U.S. Federal Reserve See No Evil

Economics / Inflation May 23, 2014 - 06:03 AM GMTBy: Peter_Schiff

In this week's release of the minutes from its April 29-30 meeting, Federal Reserve policymakers made clear that they see little chance of inflation moving past their 2% target for years to come. In order to make such a bold statement, Fed economists not only had to ignore the current data, but discount the likelihood that their current stimulus will put further upward pressure on prices that are already rising.

In this week's release of the minutes from its April 29-30 meeting, Federal Reserve policymakers made clear that they see little chance of inflation moving past their 2% target for years to come. In order to make such a bold statement, Fed economists not only had to ignore the current data, but discount the likelihood that their current stimulus will put further upward pressure on prices that are already rising.

Even if you believe the highly manipulated government CPI data, April's year over year inflation rate came in at 1.95%, a statistically insignificant difference from the Fed's 2% target. If annualized, April's monthly change would equate to a rate closer to 4%. On the producer side, the numbers are even worse. Last week the Producer Price Index (PPI) came in at .6% for April, after notching up .5% in March. These two months together annualize at 6.6%. So already there is very little wiggle room, if any, before the Fed reaches the point where even its dovish leaders should admit that inflation is a problem.

But like most modern economists, leaders at the Fed deny Milton Friedman's famous maxim that inflation "is always and everywhere a monetary phenomenon." Instead they like to think of it as a kind of pesky but necessary byproduct of economic growth. (Recently the theory has gone even further, mixing cause and effect to determine that inflation causes economic growth). If this were so, then the Fed would have a lot to worry about if its economic forecasts can be trusted.

Despite the muted economic statistics over the last few months, the Fed has not backed off Janet Yellen's 3.0% forecast for 2014 GDP. The near zero growth we saw in Q1 (likely to be revised negative) has not convinced her, or anyone at the Fed, to ratchet down this estimate. So to hit that target, growth for the remainder of the year will have to come in close to 4% per quarter.

If the economy finally picks up to that level, by throwing off the supposedly chilling effect of the past winter, then based on the Fed's views it should expect significant upward pressure on inflation. Yet nowhere in the minutes released today is that possibility even considered. In fact, they explicitly said that inflation would be well below 2% for the next few years, despite the fact that it's already at 2% right now...during a period of admitted weakness! So they expect the economy to grow and inflation to subside even while real interest rates stay deep in negative territory? In essence, they are writing a new economic textbook on the fly. In truth, they are simply stringing together words and ideas designed to soothe the market and to keep anyone from detecting the dangerous trap that they have led us into. So just as the Fed saw no risk of housing prices falling in 2006, they see no risk of consumer prices rising now. In fact, they are just as confident that inflation is "contained" as they were about the sub-prime mortgage crisis. Based on their track record, people should fear exactly what the Fed is not worried about.

In the meantime, the truth about inflation is bubbling up in some unexpected places, sometimes from the same government that tells us that it's not a problem. In order to calculate the payment levels for the SNAP Food Program (aka "Food Stamps"), The U.S. Department of Agriculture is responsible for providing a baseline estimate for the costs needed to feed the typical family that would qualify for the program.

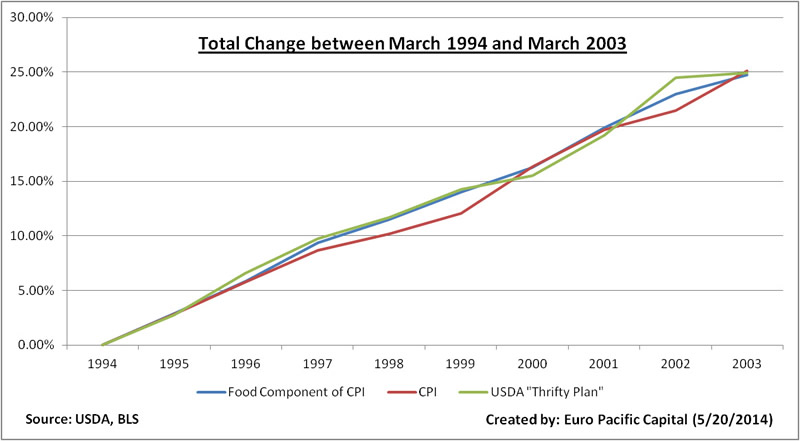

Looking over a twenty-year time frame provides a revealing pattern that we have seen in other places (see Big Mac Index). From 1994 to 2003 the CPI rose by a total of 25% or about 3.2% per year. This is almost exactly the same change that was seen in both the food component of the CPI and the USDA SNAP estimates for their "thrifty" plan to feed a family of four (the "thrifty" plan is the least expensive) over the same period.

