Unanimous Bullish Stock Market Patterns

Stock-Markets / US Stock Markets Apr 19, 2008 - 01:39 AM GMTBy: Brian_Bloom

The chart patterns in the following three scenarios are unanimous: The industrial markets will rise back to (but not yet break above) their previous highs:

The chart patterns in the following three scenarios are unanimous: The industrial markets will rise back to (but not yet break above) their previous highs:

The April 18th buy signal on the traditional Point & Figure chart of the Wilshire 5000 is calling for a move to 15,400.

(Charts courtesy stockcharts.com )

Should this manifest, the chart below (the less sensitive 3% X 3 box reversal chart of the Wilshire) shows that the index will hit a “triple top” (arguably a quadruple top).

The sell signal on the 3% X 3 box reversal chart above, (still currently in place) will be negated under these circumstances; but the move should be regarded as a “technical” move unless and until the price breaks to a new high.

Turning now to the Dow Jones Industrial Index:

The April 18 th buy signal on the traditional Point and Figure Chart of the Dow Jones Industrials Index below is calling for a rise to 13,800

Again, the following chart shows that 13,800 will take the Dow Jones to below it previous high of 14,094 (14150 in the above chart); and, again, a “triple top” will likely manifest.

Similarly, the April 18 th buy signal in the traditional Point and Figure Chart below of the $SPX is calling for a rise to 1510

In this case, the following chart shows that 1510 will take the $SPX to below it previous high of 1535.

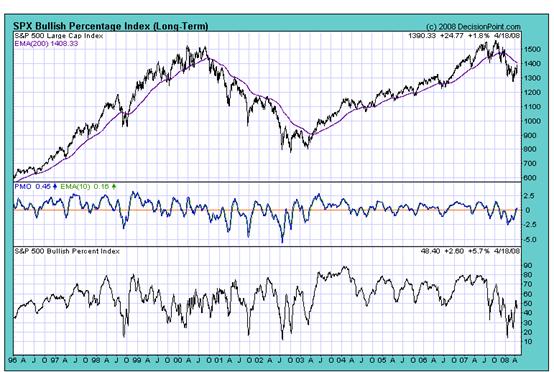

It is very difficult to draw definitive conclusions from the above. However, one clue may lie in the Bullish Percent Index Chart below (courtesy decisionpoint.com )

Readers are urged to study this Bullish Percent Index chart very carefully.

In October 1998, the percentage fell to around 15%, and the $SPX Index started to rise strongly soon thereafter. In October 2001, the percentage fell to around 20%; and the market rose by way of technical reaction thereafter. In June 2002, the percentage bullish bottomed at 10%, and the $SPX started to rise strongly thereafter – finally hitting a double top in June 2007; and then hitting a triple top in October 2007.

Then, in early 2008, the percentage bullish fell once again to around 12%; and the market bottomed.

Taking a step back we see that, since around April 2005, the percentage bullish chart has shown falling bottoms, as investors became more and more pessimistic.

The $64,000 question is whether we are witnessing a technical reaction, or the beginning of a new move which will land up in a break to new highs.

The answer, in my view, sheets back to the difference between tactical, strategic and philosophical decisions. From a tactical perspective, “traders” should have bought when the percentage bullish chart hit the 12% level and started to rise.

From a strategic perspective, arbitrageurs may be facing an opportunity. If one has the courage, the buy signals of April 18 th show that the markets may have up to an 8% upside potential (over an unspecified period) before the next strategic decision needs to be taken.

The next strategic decision will be dependent on whether the triple tops on the various Wilshire, $SPX and Dow Jones Charts can be penetrated on the upside to reach new highs.

Now let's take a philosophical view – which is what investment should be all about:

It seems highly likely that, as the various indices rise to approach their previous tops, the level of the “percentage bullish index” will give significant clues.

If the percentage bullish index chart is approaching its historical highs, then the odds are against a breakout of the markets to new highs (because most who were predisposed to buy will have already bought). However, if, as the previous highs are approached, the percentage bullish index chart starts to fall strongly, then the odds will favour a breakout to new highs.

The view of this analyst is that the level of percentage bulls will be rising and that a new high will not be achieved . This view flows from my understanding that “wealth creation” is not a function of printing money; it is a function of entrepreneurial optimism – the view of entrepreneurs of the likely future buoyancy of market demand for their products and services.

Philosophically speaking, there needs to be a paradigm shift in underlying economic drivers before entrepreneurs will start to feeling optimistic. Looking back into history, the primary economic driver of the US economy was US consumer demand. We need to face reality here. This has gone away, and will unlikely return for many years to come.

It follows that the “drivers” of corporate profitability in the USA going forward will have to be a mixture of US government infrastructural spending, and export activity.

If the US Dollar falls strongly, it will render US prices relatively cheaper in foreign currency terms, but the hard fact is that labour costs in the USA are significantly higher than in the likely import oriented countries such as China and India. They can produce anything the US can produce, and they can produce it cheaper in their own currencies – regardless of the US$ exchange rate. So, this begs the question: What will the US export?

