USD/JPY Ignition

Currencies / Japanese Yen May 07, 2014 - 04:22 PM GMT Ignition...liftoff! USD/JPY rose from 101.43 at the low to 101.75 at 8:00 am. At 8:00 am SPX futures started to ramp. SPX pre-market is up 7 points and may go to Short-term resistance at 1876.00 or 17-day resistance at 1878.00 (not shown).

Ignition...liftoff! USD/JPY rose from 101.43 at the low to 101.75 at 8:00 am. At 8:00 am SPX futures started to ramp. SPX pre-market is up 7 points and may go to Short-term resistance at 1876.00 or 17-day resistance at 1878.00 (not shown).

There is some concern that the decline so far is not impulsive. The best explanation why is that the shallow clustering of supports temporarily prevent the declines from making the longer declines typical in an impulse. Another explanation is that SPX may be making a Leading Diagonal wave. Something else may be happening if the ramp goes above 1885.51.

On the Calendar today, is a speech by Janet Yellen to the Joint Economic Committee of Congress at 10:00 am. ZeroHedge reports, “If there is anything that does matter it will be that the central-planning Chairmanwoman of the "free" world, Janet Yellen will speak before the Joint Economic Committee of Congress at 10am. Algos are surely hoping that she reveals a USDJPY target, and thus S&P 500, EOD target at least 1% above the overnight lows.”

Some attribute the ramp to renewed talks with Putin, but that may be just an accident of timing. Hopefully the ramp will be over soon after 10:00.

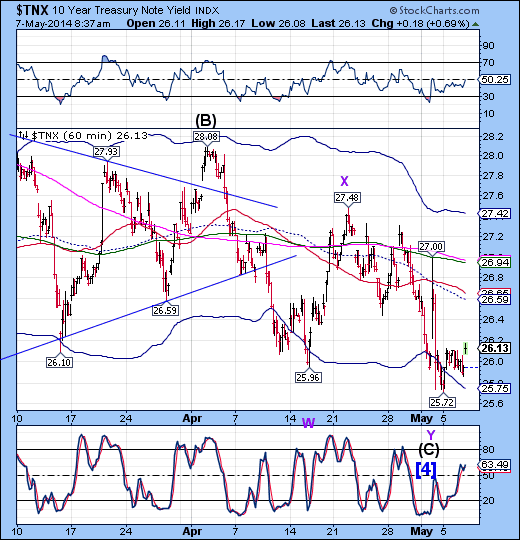

Bank of America may be finally right on their “short bonds” call.

Non-Farm productivity fell most in a year at 1.7% in Q1 - notably worse than the 1.2% drop that was expected. Output growth slowed dramatically and real compensation also fell.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.