Stock Market Primary III Wave Continues

Stock-Markets / Stock Markets 2014 Jun 22, 2014 - 06:22 PM GMTBy: Tony_Caldaro

The bull market made news highs this week, after the FOMC meeting, statement, and press conference. For the week the SPX/DOW were +1.3%, the NDX/NAZ were +1.0%, and the DJ World index was +1.0%. On the economic front positive reports continue to outpace negative ones. On the uptick: the NY/Philly FED, industrial production, the NAHB, the CPI, leading indicators, and weekly jobless claims improved. On the downtick: housing starts, building permits, and the WLEI. Next week we get reports on Q1 GDP, Personal income/spending, and the PCE.

The bull market made news highs this week, after the FOMC meeting, statement, and press conference. For the week the SPX/DOW were +1.3%, the NDX/NAZ were +1.0%, and the DJ World index was +1.0%. On the economic front positive reports continue to outpace negative ones. On the uptick: the NY/Philly FED, industrial production, the NAHB, the CPI, leading indicators, and weekly jobless claims improved. On the downtick: housing starts, building permits, and the WLEI. Next week we get reports on Q1 GDP, Personal income/spending, and the PCE.

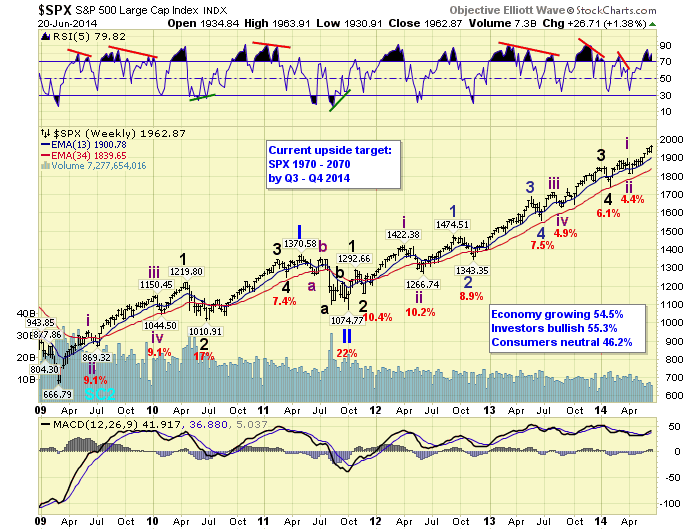

LONG TERM: bull market

This bull market continues to unfold. But has recently reached the point where investors feel the Central Banks of the world have their back, and they have nothing to fear. Volatility is at its lowest level since 2007, and risk premiums on sovereign debt are also at similar lows. After a multi-year bull market this is typically the calm before the storm. As bull markets begin their topping pattern, volatility increases and debt risk rises. This is likely to start in the next quarter.

For now Primary III, of this five primary wave bull market, continues to unfold. Primary waves I and II completed in 2011, and Primary III has been underway since then. After a simple Major wave 1 in late 2011, Major wave 3 extended and extended into early 2014. Then after a Major wave 4 decline in February 2014, Major wave 5 began and is still rising. When it concludes Primary III will conclude, and the steepest correction since 2011 will unfold for Primary wave IV. Primary IV will likely coincide with a world event. We currently have both Iraq and the Ukraine to consider.

