Laddering Adds Another Layer of Financial Protection for Retirement

Personal_Finance / Pensions & Retirement Jan 23, 2014 - 05:46 PM GMTBy: Don_Miller

Laddering reminds most people of a strategy often used when owning multiple CDs. Back when interest rates made them worthwhile, if you were trying to arrange cash flow, you could stagger the maturity dates of your CDs so you always had one maturing in the near term. Longer-term CDs had better rates, but they tied up your money; laddering mitigated that problem.

Laddering reminds most people of a strategy often used when owning multiple CDs. Back when interest rates made them worthwhile, if you were trying to arrange cash flow, you could stagger the maturity dates of your CDs so you always had one maturing in the near term. Longer-term CDs had better rates, but they tied up your money; laddering mitigated that problem.

For example, if you had $500,000 to invest and a five-year CD was paying 6%, you could count on $30,000 in income each year. But what if you needed money before the maturity date? You could build a ladder, buying five $100,000 CDs, with one maturing each year. Sure, the CDs you initially bought in the short term would have slightly lower rates, but as each one matured, you could replace it with a five-year CD.

Once your ladder was complete, you could expect $30,000 in interest income, plus another $100,000 in liquidity each year. While constant cash flow was the main reason for doing this, laddering is a tool that has many more uses—most notably, inflation protection.

Inflation Protection

Suppose an investor bought a five-year, $100,000 CD paying 6% on January 1, 1977. The table below shows the inflation rates during the five-year period that followed.

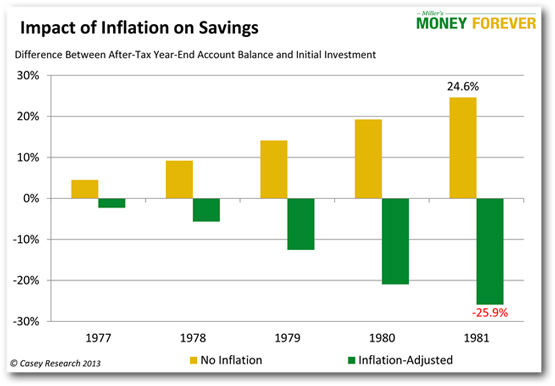

Assuming this investor-taxpayer was in the 25% tax bracket, even if he’d reinvested his interest, he would have had a 25.9% net loss of buying power due to high inflation, as illustrated in the chart below.

By using a CD ladder, he could have mitigated some of his inflation risk. At the end of each year from 1977-1981, an investor who laddered could have rolled over a CD at the prevailing interest rate. By the end of 1981, he could have had five CDs paying rates much higher than 6%.

One note of caution: at one time, most CDs were non-callable, meaning that both the lender (us) and the bank were committed for whatever period the CD specified. Then banks started issuing callable CDs, meaning they could pay off their debt at any point during the period.

The same feature applies to bonds. If you lend money to someone and agree to callable terms, they have protection if interest rates go down. If interest rates rise, there’s a good chance you’re losing out because of inflation. Given a choice, I would take a slightly lower interest rate for a non-callable bond or CD.

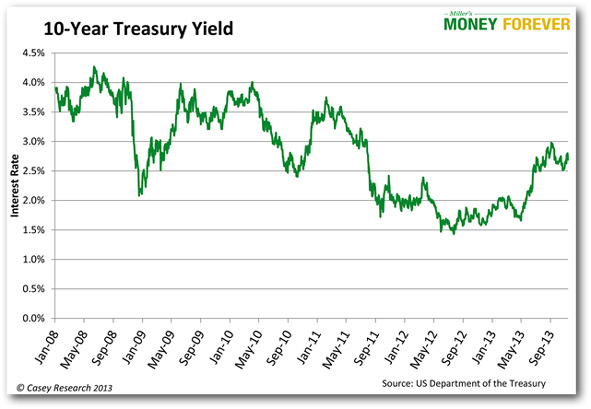

The above chart tracks the interest rates for the 10-year Treasury. As you can see, overall interest rates have dropped. CDs and other fixed-income products have followed that same track. However, the trend has started to reverse, and we must protect ourselves.

Currently rates on CDs and top-quality bonds are still below inflation; they aren’t a good investment. Some 10- to 30-year high-risk bonds are paying 5-7%, but we do not recommend any of those products. Instead, we suggest laddering very short-term bonds if you have a need for fixed-income investments—in other words, creating a bond ladder. As interest rates continue to rise, you can then roll it out over three to five years so your yields keep pace with inflation and market interest rates.

Note that many of our subscribers have foreign currency CDs with EverBank, some of which have a 90-day period. Inflation protection is one of the key goals with those CDs. So if you’re investing in them, break your capital into thirds and ladder your CDs so you have one maturing every month.

Annuities: Another Use for Laddering

Many retirees also use annuities for guaranteed fixed income. We believe annuities have their place under certain circumstances. In general, however, they offer little protection in a high-inflation environment. While some have inflation riders, they come at a cost: lower initial monthly payments or some sort of cap on the increase.

Nevertheless, our frequent collaborator Stan the Annuity Man told me of a client who laddered his total $500,000 annuity purchase over five years as a means of increasing inflation protection. As an added bonus, he was one year older each time he bought the next $100,000 step in his ladder, which gave a boost to his monthly payments.

Laddering can help protect against high inflation, volatile interest rates, and cash-flow problems. It may mean you miss a little income in the short term, but in the long run it adds another layer of protection.

Annuities – with the additional protection afforded by laddering – make sense for many retired people and those approaching retirement age because they can provide a guaranteed income – which can make it a lot easier to sleep at night.

To help you determine whether an annuity is right for you, I put together an easy-to-follow report called The Annuity Guide.

This new report is jam-packed with invaluable information that will uncomplicate the world of annuities and is a must-read for anyone considering one.

Act now to get your copy of this important special report.

© 2014 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.