Gold Breaks Below Technical Support Ahead of Fed Interest Rate Meeting

Commodities / Gold & Silver Apr 30, 2008 - 08:22 AM GMTBy: Mark_OByrne

Gold was down $18.20 to $874.70 per ounce in trading in New York yesterday and silver was down 45 cents to $16.57 per ounce. The London AM Gold Fix at 1030 GMT this morning was at $867.75 £440.77 and €557.72 (from $886.00, £447.50 and €569.23).

Gold was down $18.20 to $874.70 per ounce in trading in New York yesterday and silver was down 45 cents to $16.57 per ounce. The London AM Gold Fix at 1030 GMT this morning was at $867.75 £440.77 and €557.72 (from $886.00, £447.50 and €569.23).

Fed's Interest Rate Decision

The Federal Reserve's much anticipated interest rate decision remains the central focus for the markets today. The dollar has continued to strengthen this morning, most equity markets and commodity markets internationally are down. Markets expect that rates will be cut by 0.25% to 2.0%, though the tone of the statement will be closely watched. There is much speculation that the FOMC will indicate that it is coming to the end of its easing cycle due to the emergence of significant inflationary pressures.

Monetary policy remains extremely loose and expansionary and the printing presses remain in full effect. Thus negative real interest rates look set to be continue for the foreseeable future which is obviously bullish for gold.

Another Healthy Correction and Consolidation

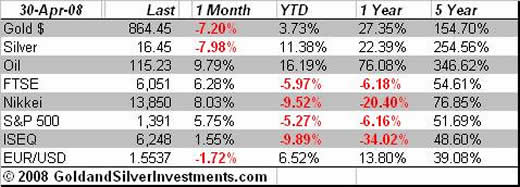

Gold continues to sell off on oil weakness and dollar strength. However, we are confident that this is another short term correction in a long term secular bull market. Gold remains up 27.35% in the last year and has outperformed nearly all asset classes since the outbreak of the credit crisis. Gold has risen 33% from $650 in mid August 2007 to $865 today (see Technical Analysis below) which is a sterling performance by any standards and has led to a typical bout of profit taking and healthy consolidation. Gold has again proven it's safe haven credentials over the medium to long term and will continue to do so.

The economic news yesterday was very bad with sharply falling house prices and consumer confidence. US advance GDP for Q1 and the Chicago PMI are expected to be poor. Gross domestic product probably increased at a 0.3% annualized rate in the quarter after a 0.6% gain in the fourth quarter, according to a survey of economists conducted by MarketWatch. But the U.S. economy is already in recession and contracting despite government manipulation and hedonic adjustments of inflation and growth statistics. And this is the first recession since the 1970's where declining growth has been met with rising inflation – classic stagflation – which will again result in gold outperforming other asset classes.

Technical Analysis

Trend support at $893 has now been broken and the 1st April low at $870 is proving to be short term support again.

Any close below $870 would open up a retest of the 22nd Jan support/8th Nov resistance at $845/$850. Coincidentally this is also very close to the 50% Fibonacci retracement of the move from the break-out at $686 to the high at $1030, approximately $855. This should prove to be significant support.

A break of these levels will open up a move towards the 200 day moving average at $822, with the 100 day moving average having been broken at $903.

A fall below the 200 day moving average would ultimately find support at the bottom of the Oct 07 consolidation at $775.

Trend resistance is currently at $925 which is also back above the 100 day moving average. A break of this would be very bullish and should mark the start of the next upward move, paving the way for a retest of the 17th March highs,

Silver

Silver is trading at $16.45/16.50 per ounce at 1200 GMT.

Contrary to some analysis which claims silver is overvalued we continue to believe silver is very undervalued and will at least reach it's nominal high of $50 per ounce in the coming years. http://www.moneyweek.com/file /28810/why-the-silver-price-is -set-to-soar.html

PGMs

Platinum is trading at $1903/1923 per ounce (1200 GMT).

Palladium is trading at $414/419 per ounce (1200 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.