London Gold Price Fix Is Manipulated Although Evidence Exists For Many Years

Commodities / Gold and Silver 2014 Mar 03, 2014 - 06:43 AM GMTBy: GoldSilverWorlds

It was only a week ago when we wrote that the Financial Times removed the article “Gold Price Rigging Fears Put Investors On Alert” from their website, a couple of hours after being published. We were able to dig up the original article in Google’s caching memory and took screenshots of the removed article.

It was only a week ago when we wrote that the Financial Times removed the article “Gold Price Rigging Fears Put Investors On Alert” from their website, a couple of hours after being published. We were able to dig up the original article in Google’s caching memory and took screenshots of the removed article.

Less than a week later, it is Bloomberg releases the article “Gold Fix Study Shows Signs of Decade of Bank Manipulation.”

From Bloomberg (source):

The London gold fix, the benchmark used by miners, jewelers and central banks to value the metal, may have been manipulated for a decade by the banks setting it, researchers say.

Unusual trading patterns around 3 p.m. in London, when the so-called afternoon fix is set on a private conference call between five of the biggest gold dealers, are a sign of collusive behavior and should be investigated, New York University’s Stern School of Business Professor Rosa Abrantes-Metz and Albert Metz, a managing director at Moody’s Investors Service, wrote in a draft research paper.

“The structure of the benchmark is certainly conducive to collusion and manipulation, and the empirical data are consistent with price artificiality,” they say in the report, which hasn’t yet been submitted for publication. “It is likely that co-operation between participants may be occurring.”

The remainder of the article does not add particularly interesting information.

We have no interest in analyzing the findings of the research. Readers interested in a critical analysis should read Ross Norman’s comments, managing director of bullion company SharpsPixley in London (read analysis).

We would like to point out how Bloomberg’s news is no news at all. In the past two years, we released several articles in which gold and silver price manipulation was discussed at length, based on facts and figures, without any bias. Obviously, there was no reference from the mainstream media to any of these findings on our site or on similar precious metals sites (think of GATA, Goldseek, and the likes).

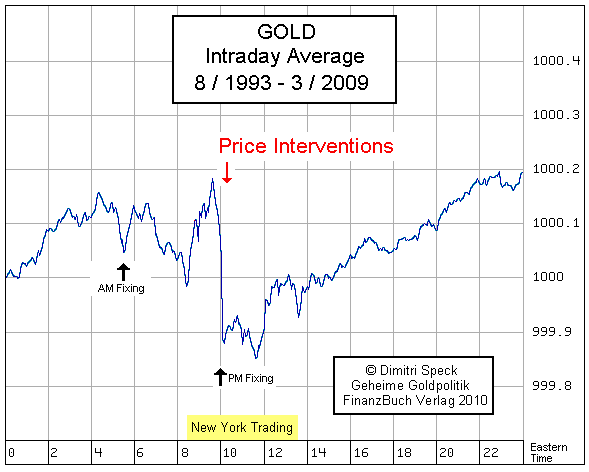

First, on November 30th 2012, a year and a half ago, we released an interview with statistical researcher Dimitri Speck. We explained that his research showed evidence of central banks influencing systematically the price of gold as of August 1993. Mr. Speck’s conclusion comes from intraday price statistics, where he observed several anomalies. First, since 1993, the price has been falling systematically during the trading session of COMEX in NY. Another trading anomaly is that during the PM fix the price systematically tends to drop significantly. The following chart is the result of 16 years of recording intraday data. The sudden price drops are so sharp and systematic, that it can only point to intervention.

It was not only us who released this information. Dimitri Speck’s own website had existed for much longer and his work was released by GATA long before. The gold price manipulation during the London Fix was clearly much longer visible.

Bloomberg comes indeed very late with the “discovery” of gold price manipulation. Ironically, just two weeks ago, precious metals analyst Ted Butler explained here that Bear Stearns went bankrupt mainly because of excessive short positions on gold and silver in 2008. Butler wrote “What baffles me today is that no well-known journalist from outside the gold and silver world has yet picked up on what is an easy-to-document story of epic historical proportions. It’s the story of why Bear Stearns went under, and how the gold and silver price manipulation continued since the day JPMorgan took over Bear.”

Butler has provided evidence of gold and silver manipulation for several years. The key findings of Butler are based on COMEX gold and silver dominant positions by Bear Stearns and JP Morgan. Since the fall of Bear Stearns, JP Morgan has taken over those dominant positions in the futures markets, allowing them to set the direction of the price.

Backed by evidence and facts from the official COT reports (released by the CME group), Butler wrote in JP Morgan’s Perfect Silver Manipulation Cannot Last Forever:

JPMorgan’s real crime resides in its ability to sell unlimited quantities of COMEX silver contracts short on the way up in price to the point of creating unprecedented levels of market share and concentration. In December 2009, JPMorgan held more than 40% of the entire short side of COMEX silver and close to that market share on other occasions. To my knowledge, there has never been a greater market share or corner in any major market in history. These unlimited short sales by JPMorgan inevitably satisfy technical buying interest and then that technical buying turns to selling at some point, with JPMorgan then working to induce the tech funds into selling. The buying back by JPMorgan is the illegal ringing of the cash register and closing out of the manipulative silver short positions sold at higher prices.

Moreover, in 2013 – The Year of JPMorgan, Butler discussed evidence of JP Morgan’s market corners in both gold and silver:

It is well-established that a market corner is against commodity law. In fact, this is the most important aspect to commodity law, because market corners are unquestioned proof of manipulation. CFTC data indicate that JPMorgan held short market corners in COMEX gold and silver at the start of the year and that this crooked bank holds a long market corner currently in COMEX gold. There can be no question that JPMorgan held and holds market corners in COMEX gold and silver based upon market share.

While the London Fix price manipulation was already known for years (for instance by research from Dimitri Speck documented on several sites including ours), it is the COMEX futures dominant positions of JP Morgan that is an even bigger act of price manipulation. As usual, the mainstream media are running behind the truth and are not able to report on the most relevant facts.

Source - http://goldsilverworlds.com/price/bloomberg-reports-london...

© 2014 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.