The Death of Deflation

Economics / Deflation Apr 30, 2014 - 10:15 AM GMTBy: Clif_Droke

If investors have learned nothing else from the events of the last five years, they’ve at least learned that fighting the Fed doesn’t pay.

If investors have learned nothing else from the events of the last five years, they’ve at least learned that fighting the Fed doesn’t pay.

Indeed, the biggest lesson of all since 2009 is that monetary liquidity is the single biggest determinant of future stock prices. Given a loose enough monetary policy, stock prices will always respond by going higher.

The loose monetary environment of the last five years has been facilitated by record low interest rates. Low rates have in fact been indispensible in allowing the Fed to engineer the five-year bull market in equities. Low interest rates have also made possible the relatively strong retail economy of the last couple of years, which in turn has allowed consumers to finance homes and purchase automobiles. Further, it’s indisputable that the low interest rate environment of recent years has been a boon for corporate financing.

Low interest rates are at once a symptom and a contributor to deflation. Low rates contribute to deflation by allowing businesses to continue producing when their more efficient competitors would have buried them under normal circumstances. This translates into increased competition, which means more supply is produced resulting in falling prices for many goods and services.

One of the most important aspects of the 60-year cycle of inflation/deflation is that it governs the direction of interest rates. The cycle can be divided into half, with the first 30 years witnessing an overall rising trend inflation, while the second half is marked by falling interest rates, hence disinflation or deflation. The 60-year long-term deflationary cycle will bottom around October of this year, at which time a new long-term inflationary cycle will begin.

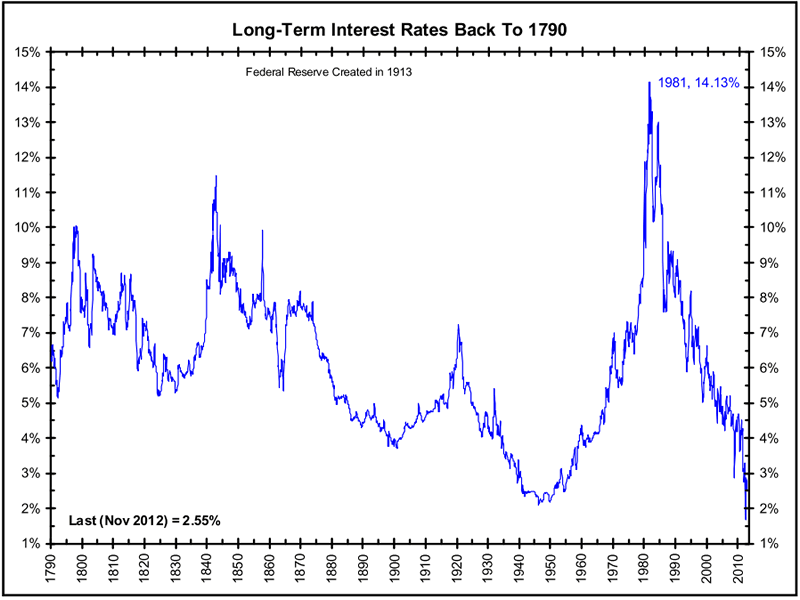

The following graph, created by Barry Ritholtz (http://www.ritholtz.com), shows long-term interest rates going back to the year 1790. Of special significance, notice how the 60-year Kress cycle of inflation/deflation can be tracked beginning around the mid 1890s (when the current 120-year Super Cycle began) before peaking approximately on schedule in the 1920s. This was followed by a 30-year cycle into the early 1950s, followed by another 30-year advance into the early 1980s – just as the Kress cycle predicted. The last 30 or so years, of course, have been marked by dramatically falling interest rates in reflection of the deflationary phase of the 120-year cycle.

The major financial crisis which always accompanies the final deflationary leg of the long-term cycle occurred in 2008-09. A crisis of similar magnitude is unlikely for quite some time. While a milder economic slowdown or global financial panic can still occur while the long-term cycle is bottoming and shifting its phase, central banks have seen to it that any such crisis will be of relatively short duration and of lesser magnitude than the 2008 crisis. Moreover, any such crisis will not ultimately threaten the survival of the global economy.

