How Putin Conquered South Africa, Russia Uranium Victory over the United States

Commodities / Uranium Jan 14, 2014 - 09:57 AM GMTBy: Marin_Katusa

In the global war for energy supremacy, Russia has won another victory over the United States.

In the global war for energy supremacy, Russia has won another victory over the United States.

This time, the battleground has been South Africa, where Russia's state-owned nuclear power company, Rosatom, has just signed an agreement to build eight new reactors. Once all of them are operational, South Africa's nuclear capacity will increase more than sixfold—from 1.8 gigawatts (GW) to 11.4 GW over the next 15 years.

This means that Russia will help develop the entirety of South Africa's nuclear energy sector, including financing and training.

And just as importantly, South Africa will be using Russia's nuclear fuel.

Rosatom has been busy signing these types of deals with other foreign countries as well—Finland, Turkey, Ukraine, even the United Kingdom—which guarantees that Russia will be able to keep a stranglehold on these countries' nuclear industries.

The strategy is clear: Rosatom is aiming to become the world's largest supplier of uranium in the coming years.

Remember what we said about the ongoing "Putinization" of Europe's oil and gas; how Russia is planning to leverage its control over Europe's energy to gain political and economic benefits?

The same thing is happening in uranium, except the stakes are even higher—because Putin is now looking to dominate the global nuclear market.

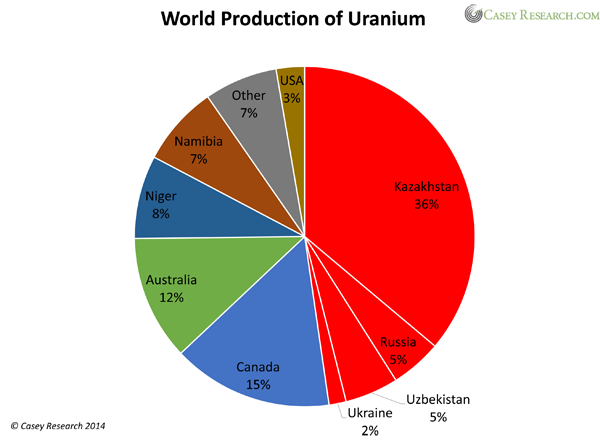

Russia and the former Soviet nations (colloquially called "the -stans") already control nearly half of the world's uranium supply:

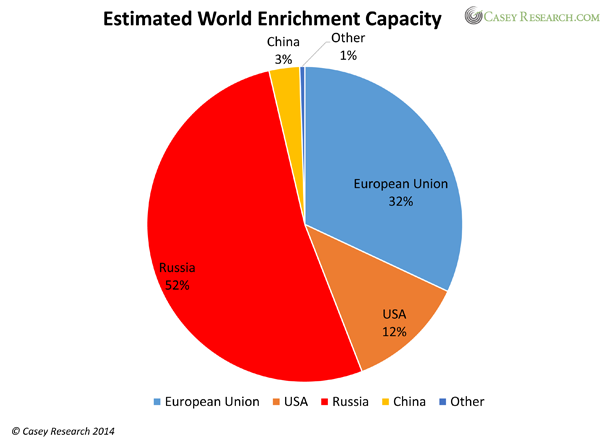

Similarly, they hold more than half of the world's capacity for uranium enrichment, a necessary part of fuel fabrication:

Note that the United States only controls 3% of global uranium supply—and less than 15% of the enrichment capacity, despite the fact that it's the largest consumer of uranium in the world.

While nuclear energy powers one out of every five homes in America, the US currently imports more than 90% of the uranium required for its nuclear reactors.

So what happens when one day Rosatom says "Nyet" to the American utilities? You can be sure that they'll be scrambling to find any source of uranium they can get their hands on.

And they'll pay far more than the current spot price of US$34.50/lb. You should know that the price of uranium accounts for just 3% of the total costs of a nuclear power plant, so whether the utilities pay $100 or even $200 per pound of yellowcake is irrelevant, as long as they can keep the reactors running and the lights on in America.

As the US and other countries scramble to get out from under Putin's heavy thumb, for the right uranium producers outside of Russia's sphere of influence, this will be a bonanza for the history books.

***

You just read an article from the Casey Daily Dispatch, Casey Research's informative daily e-letter. Get the Daily Dispatch in your inbox every day and stay in the loop on the ever-changing energy, gold, and technology sectors, as well as big-picture economic trends… all completely free of charge. Click here to get it now.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.