There is one area where the US has retained its lead, and that has been in emerging technologies. But, in this regard, we are facing a real problem. The Chinese in particular have shown a cavalier disregard and disrespect for Intellectual Property. Historically, Chinese entrepreneurs have just leveraged off the IP of others with no thought of paying for it. (For example, the latest software and music CDs can be bought for as low as one dollar in Hong Kong).

Will they change their attitude? I have no idea.

But the realities are as follows:

- 65% of the world's monetary reserves is denominated in US Dollars

- The US public debt is over $9 trillion, and is rising at an accelerating rate. My most recent calculation shows that it is now rising at the rate of $1 trillion a year.

The above begs more questions: If the US Government is going to invest in infrastructure to drive the US economy, how will they pay for it? By printing more dollars?

If they print more dollars, what will happen to the value of the US Dollar, and to the value of the entire world's monetary reserves?

Well, there can be no doubt that the world's investment community is expecting a continuation of dollar denominated price inflation. This implies that the market is expecting the US Dollar to fall, and that the US can expect rising inflation within its borders.

Which brings us back to the question: Going forward, can exports be relied upon to drive the US economy?

Summary and Conclusion

Philosophically speaking, the future of the US economy appears to depend on the integrity of emerging economies as regards US owned intellectual property. As these emerging countries become more economically robust, they may turn to the US for infrastructural development based on US developed Intellectual Property.

Will they be prepared to pay for it? Unfortunately, there is no way to second guess the outcome of this.

In this analyst's view, the market's view of the answer to this question will be reflected in the level of investor optimism if/when the industrial markets approach their historical highs. Paradoxically, if investors are optimistic (a high Bullish Percentage Index) then the answer will probably be “no” and the US equity markets can be expected to fall strongly.

It is my current view that we are witnessing an artificially stimulated technical reaction and that the markets will not rise to new highs.

Author's comment

This hard-nosed view is based on a cynical perspective of the human psyche. There is no significant historical basis for expecting a sudden outbreak of honesty and integrity. Further, based on the current technical evidence, there is no reason to anticipate such a breakout.

However, my mind is wide open. If there is an energetic shift in favour of integrity, then the emerging economies will honour the value of what the US has to offer; and be prepared to pay for it.

Ironic isn't it? If historical attitudes are a guide to future attitudes, then the US economy is doomed. The US has reached a point in its history where its very future is now dependent on the integrity of others in their dealings with it.

Those readers who have been following my most recent articles will now understand more clearly why I have been going on about ethics and integrity. The wheel has turned. There may be some amongst you who will accept the Mayan Calendar's forecast that, on May 16 th 2008, there will be an energetic shift towards embracing the concept of ethics and integrity. I mention this for the sake of balance and completeness. Also for the sake of completeness it needs to be emphasised that I am starting to see the first tentative evidence of such a move. The recent move by the FAA to tighten its attitude towards safety is one such straw in the wind.

Overall Conclusion and recommendation

Technically, it could still be argued that we are in the early stages of a Primary Bear Market. However, it seems that we may have reached a bifurcation point in the markets – where historically successful companies will begin to slowly fade away, and new generation businesses may emerge to become drivers of economic activity. My current view is that the markets will not reach for new highs, and neither will they collapse. If you are a long term oriented investor, then, apart from commodities (including gold) which are likely to hold their values in dollar terms, and apart from short term treasuries, it seems that the smartest place to be is in emerging technologies which hold out the expectation that they may contribute to an improvement in the quality of life. It is emphasised that the core deciding factor should be “integrity”. You will need to focus on the deeper facts as opposed to the surface spin. You should pay a maximum of 10X P/E at entry, and less if the business has a risk that it may not survive for whatever reason. But, you will need to be patient.

By Brian Bloom

Target date for publication of Beyond Neanderthal is now, ironically, May 19th 2008. It wasn't planned that way.

Author's comment : Beyond Neanderthal is a factional novel, the edited manuscript of which is now complete and has been sent in for layout and design. The storyline essentially puts together a jigsaw puzzle of seemingly random facts and the picture which emerges places the following issues in context of more than 5000 years of history: Peak oil and alternative energy paradigms, clash of civilizations, world economy, climate change, “apparent” world overpopulation … and it also points a possible pathway forward through all these landmines.

In researching Beyond Neanderthal the author paid particular attention to society's attitudes to gold, going back 5,000 years in time. As Sir Isaac Newton apparently discovered way back in the late 1600s, there is far more to gold than meets the eye. Since June 2007, the author has been inviting people who may be interested in acquiring a copy of Beyond Neanderthal to register that interest at www.beyondneanderthal.com Within 2-3 weeks, when the layout has been checked and sent to the printers, I will be personally emailing all people who have registered their interest and inviting them to place order/s via the publisher's book distributor. (It is the largest independent book distribution company in Australia , and it has a high level of integrity). In the meantime, if you have an interest to acquire a copy, please register than interest now. Deliveries will be made on a first-come-first served basis, and it is starting to look like we might have to go to a second edition. At this stage there is still time to change the print-run order on the first edition.

Copyright © 2008 Brian Bloom - All Rights Reserved

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.