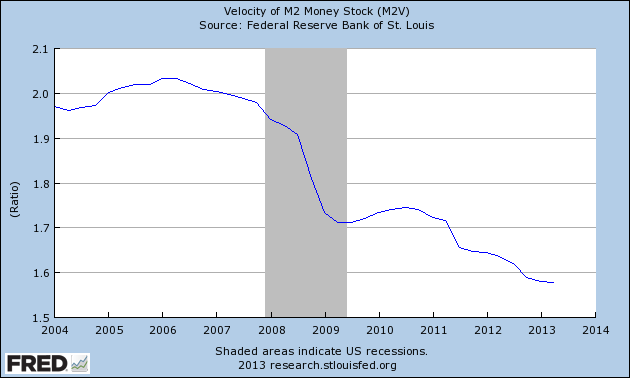

The next major crisis will likely not involve a deflationary collapse, but rather an inflationary spiral. When the long-term Kress cycle bottoms later this year, the new long-term cycle of inflation which follows may well cause a major shift in the American standard of living. The Fed’s zero interest rate policy (ZIRP) will end as the natural rate of interest begins rising. The velocity of money (the rate at which money changes hands) will reverse its long-term downward trend and will commence a new uptrend as money finally comes out of the sidelines. Corporate and consumer borrowing will both also steadily increase.

At first this will be highly stimulating for the economy. According to classical K-Wave theory, the early years of the long-term inflation phase are typically benign and are likened to the mild spring season which follows winter (deflation). This time around, though, will probably be different. Considering the tremendous amount of money sitting idle along with several years’ worth of pent-up demand, the money that will inevitably be unleashed upon the economy in the years following 2014 will quickly increase inflationary pressure. Prices for both raw commodities and finished goods will rise and wages, which have been stagnant for years, will finally do the same. Combined with rising interest rates, the post-2014 economic climate will be fundamentally different from that of the last 15 years.

In a normal inflation/deflation cycle, the transition from deflation to inflation would ordinarily be a gradual progression over a 10-15 year period. In the U.S., however, years of artificially high retail food and fuel prices will short-circuit this process. Since retail food and fuel prices were never allowed to decline in the last five years, the increase in the cost of living could be dramatic in the years immediately following the 2014 cycle bottom.

With crisis comes opportunity, however. While retail prices and interest rates will increase after the birth of the new inflation cycle, equity prices will also likely see increases. The year 2015 should be an especially propitious time to own stocks, especially if the market’s internal imbalances are reduced this year. As more and more sidelined money enters the economy in 2015 and beyond, the labor market will also show substantial improvement. Accordingly, workers should see their bargaining power increased.

The years immediately following 2014 will be filled with both challenges and opportunities. The most pressing concern for investors will be that of rising interest rates and inflation protection. For consumers the biggest challenge will be increased living costs due to the effects of the new long-term inflationary cycle. The ones who survive and prosper will be those who understand the new world created by the long-term Kress cycle.

Kress Cycles

Cycle analysis is essential to successful long-term financial planning. While stock selection begins with fundamental analysis and technical analysis is crucial for short-term market timing, cycles provide the context for the market’s intermediate- and longer-term trends.

While cycles are important, having the right set of cycles is absolutely critical to an investor’s success. They can make all the difference between a winning year and a losing one. One of the best cycle methods for capturing stock market turning points is the set of weekly and yearly rhythms known as the Kress cycles. This series of weekly cycles has been used with excellent long-term results for over 20 years after having been perfected by the late Samuel J. Kress.

In my latest book “Kress Cycles,” the third and final installment in the series, I explain the weekly cycles which are paramount to understanding Kress cycle methodology. Never before have the weekly cycles been revealed which Mr. Kress himself used to great effect in trading the SPX and OEX. If you have ever wanted to learn the Kress cycles in their entirety, now is your chance. The book is now available for sale at:

http://www.clifdroke.com/books/kresscycles.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.