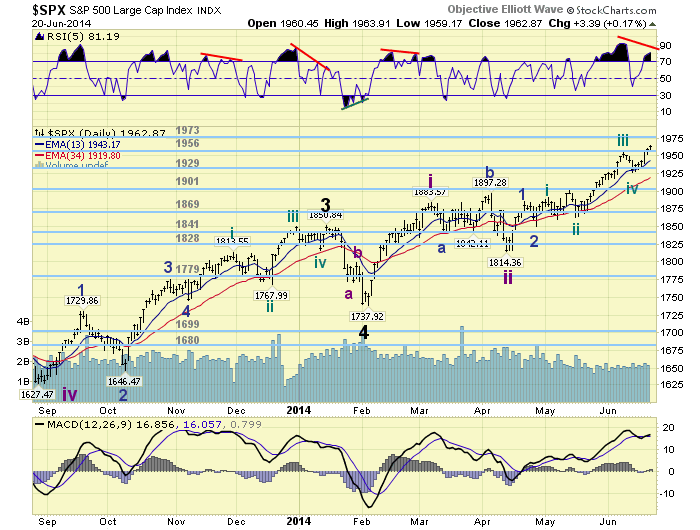

MEDIUM TERM: uptrend

From the Major wave 4 low in February at SPX 1738, we had an Intermediate wave i uptrend into April and SPX 1897. After that there was a short-lived Intermediate ii correction to SPX 1814 by mid-April. Then the current Intermediate iii uptrend began. We have been counting this uptrend, naturally, with five Minor waves. Minor 1 was simple and ended at SPX 1885. Minor 2 pulled back to SPX 1851 by late-April. Minor wave 3, however, has been subdividing into Minute and Micro waves. Typical of a third wave.

The first four Minute waves were as follows: 1891-1862-1956-1926. Minute wave v made new highs this week as it reached SPX 1964. At this new high the market is displaying negative RSI/MACD divergences on the daily charts in all four major indices. And, both the SPX plus NAZ (which made new bull market highs this week), display a Minor wave 3 that is nearly 1.618 times Minor wave 1. Since we had been expecting Minor wave 3 to top around the 1956 to 1973 pivots, we think it is time to get a bit cautious short term. Medium term support is at the 1956 and 1929 pivots, with resistance at the 1973 and 2019 pivots.

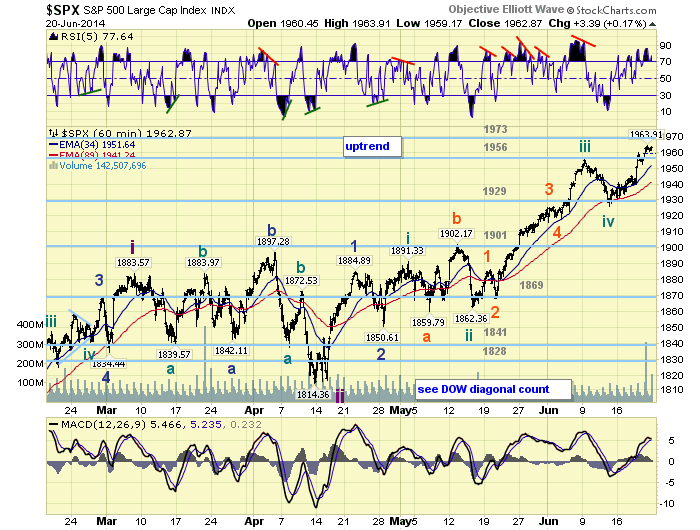

SHORT TERM

Short term support is at the 1956 and 1929 pivots, with resistance at the 1973 and 2019 pivots. Short term momentum ended the week overbought. The short term OEW charts remain positive with the reversal level now SPX 1959.

We have been tracking the Micro waves of this recent rally: Minute wave v. We had a clear 1-2-3 rally, 1941-1931-1960, until Thursday. Then the market pulled back 8 points to SPX 1952. We would have liked to have seen a bit more of a pullback, but decided to take the cautious approach since Minute v has already hit out projected range. As such we can now count five Micro waves: 1941-1931-1960-1952-1964. When this last rally concludes, if it has not done so already, a Minor 4 pullback should drop the market back to the 1929 pivot range. After that a Minor wave 5 rally should take the market to new highs and end the Intermediate wave iii uptrend. Best to your trading!

FOREIGN MARKETS

The Asian markets were mostly lower for a net loss of 0.6%.

The European markets were mostly higher for a net gain of 0.6%.

The Commodity equity sector was mixed for a gain of 0.1%.

The DJ World index is still uptrending and gained 1.0%.

COMMODITIES

Bonds continued their downtrend and finished flat on the week.

Crude gained 0.1% as it continues to uptrend.

Gold finally confirmed an uptrend and gained 3.1%: Major C should be underway.

The USD is still uptrending but lost 0.3% on the week.

NEXT WEEK

Monday: Existing home sales at 10am. Tuesday: Case-Shiller, the FHFA index, New home sales and Consumer confidence. Wednesday: Q1 GDP (est. -1.8%), and Durable goods orders. Thursday: weekly Jobless claims, Personal income/spending, and PCE prices. Friday: Consumer sentiment. The FED has a clean slate ahead of the upcoming three day weekend. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2014 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.