A Bank Run in London? Debt Rattle 2014

Stock-Markets / Credit Crisis 2014 Jan 25, 2014 - 04:13 PM GMTBy: Raul_I_Meijer

It seems to come as a surprise to some, but when you think about it, it seems obvious that it only makes sense that if you try to hide a crisis behind huge amounts of money and credit leaked into global financial markets, those markets become addicted to credit injections faster than you can say taperworm.

It seems to come as a surprise to some, but when you think about it, it seems obvious that it only makes sense that if you try to hide a crisis behind huge amounts of money and credit leaked into global financial markets, those markets become addicted to credit injections faster than you can say taperworm.

There may be something to say for stimulus and Keynesianism in certain situations, but not in all cases, and certainly not in a world already drowning in piles of leveraged debt. There it merely serves to further distort economic systems, a distortion that makes it so difficult for people to see what is real and what is not, that it can and will safely be used by the financial industry to dump its part of the debtload on everyone else. It is then inevitable that cracks will appear, first among the weaker parties involved: Argentina, Greece, Venezuela.

And it would be a great idea for everybody to wonder why, as the BBC of all news services reported yesterday that HSBC has put restrictions on cash withdrawals. Don’t ever forget, please, that banks will always be very careful with actions like that, because before they know it they may be causing a bank run. There can be no doubt, therefore, that what’s happening at and to HSBC is something truly serious. Not having enough cash to pay people’s demands for their own money is not the picture a major bank – or any bank – wants projected out there in the world. You might also, especially if you live in the UK, want to ask yourself what this means for other British banks. They’re all very much interconnected, and if one imposes such measures, there’s no telling how far others may be behind.

Still, the biggest story yesterday was the 2.5% loss in many western European stock markets, a severe swing for that part of the globe, something you normally, in the “rich markets”, see only in the Nikkei (it lost 1.94% before Europe started plunging) . Something’s going on alright. Wall Street lost 2%, London 1.6%. The talk is all of emerging markets, but is that really the whole story? Does a looming Argentina default crush trans northern atlantic stocks by that much? There’s a lot of short covering going on, that much is clear, but whether that’s restricted to emerging stocks and bonds remains to be seen. This may continue into the new week. There’s only so much trust to go around, and trust today looks as leveraged as credit and asset “values” do: one big storm, or even one flapping butterfly wing, and it could all be gone. No more trust, no more credit, and no more value.

• Bank-Run Fears Continue; HSBC Restricts Large Cash Withdrawals

Some HSBC customers have been prevented from withdrawing large amounts of cash because they could not provide evidence of why they wanted it, the BBC has learnt. HSBC admitted it has not informed customers of the change in policy, which was implemented in November. The bank says it has now changed its guidance to staff.

“When we presented them with the withdrawal slip, they declined to give us the money because we could not provide them with a satisfactory explanation for what the money was for. They wanted a letter from the person involved.” Mr Cotton says the staff refused to tell him how much he could have: “So I wrote out a few slips. I said, ‘Can I have £5,000?’ They said no. I said, ‘Can I have £4,000?’ They said no. And then I wrote one out for £3,000 and they said, ‘OK, we’ll give you that.’ ”

He asked if he could return later that day to withdraw another £3,000, but he was told he could not do the same thing twice in one day. Mr Cotton cannot understand HSBC’s attitude: “I’ve been banking in that bank for 28 years. They all know me in there. You shouldn’t have to explain to your bank why you want that money. It’s not theirs, it’s yours.”

• Emerging market chaos hits stock markets and currencies (Guardian)

A series of political scandals and accusations of mismanagement in some of the world’s major developing economies triggered turmoil on international stock exchanges on Friday.

The FTSE 100 fell more than 100 points, or 1.6%, and the Dow Jones dropped 1.2% as traders reacted to concerns that Argentina, Turkey, South Africa and several vulnerable Central American nations might be on the brink of a currency crisis. Political instability in Ukraine and the nose-diving Venezuelan economy added to the nervous atmosphere on exchanges, which have spent the last few weeks galloping ahead on the back of stronger growth forecasts in the US, UK and Japan. Central banks waded into the markets in an effort to stabilise currencies that were rapidly depreciating in an emerging markets selloff.

