Bearish Banks Help Fuel Gold’s Meteoric Run

Commodities / Gold and Silver 2014 Mar 14, 2014 - 04:38 AM GMTBy: Clif_Droke

Just when you thought the last of the big institutional banks were ready to throw in the towel on their bearish metal forecasts, yet another one has joined the ranks of the gold bears.

Just when you thought the last of the big institutional banks were ready to throw in the towel on their bearish metal forecasts, yet another one has joined the ranks of the gold bears.

Morgan Stanley was the latest to enter the fray on Monday when it lowered its gold price forecast for 2014 and 2015 in a research report. The group based its lower forecast on the expected impact of reduced monetary stimulus combined with increased regulatory pressure on investment banks to reduce the scale of proprietary commodities trading.

Morgan noted that while demand for physical gold remained strong in China, imports to India were low. Moreover, Morgan asserted that last year’s sell-off of assets by gold ETFs nullified the strength provided by increased Chinese demand. “The lower price environment will pose significant challenges for gold miners given the substantial rise in costs over the past decade,” the bank said.

Morgan Stanley lowered its 2014 average price forecast for gold by 11.6 percent to $1,160/oz, and cut its average 2015 gold price forecast by 12.5 percent to $1,138/oz.

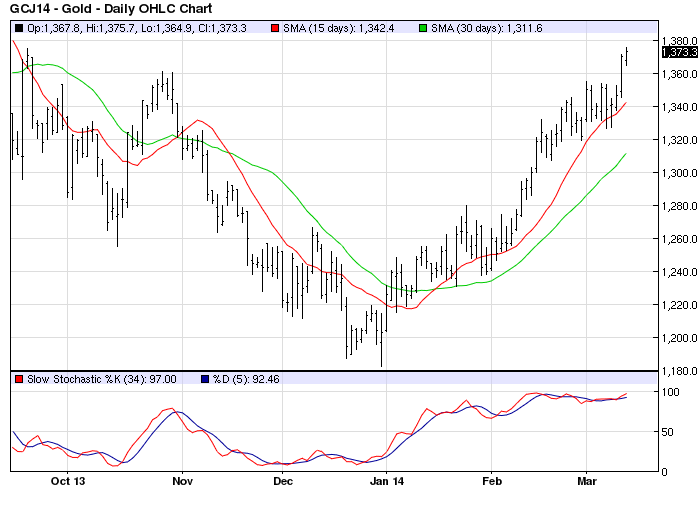

Let’s examine the two basic assumptions behind Morgan Stanley’s bearish gold forecast for 2014-2015. The first negative assumption is that reduced monetary stimulus will result in lower gold prices. We’ve already discovered in previous reports the fallacy of this argument. Indeed, ever since the U.S. Federal Reserve announced that it be tapering its asset purchases the gold price has gone up in contrast to what most institutional analysts predicted. This is because quantitative easing (QE) isn’t a major driver for the gold price; volatility and investor uncertainty are the main drivers.

In the final portion of the deflationary long wave, fear and uncertainty are the main reasons for owning gold. As long as investor trepidation remains, any increase in economic fragility or geopolitical tension (e.g. China, Russia, Ukraine) will only serve to underscore gold’s attractiveness as a financial save haven. In just the last two-and-half months we’ve seen how a stock market correction, an emerging markets scare, military tensions in Eastern Europe, and economic uncertainty in China have combined to lift the yellow metal to its highest levels since last September. All the while the Fed has been reducing the pace of its mortgage purchases and otherwise shrinking its QE policy.

If anything, reducing the pace of QE has helped rather than hindered the gold price. We could speculate the reason for this as being that investors are perhaps apprehensive about the stability of the economic recovery in the face of a tightening central bank money stance. Regardless of the actual rationale, gold investors have no problem with tighter monetary policy, thus undermining the primary basis for Morgan’s bearish gold forecast.

Morgan Stanley’s second reason for embracing a bearish 2014-15 gold outlook are the new rules restricting proprietary commodities trading among investment banks. Yet even before these rules were implemented banks had already begun shrinking their commodity trading desks. Indeed, bank trading is no longer even a central pillar behind gold price momentum and hasn’t been for a long time. This, then, is also a deceptive reason for expecting gold to underperform in the coming 1-2 years.

With the gold price having rallied some 15 percent off last year’s lows, the leading institutional banks are wiping a lot of egg off their faces. Goldman Sachs, arguably the most respectable of the big Wall Street banks, is bending over backwards of late in making excuses for its blown gold call from late last year. In its latest report to its clients, Goldman asserts its continued belief that the gold rally will soon fade despite renewed buying among hedge funds.

According to U.S. government data, hedge funds and other speculators increased bullish bets on gold for a fourth consecutive week and are currently the most bullish they’ve been since December 2012. The net-long position in gold climbed 3.8 percent to 118,241 futures and options in the week ended March 4, according to the Commodity Futures Trading Commission (CFTC). Short holdings, by contrast, were down 15 percent to 26,321, the lowest since October.

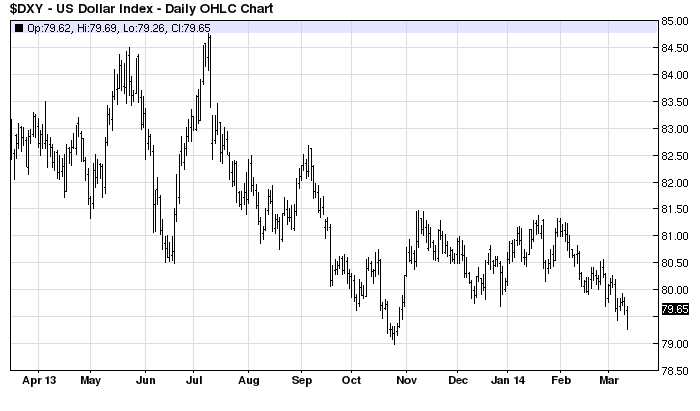

Goldman’s chief commodities analyst, Jeffrey Currie, said that turmoil between Russia and Ukraine doesn’t alter the firm’s bearish view on gold. He also told Bloomberg that lower mining costs means that it’s “more probable than it was six months ago that prices would drop below $1,000.” Goldman seems to be grasping at straws in its attempt at rationalizing a blown bearish call. Moreover, the firm believes a strengthening dollar will weigh against the metals based on the expectation of accelerating U.S. economic strength. Yet the dollar has shown no sign of strengthening as yet but instead continues to grind lower and is testing a major low.

In contrast to Goldman and the Wall Street banks, billionaire hedge-fund manager John Paulson, who holds the biggest stake in SPDR Gold Trust (GLD), reported gains in his firm’s bullish gold strategies last month. Holdings through gold ETFs rose in February for the first time since 2012. Assets in the GLD, world’s largest gold ETF, are up 0.9 percent in 2014 following a 41 drop drop in 2013 that resulted in a $41.8 billion decline in value.

Gold & Gold Stock Trading Simplified

There exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. Some complain of being unable to “pull the trigger” on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my book, “Gold & Gold Stock Trading Simplified,” I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It’s the same system that I use each day in the Gold & Silver Stock Report – the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years.

The methods revealed in “Gold & Gold Stock Trading Simplified” are the product of several year’s worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today’s fast moving and volatile market environment. You won’t find a more timely and useful book than this for capturing profits in today’s gold and gold stock market.

The book is now available for sale at:

http://www.clifdroke.com/books/trading_simplified.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.