Catch the Gold Golden Goose

Commodities / Gold and Silver 2014 Jun 25, 2014 - 04:38 PM GMTBy: Investment_U

Sean Brodrick, writes: Gold got goosed two weeks in a row. Last week it shot up $39 an ounce. That came on the heels of a $24 move the previous week. Could gold go higher from here?

Sean Brodrick, writes: Gold got goosed two weeks in a row. Last week it shot up $39 an ounce. That came on the heels of a $24 move the previous week. Could gold go higher from here?

Yes.

I'll show you why.

Blame the Fed

Last week, the Fed signaled that it would stick with a near-zero interest rate policy for a good, long time. This means the Fed will likely continue to keep rates lower despite strong signs that inflation could be around the corner. This disappointed some traders (mostly gold bears) who thought the Fed would start to "normalize" its interest rate policy.

And so that provided the spark for gold's $39 move. But many forget that gold moved the week before the Fed announcement as well. So why'd that happen? The reason is counterintuitive. It's because sentiment got incredibly bearish.

I'll explain: The weekly Commitment of Traders report released by the Commodity Futures Trading Commission showed that the number of speculative shorts in gold was very high. When speculators bet all on one side, it's usually a sign that a bottom has formed, and gold will rebound from there. That's because when everybody turns bearish, there is no one left to sell.

Stoking the Fires of Inflation

And there's another good reason traders are buying gold now. I'm talking about fear of inflation.

Inflation is low - currently 2.1%, according to the Bureau of Labor Statistics. This is actually an uptick from the 1.1% hit in February.

Now, here's the scary news.

There are signs there is more inflation percolating in the system. Just look around you - anyone with eyes can see it. Airline fares are up 17% since February. Home prices have jumped 13.3% since January. Food prices are up a whopping 23% since December, using the Thomson Reuters/Jefferies CRB benchmark.

The biggest inflation risk is in energy prices. Gasoline prices are up 10% since December.

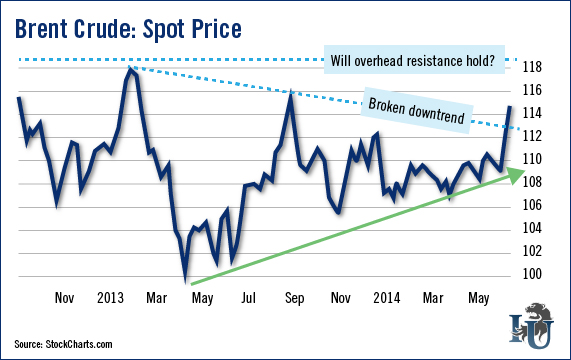

The price of Brent crude, to which the U.S. gasoline price is linked, broke out last week, as you can see in this chart...

This breakout gives us a target of $121. The rule of thumb is that an increase of $10 in the price of Brent crude oil tends to lead to an increase of $0.25 in the price of a gallon gas. And this breakout could mean we'll see the price of Brent crude rise nearly $20 in a little over a year.

So heck yeah, that's inflationary.

This is why traders have suddenly rediscovered gold. They see inflationary forces heating up all around them. They see a Fed that is willing to keep interest rates lower for longer than anyone dreamed possible. They believe this is potentially rocket fuel for inflation. And historically, one of the ways people hedge against inflation is with gold.

Sentiment Remains Incredibly Bearish

Now that we've seen gold jump, the move must already be priced in, right? Nope, I don't think so. The Perennially Wrong Boy's Choir of Wall Street still hates gold. Hates it!

Just weeks ago, French mega-bank Société Générale lowered its gold price target to $850. And it's in good company. Goldman Sachs issued a $1,050 gold target in January and has stuck with it. Moody's has a target of $900. And in April, Morgan Stanley said "Gold won't see $1,300 again."

Oops! Gold closed at $1,314.70 on Friday.

Yet those bearish forecasts are still on the table. Those banks, if they follow their own advice, are racking up losses. Boy, I'd hate to be a gold bear tossing and turning in a flop-sweat right about now. That ruins a good night's sleep. Eventually, they'll have to cover.

Hmm... I wonder what could happen to the price of gold when they do cover?

To the moon, Alice!

Good investing,

Sean

Editor's Note: Sean was recently interviewed about the immense investment potential of one man's invention that's creating scores of overnight millionaires. Go here to watch the full interview and find out how his invention could hand you as much as $127,000 each year for 45 years.

Source: http://www.investmentu.com/article/detail/38320/gold-catch-golden-goose

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.