In the wake of the collapse of the Argentine peso, which kickstarted the latest wave of selling, the Turkish lira hit record lows despite spending an estimated £1bn to prop up the currency’s value during the day. The rouble and the rand languished at levels not seen since the 2008-09 financial crisis.

Some analysts blamed profligate government spending and corruption for the turmoil affecting some countries. Turkey is in the grip of a corruption investigation that has come close to the prime minister, Recep Tayyip Erdogan, while Ukraine’s president, Viktor Yanukovych, is facing violent protests that have spread from the capital, Kiev. Others blamed weakening demand for raw materials as the Chinese economy slows. The US recovery, which will attract investor funds previously parked in developing countries to earn a bigger return, is another destabilising factor.

Yes, it’s really true: more “value” was added in London property sales than in the entire New Zealand economy. A bubble? Now why on earth would you say so? Think positive!

• London property generated more wealth than entire New Zealand economy (Telegraph)

London’s soaring property market generated more wealth than the entire New Zealand economy last year as the value of homes in the capital surged by more than £100 billion, according to new research.

The astonishing scale of property wealth in the capital means the 10 most upmarket boroughs alone are valued at £609 billion – more than all the houses in Scotland, Wales and Northern Ireland added together. Booming demand for flats and houses last year added £106 billion to the total worth of London’s increasingly precious property, now estimated to be worth a record £1.24 trillion, a study by estate agents Savills reveals.

The research came amid reports that the last remaining homes in London on the market for less than £100,000 have been snapped up in recent weeks. According to the capital’s estate agents, rapidly increasing prices are failing to deter buyers who still massively outnumber sellers, a sure sign – they claim – that the city’s property bubble shows no sign of bursting.

Economist Ann Pettifor, one of the good guys, has a new book out, and talks about her ideas in an RT interview.

• Ann Pettifor on breaking the despotic power of finance

Ann Pettifor is a world renowned economist whose book “The Coming First World Debt Crisis” was published in 2006, just one year before we had the worst financial crisis in three quarters of a century. She is one of the few economists who can claim to have genuinely predicted the crisis.

She now has a new book out, called “Just Money: How Society Can Break the Despotic Power of Finance”. In it, Dr. Pettifor describes how the legitimacy of monetary systems originates in the social contracts inherent in credit-based transactions. The breakdown of the Bretton Woods system led to a destabilizing credit structure increasingly dominated by speculative activity instead of credit based on productive investment. Dr. Pettifor explains her framework for understanding money that will lead to sustainable and productive growth without destabilizing bubbles and crisis.

Wait a minute! Wasn’t there more gas in the US than it knew what to do with? One series of cold snaps and it’s already not enough anymore? What is going on here is that the – shale induced – glut has provoked so much speculation that the price has plummeted to such an extent that investment in gas exploration infrastructure has plummeted just as fast. And now, baby, it’s cold outside.

• US Natural Gas Jumps to $5 for First Time Since 2010 (Bloomberg)

Natural gas futures surged above $5 for the first time in more than three years as U.S. demand soars and stockpiles tumble during a blast of arctic weather. Gas jumped 9.6% in the biggest daily gain in 19 months. January is on track to be the coldest month of the century in the lower 48 states, according to Commodity Weather Group LLC. U.S. inventories of the fuel, used to heat 49 percent of U.S. households, have dropped at a record pace during the heating season, government data show.

“It hit the magical $5 number,” said Stephen Schork, president of Schork Group Inc., a consulting group in Villanova, Pennsylvania. “There’s not enough supply and a lot of demand. It’s not just cold in one market, it’s brutally cold from Chicago heading east.” Natural gas for February delivery rose 45.2 cents to $5.182 per million British thermal units on the New York Mercantile Exchange, the highest settlement since June 15, 2010.

Ambrose from Davos. I’d like to ignore that whole parade over there, or at least rename it “The Shining”, but this is not bad. Remember how we were all going to work maybe 20 hours a week, if that, and be richer than ever? What would all those people do with all that extra leisure time? Something tells me it wouldn’t be good for the planet. Instead, we’ve gotten droves of people with nothing but free time, and even they feel more hurried than their ancestors. Is there anyone who feels they have more time than before? What use is that if it’s only spent texting and Bieber blabbing?

