spending cuts and higher taxes. Only when the double-whammy combination of higher taxes and lower spending is applied do we see US debt start to fall. Otherwise the “big number” for total US debt, both federal and state roars up to 190% of GDP by 2038. Possibly comforting for anarchists who want to end the party (tea or otherwise) right now, the scenarios for debt heading towards 200% of GDP are the most realistic, because they integrate a continued “don't tax-but do spend” mentality keeping its hold on politicians, which is what they always did in the past.

Possibly the CBO's forecasts and scenarios are too credible, and therefore “boring”. In 2013, net interest payments on the federal debt are around 8% of GDP. But under the CBO's “debt business as usual” scenario, that share could rise to 20% by 2026, 30% by 2049, and 40% by 2072. This could

theoretically continue until one-half of all government revenues are swallowed by interest payments on debt – not paying down the debt, but just paying interest on it.

The CBO says that things can be done to prevent the endgame. First, bring Federal held debt back down to 39% of GDP in 2038—as it was at the end of 2008—which requires a combination of increases in tax revenues and cuts in spending outside of spending on interest charges at a rate of 2% every year to 2038. Tax more and spend less. Nobody is satisfied because Republicans want to tax less and Democrats want to spend more. So its all “very boring”. Anybody watching the Obama morality playact and the political shenanigans in Washington will instantly understand the probability of tax hikes and spending cuts on this scale is zero.

FORGET THE SUMS

This is the likely main reason why rentacrowd journalists and talking heads steer clear of reality. While the Federal Reserve continues running near-zero interest rates and QE, buying Treasury notes at a rate of $85 billion a month, this alone will account for three-quarters of new government borrowing unless it stops immediately – which Wall Street and the bankster crowd says it can't. As we know, even whispers of Taper Down earlier this year sent up interest rates on US debt by 1%, but the usually ignored facts that about one-half of all Federal debt is now in foreign hands and has a maturity of less than 1 year means that things can change – for the worse – very fast. This is certainly not the stuff for breakfast-time TV talking heads!

Many Republicans and the Tea Party, and plenty of others like to pretend they are playing the card of History. Once upon a time, Western society had governments which only looked after defence (then called war) and foreign affairs – basically the same two things. In fact national debt was only invented, from the 18th century on, to finance and fund overseas wars.

As we know, today's Obama Shutdown has winkled a 50% line of funding for Defense, while NASA and the IRS tax and revenue service's operations got slammed by a cut of well over 90%. Why do this if the US national debt was (and is) so stupendous? One reasons is the entire political class or brahman caste has built itself a wall of straw bogeymen, and an alternate universe that blinds it to the drab, uninteresting world where voters and taxpayers live. In this special universe, demons lurk. Partisan politics is the only antidote. When an opposing party spokesperson says Z you are obliged to say A. There is no middle ground.

The big problem with this alternate universe is very simple. It doesn't exist. But the debt does.

Government created and expanded the national debt. Copping out by pretending you suddenly became an anarchist or transcendental meditator, or beach bum will not work. Government is real and has to do several things which include paying down the debt. Time is up for the partisan playact.

By Andrew McKillop

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2013 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

Andrew McKillop Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.