Why I’m Still Skeptical on Key Stock Stock Market Indices

Stock-Markets / Stock Markets 2013 Nov 14, 2013 - 12:31 PM GMTBy: DailyGainsLetter

Mohammad Zulfiqar writes: The companies on key stock indices are showing very troubling trends, which can cause them to slide lower and generate losses in investors’ portfolios. Don’t just look at the number on the surface.

As of November 8, 446 companies on the S&P 500 have reported their corporate earnings and 73% of them were able to show earnings above estimates. The corporate earnings growth rate was 3.4%. (Source: “Earnings Insight,” FactSet web site, November 8, 2013.)

These numbers certainly sound surprising on the surface, but just looking a little deeper into the details shows that they’re the only good thing about them. As mentioned earlier, 73% of them beat the corporate earnings estimates; sadly, only 52% of them were able to beat their estimated revenue.

This means that the companies aren’t selling as much; rather, their corporate earnings are coming from somewhere else. One place it could be is from cost-cutting; an example of this could be General Electric Company (NYSE/GE), one of the conglomerates on the key stock indices.

The company’s revenue fell 1.5% in the third quarter to $35.73 billion. The company also said that it has cut costs by $1.0 billion; the original goal was to make these cuts in one year, but it was able to do it in nine months. The CEO of the company expects more cuts coming until the end of the year. (Source: Linebaugh, K., “General Electric Slashes Costs,” The Wall Street Journal, October 18, 2013.)

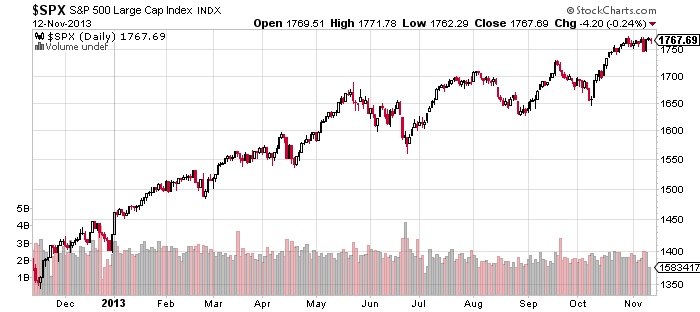

Currently, the key stock indices are soaring higher each day, and they continue to break new records. Just look at the chart below of the S&P 500, which seems to show that nothing is wrong and the trend is strong.

Chart courtesy of www.StockCharts.com

When I look at all this, I feel slightly skeptical. Companies on key stock indices are showing great corporate earnings and missing on revenues, which tells me that their profits aren’t really coming from their core business, but from elsewhere. This should be a sign of great concern.

In the short run, key stock indices look to have momentum to the upside and we are seeing too much optimism. Things may continue to go that way, but based on poor fundamentals, they can turn very quickly as well.

Those who are investing for the long term should look into taking some profits off the table. They should also be very cautious in what they buy, because some sectors have seen robust growth, but their fundamentals are deteriorating faster than others.

This article Why I’m Still Skeptical on Key Stock Indices was originally published at Daily Gains Letter

© 2013 Copyright Daily Gains Letter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.