Makes me think of one of my favorite quotes of all time, which I looked up again the other day, from US writer Susan Ertz, I’m sure I’ll be using it again some day soon:

“Millions long for immortality who don’t know what to do with themselves on a rainy Sunday afternoon.”

• Will the 2nd Great Machine Age be a frightening jobless dystopia? (AEP)

Thanks to lightning-speed advances in hi-tech, humanity (or part of it) is close to achieving its dream of prosperity without toil. We are already starting glimpse the awful consequences. As Voltaire said, work is the triple tonic for needs, vice, and boredom. A Davos vote split 51:49 on whether “technological innovation” will keep displacing jobs – and at an accelerating rate – leaving us with a deformed world where hundreds of millions are left on the unemployment scrap-heap (205m so far).

The waters have been so muddied by the global financial crisis – and the 1930s response to it in some quarters – that it is hard to separate the chronic job wastage caused by “robots” (to use a metaphor) from the temporary effects of scarce global demand.

Phillip Jennings, head of the UNI global labour federation, said it would be a “miscarriage of justice” to blame the 32 million job losses since the Lehman-EMU crisis on the iPad or the driverless car. “You can’t put technology in the dock for 50% youth unemployment in Greece or Spain. I blame the EU Troika. It was the economic and political decisions taken that have led to the collapse of jobs. In Greece it has gone beyond depression into a humanitarian crisis,” he said at the World Economic Forum.

He said some $2 trillion of corporate cash is on the sidelines in the US, $700bn in the UK, and another $2 trillion in the rest of the world. “There is an investors strike. This is a problem of demand in our economies, they are comatose,” he said. [..]

Apple’s new Mac Pro will be made in Austin, Texas. Robots have rendered the labour cost irrelevant. The BRICS and mini-BRICS can longer under cut on price. “Wages don’t matter any longer. Off-shoring was just a way station.” We are back to reshoring, but without jobs. Welcome to our brave new world.

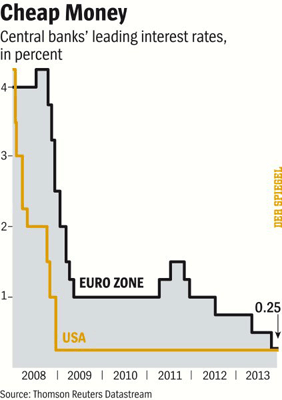

Bundesbank head Jens Weidmann was always the NO vote in the ‘stimulus until we die’ battle from Brussels. He’s lost out. Is that a good thing?

• The Bull in the Euro Zone’s China Shop (Spiegel)

He is now living with the risk of being regarded solely as Germany’s Herr Nein — a person who is no longer taken seriously because the only thing he seems to be capable of saying is “no”. Finance ministers from Germany’s neighboring countries — who just a few years ago nervously followed Weidmann’s every word — are openly dismissive today. With five years left to go in his term as head of the Bundesbank, it’s possible he’s already gone too far.

Weidmann openly admits in interviews that he’s thought about this question, but he denies there’s any truth to it. He says his influence hasn’t diminished in any way, that people still listen to his positions. After all, he insists, they’re well-founded and argued logically. He describes reports to the contrary as “perturbing and anything but helpful.” Besides, he adds, “It would be problematic if we all had the same opinions when it came to difficult decisions taken under a high degree of uncertainty. Europe has to live with the fact that we’re struggling to find the right path.”

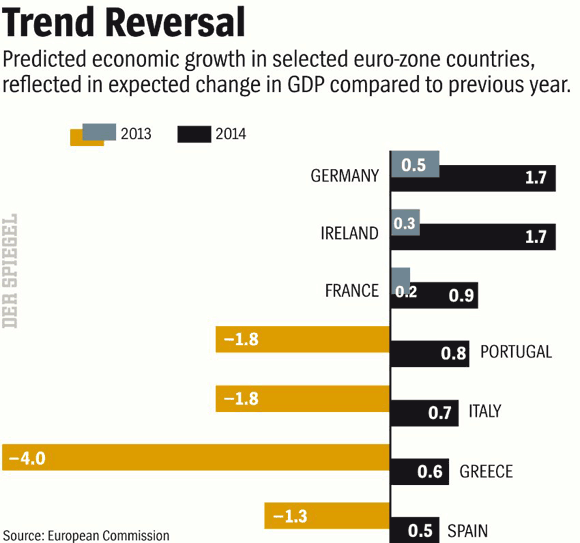

France will be a hot story in 2014. If Hollande “reforms” the way everybody seems to want, he’ll lose the next election and a wide variety of agricultural appliances will invade the Champs d’Élysées. If he doesn’t reform, France will become a PIIG with lipstick. I said it before: If you’re France, the best thing to do is reintroduce the franc, and meet your basic needs domestically.