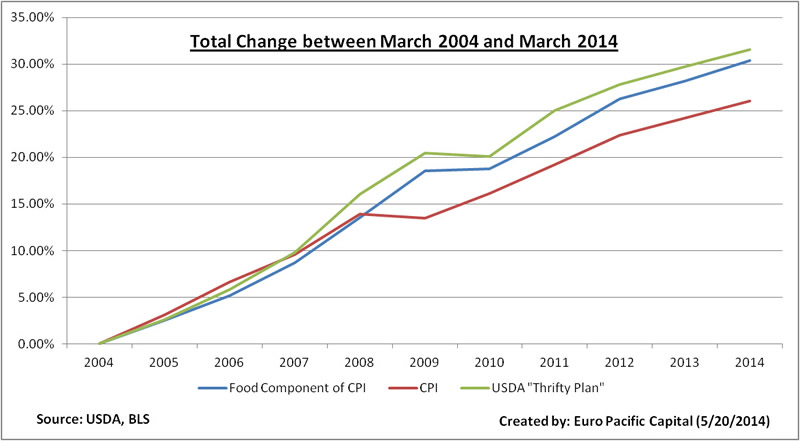

But that all began to change in the early part of the current century as the costs began drifting apart from the official CPI. I have made the case many times that this occurred as a result of changes in the way the CPI is calculated, all of which were designed to conceal the true level of inflation.

From 2004 to 2014 the CPI was up 26% or about 2.5% per year. However, the food component of the CPI was up 30% and the USDA estimate for a family of four was up 32% (The higher cost "liberal plan" increased even more, at 35% over that time). When comparing two sets of government data, it's tough to credit one over the other. But the USDA data is likely much closer to what most of us who shop for food actually experience. If accurate, the USDA numbers mean that over the past decade the costs to actually feed a family increased 23% more than most economists like to tell us.

Rising food prices are a major problem for many Americans struggling to make ends meet in our listless economy. Exactly how much more pain does the Federal Reserve want to inflict on the middle and lower classes before it relents and stops creating even more inflation?

There is a growing belief among economists, highlighted in a recent debate I had with Nouriel Roubini, that higher prices are actually a benefit to consumers. They believe that the growth created by inflation is worth more than the cost imposed at check-out lines. Instead, we are simply getting another dose of 1970s-style stagflation as higher prices simply amplify the pain of a stagnant economy and diminished employment opportunities.

The good news for Roubini and his ilk is that inflation does indeed help some people...the very rich. I have long argued that Fed stimulus and quantitative easing only result in the formation of asset bubbles that unevenly favor the rich, while misdirecting capital away from savings and productive investments that would benefit everyone else. Economists had blamed the recent disappointments from mass-market retailers like Walmart, Target, Best Buy, Staples, Dick's Sporting Goods, and Pet Smart (to name but a few) on the ravages of winter weather rather than weak fundamentals. But yesterday the upscale vendor Tiffany's issued a boffo report that showed net income up an astounding 50% over first quarter in 2013. The rich seemed to have little trouble braving the elements to buy baubles on Fifth Avenue, yet average Americans were too thin-skinned to make it to Dick's Sporting Goods.

While the world talks about the dangers of deflation, which offers no harm to economies or consumers, actual inflation is everywhere to be seen and nowhere acknowledged. Instead, we get a universal agreement that the middle class must continue to suffer so that the Fed and financial speculators can continue to revel in the charade.Peter Schiff is the CEO and Chief Global Strategist of Euro Pacific Capital, best-selling author and host of syndicated Peter Schiff Show.

Catch Peter's latest thoughts on the U.S. and International markets in the Euro Pacific Capital Spring 2014 Global Investor Newsletter!

Regards,

Peter Schiff

Euro Pacific Capital

http://www.europac.net/

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.