Wall Street Yield Trade: Another Explanation For Low Inflation

Stock-Markets / Inflation Jun 10, 2014 - 12:36 PM GMTBy: EconMatters

In an unprecedented move to fight off the threat of deflation, ECB cut its main interest rate to near zero at 0.15%, and its interest rate on deposits to a negative 0.1% for the first time. This means ECB will now be charging banks 0.1% to hold their reserves. ECB hopes these aggressive measures would spur banks to ramp up lending, and also weaken the euro. France has long been arguing that high euro exchange rate is holding back the economic recovery in the Euro Zone.

In an unprecedented move to fight off the threat of deflation, ECB cut its main interest rate to near zero at 0.15%, and its interest rate on deposits to a negative 0.1% for the first time. This means ECB will now be charging banks 0.1% to hold their reserves. ECB hopes these aggressive measures would spur banks to ramp up lending, and also weaken the euro. France has long been arguing that high euro exchange rate is holding back the economic recovery in the Euro Zone.

Testing Keynesian Theory

ECB and the U.S. Fed essentially have the similar Keynesian idea: Central Bank's act of reducing interest rates and increasing money supply would discourage saving, stimulate spending and demand for goods, services and improve bank balance sheets and banks’ capacity to lend. This sounds nice in the context of Keynesian Economics; however, it has not worked quite that way in the U.S. despite Fed's massive money printing operation since 2008, an observation I'm sure Draghi 'overlooked' trying to repeat the proven ineffective steps of the Fed.

Deflation Anxiety

Conventional wisdom had many concerned about run-away inflation because of the $3.5-trillion injected by the Fed into the economy, but that did not really materialize. In fact, up till the two most recent hot CPI and PPI reports, one major anxiety of the Fed was that the U.S. would fall into a prolonged Japanese-style deflation.

Don't Miss >> Hot Inflation Reports To Dominate Next Fed Meeting

The Liquidity Trap?

Some economists believe the disinflation seen in the U.S. is mostly due to weak demand commonly seen during an economic recovery. A blog published in April by the St. Louis Fed noted that as money supply (M0) increased 40.29% between December 2008 and December 2013, or about 8% per year on average, inflation should run at a pace of 4.3% per year. But this did not happen. St. Louis Fed posits that the liquidity trap could be an "alternative explanation for the generally unanticipated disinflation or low inflation levels".

Liquidity trap is a situation characterized by interest rates that are close to zero and fluctuations in the money supply that fail to translate into fluctuations in price levels. One cause of the liquidity trap is cash hoarding because people expect a crisis event such as war or market crash. As the St. Louis Fed describes it:

During a liquidity trap...., increases in money supply are fully absorbed by excess demand for money (liquidity)....if money demand increases more than proportionally to the change in money supply due to the downward pressure LSAPs [Large Scale Asset Purchases] exert on the interest rate, the price level must fall to absorb the difference between the supply and demand of money.

Flight to Cash

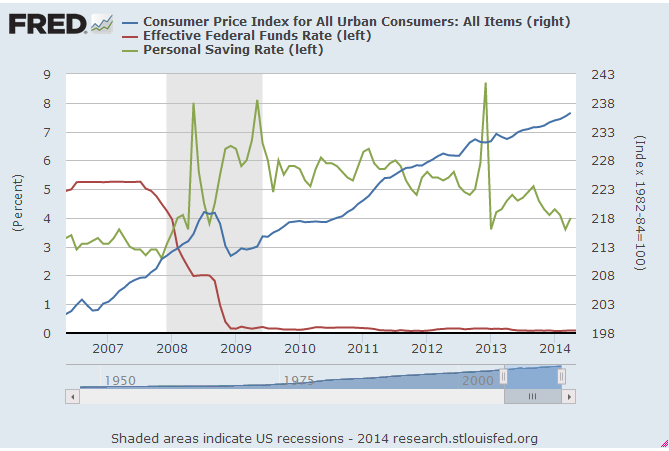

As we can see in the chart below, Personal Saving Rate spiked during the post-crisis recession period, and has remained higher than pre-crisis levels ever since. In addition to consumers, American companies are also building up liquidity and holding onto record $5 trillion in cash. This seems to support St. Louis Fed's position that low interest rate may have induced the flight to cash thus increasing the demand for money.

Wall Street Yield Trade

In our view, another major factor to the slow growth/low inflation in the U.S. is that Fed's ultra low near-zero interest rate actually incentivizes the Wall Street Yield Trade -- using the free money from the Fed to buy up Treasury for a risk-free profit delta bidding up Treasury prices while pushing down Yield. As the bond market gets more crowded, some banks would use that money to buy up stocks or commodities such as crude oil or agriculture for a much better risk/reward return than mere lending to business and consumers.

Low Interest Rate Is Deflationary

In other words, by incentivizing unproductive use of capital, low interest rate is deflationary. The majority of Fed's QE liquidity ended up in personal or corporation cash holding, or in the market (Treasury, Bond, Stocks, Commodities) without trickling down to the real economy leading to slow growth and disinflation (U.S. consumer inflation averaged around 1.6% per year from 2009 to 2013 in terms of CPI-All Urban Consumers).

European Bond Holders Could Take A Nasty Fall

In the case of the Euro Zone, low interest rate by ECB may have helped those semi-insolvent PIIGS governments to refinance their insane levels of debt. Nevertheless, bond yield is supposed to be a risk measure. After ECB announced its new low interest rate, the Wall Street Yield Trade has rendered the yield of some Euro Zone government bond a total mis-representation of the related sovereign risk. For example, while U.S. 10-year Treasury yield is hovering around 2.6%, Spanish government can now borrow at 2.57%, a rate lower than Uncle Sam. Equally ridiculous is that Italy now only pays 2.70% (or only 0.1% above the U.S.) interest for its debt.

Everybody loves a risk free trade, but this is not a normal situation. Once interest rate starts to normalize. the bondholders of the more risky Euro Zone government debt could see a rapid and nasty devaluation of their holdings.

Inflation Heating Up

The most recent reports on jobs, CPI, and PPI all suggest U.S. economy is picking up solid pace. And the chart above also shows a downward shift of Personal Saving Rate. Saving Rate is trending down most likely due to better jobs market and inflationary pressure on everyday stuff (e.g., food and energy). Inflation is indeed heating up -- the average annualized inflation rate for 2014 (Jan. through Apr.) is around 5%, while the same inflation trend from the Producer Price Index (PPI) is well above 5%.

The Right Move: Raise Interest Rate

Most central bankers are academics in the ivory tower making decisions based on economic theory that defies reality or common sense. But in its blog post, the St. Louis Fed actually made a logical argument:

....more monetary injections during a liquidity trap can only reinforce the liquidity trap by keeping the inflation rate low (or the real return to money high). ....the correct monetary policy during a liquidity trap is not to further increase money supply or reduce the interest rate but to raise inflation expectations by raising the nominal interest rate.

With both inflation and economic activity ramping up, we also believe that the Federal Reserve should raise interest rate to get ahead of the inflation curve and also to push the liquidity out of the 'risk free' Yield Trade, into more productive economic and business activity.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.