What you need to import, you can pay for with wine and cheese export revenues. It won’t be a holiday, but it’ll be much better than the alternative. France has the independence practically no other rich country has, of a huge series of nuke plants. Don’t like them but you got them, and don’t need to buy power from anyone. So make the best of it, and be independent then, and you could come out of this whole thing way ahead of your neighbors.

• France could destroy the euro, says Christopher Pissarides (Telegraph)

France could destroy the euro if the government’s gamble on supply side reforms fails to pull the economy out of its chronic malaise, Nobel laureate Sir Christopher Pissarides has warned. Sir Christopher, who won the the 2010 Nobel Prize for economics, said the ability of Europe’s second largest economy to implement sweeping changes would decide the fate of the single currency.

He warned French president Francois Hollande’s special blend of “supply-side socialism” would leave the fragile economy vulnerable to shocks for several years. “France’s fundamentals are not very good and they cannot implement policy now to reform quickly, he told the Telegraph. “Supply side reforms take time to have an effect, and I don’t know what will happen in the mean time.

“Twelve years ago, Germany was the sick man of Europe, and now France is looking like it’s letting itself go in that direction. If the reforms [don’t succeed] then I would be very worried about what would happen to the euro.” [..]

Mr Pissarides also warned the single currency bloc could be sucked into a deflationary spiral that could exacerbate already high debt levels and drag down Britain’s economy. “When there is deflation, debt becomes a much more serious problem,” he said. “And you don’t want to be in a partnership in a single market with other countries that are on a deflationary spiral when you’re trying to come up.

An article by Kumi Naidoo, Executive Director of Greenpeace International, that makes me think: are you sure you thought this through, boyo? Things don’t become so because you say so. The crux of the problem is that you can’t run our present economic systems on renewable energy. If we could, Exxon and Shell would be all over it. More renewables here and there? Sure. But that’s not where the problem resides. We need to tone down our energy use by a factor of 90% or so. Problem is, that would kill off our economies. Now you go solve that baby over there in your corporate offices at Greenpeace, and then we’ll talk again.

• Don’t Bet on Coal and Oil Growth (HuffPo)

A mind-boggling sum of about $800 for each person on the planet is invested into fossil fuel companies through the global capital markets alone. That’s roughly 10 percent of the total capital invested in listed companies. The amount of money invested into the 200 biggest fossil fuel companies through financial markets is estimated at 5.5 trillion dollars. This should be an impressive amount of money for anyone reading this.

By keeping their money in coal and oil companies, investors are betting a vast amount of wealth, including the pensions and savings of millions of people, on high future demand for dirty fuels. The investment has enabled fossil fuel companies to massively raise their spending on expanding extractable reserves, with oil and gas companies alone (state-owned ones included) spending the combined GDP of Netherlands and Belgium a year, in belief that there will be demand for ever more dirty fuel.

This will be widely used as the rationale for increasing the production of GMO crops. The industry, and all of its political lackeys, will claim they are the only ones who can solve this issue. High time for every single one of us to start growing our own food, to the extent that is possible. All those pretty front and back gardens that so many of you have, grow food in them. That will solve this land problem, AND it will get rid of Monsanto et al. Take your responsibility, one at a time.

• World faces 849 million hectare deforestation (Anba)

There will be a loss of 849 million hectares of green lands by 2050, if the current deforestation rate continues. The figure is part of a UNEP study and represents nearly the size of Brazil. If current deforestation rates persist in the coming years, 849 million hectares of green areas will be lost by 2050, according to a report by the United Nations Environment Program (UNEP), launched this Friday (24) in Davos, Switzerland, at the World Economic Forum.

According to the report, called “Assessing Global Land Use: Balancing Consumption with Sustainable Supply”, the need to feed the population, which is growing, has led to 30% of the lands of the world being used for agriculture, which has resulted in degradation and biodiversity loss in many areas.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.