European Financial Market Forecasts - Sentiment Gauge in Reaches Epic Proportion

Economics / European Stock Markets May 12, 2014 - 06:21 PM GMTBy: EWI

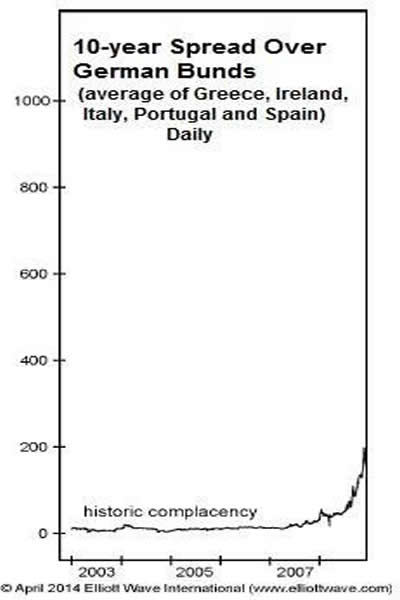

A visual history of complacency and fear as seen by the 10-year spread over German Bunds

A visual history of complacency and fear as seen by the 10-year spread over German Bunds

The one-two punch 2014 winter storms that battered the southeastern United States left $13.5 million in damages in Georgia alone and thousands of residents displaced due to burst pipes and power outages. I am one of the displaced. Three months after the flood, I'm still living out of suitcases in a hotel while my apartment gets rebuilt.

I'm ashamed to admit before Icepocalypse, I had the least comprehensive homeowner's insurance. Why bother, I thought. This is Atlanta. The only blizzard this city's seen in the last decade is on the dessert menu at Dairy Queen.

But now, you better believe the first thing I'm going to do when I move back in is upgrade my policy to cover all and any acts of man and God -- fire, tornado, sharknado, alien invasion, you name it.

It's human nature. You can never truly prepare for the worst until you experience it first-hand. Then, and only then, do you go above and beyond to protect your health and welfare.

Nowhere is this more apparent than in the world of finance. The tendency for investors to be blindly optimistic in the run-up to disaster, and then stringently fearful after is undeniable. You can actually see it with your own eyes in the yield spread between low-grade bonds and long-term securities.

In a nutshell: A falling yield spread signals a growing appetite for risk among investors, while a rising yield spread signals an aversion to risk.

As for a real-world example, the April 2014 Elliott Wave European Financial Forecast opens with a special, two-page section on one of the most accurate gauges of eurozone sentiment since the start of the financial crisis: the 10-year spread over German Bunds.

Before we delve into our analysis, let's set the pre-crisis scene to 2006 early 2007. Europhoria is off the charts as seen in these headlines from the time:

- "Euro Bull is Far From Over! Not only has the bear market been consigned to memory, it has been replaced by a rampaging bull market in equities. It's Goldilocks all over again!" -- April 20, 2006 National Post

- And -- "Lehman Brothers strategy boffin says buy, buy, buy Europe." -- January 16, 2007 Daily Mail

So, did the yield spread mirror the blind optimism among investors?

You betcha! Here, the April 2014 European Financial Forecast confirms: "By mid-year 2007, bond investors lent money to treasuries in Greece, Ireland, Italy, Portugal and Spain at more or less the same rate as they lent money to Germany." The first half of our chart of the 10-year spread over German bunds captures this historic complacency:

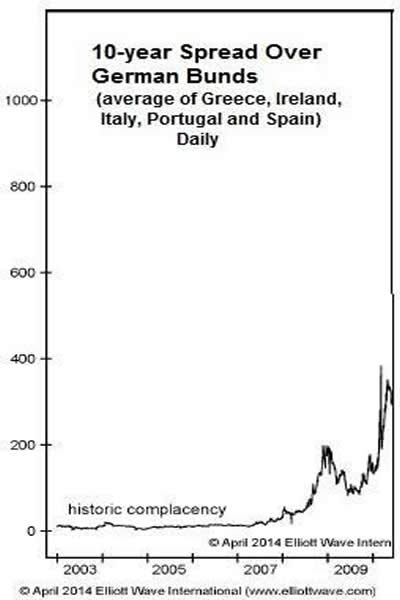

The move in the other direction was far from swift, as ingrained optimism persisted amidst the 2007 U.S subprime implosion, and 2008 Lehman Brothers bankruptcy. The next series of charts show how investors didn't fully "snap awake" until late 2008-9.

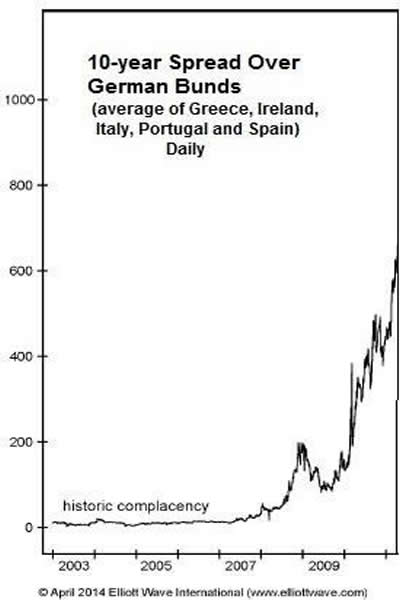

From there, the needle of sentiment swung firmly into risk-aversion territory:

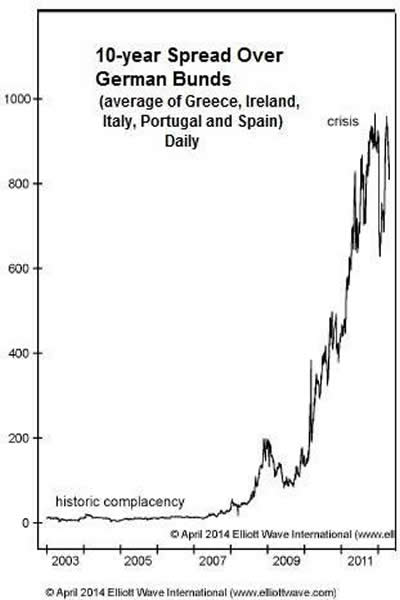

The spread between 10-year yields in Germany versus peripheral Europe rose by a factor of 43 -- from around 23 basis points in January 2008 to almost 1,000 basis points in January 2012.

Now is the time for reckoning. Historic complacency coincides with peaks, while historic fear with bottoms. So there is only question before you: Where does the 10-year spread over German Bunds stand now?

The April 2014 European Financial Forecast zooms in on the yield spread's performance since 2012 and has this answer:

Only a trend of "epic proportion can explain" today's reading; and when this phase gets underway, equities along with debt instruments "of all stripes" will follow.

Don't wait until after the tide has already turned. Prepare for the long-term changes ahead in Europe's leading economies with EWI's European Financial Forecast Service.

Start your 2-week free trial to the European Financial Forecast Service today and you'll get:

|

This article was syndicated by Elliott Wave International and was originally published under the headline One Sentiment Gauge in Europe Reaches Epic Proportion. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.