The Bernanke Monetary Policy Conundrum Heading for a Crash

Economics / Economic Depression May 07, 2008 - 05:40 PM GMTBy: Mick_Phoenix

The Bernanke Monetary Policy Conundrum Heading for a Crash

With the US Federal Reserve cutting its Fed Fund Rate to 2%, presumably to aid the cost of borrowing and allow an expansion of lending that will lift the US economy from the doldrums you would expect to see an expansion of bank business. Not so according to the latest Fed's Senior Loan Officer Opinion Survey which shows that banks are now actively avoiding the expansion of credit and it can be shown are deliberately causing a credit contraction.

With the US Federal Reserve cutting its Fed Fund Rate to 2%, presumably to aid the cost of borrowing and allow an expansion of lending that will lift the US economy from the doldrums you would expect to see an expansion of bank business. Not so according to the latest Fed's Senior Loan Officer Opinion Survey which shows that banks are now actively avoiding the expansion of credit and it can be shown are deliberately causing a credit contraction.

This has profound meaning for the US and the wider global economy.

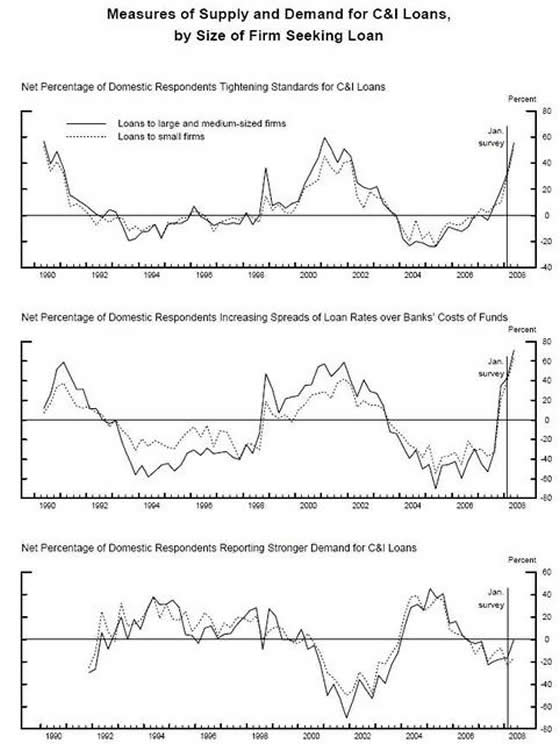

Let's look at the evidence. The following 3 charts show the Bernanke Conundrum as it applies to business. Yes, business - its not just consumers getting squeezed:

This is for all business sizes in the April survey, conditions have been tightened, rates have been further increased above the cost that banks incur to borrow and here is the crunch, demand is increasing from business.

How important is this?

Very, I mean crash imminent (Q2/3) very important. It is clear to see that borrowing conditions for business have not improved even with the Fed liquidity/solvency actions and the cutting of rates. Around 60% of domestic banks are making it difficult or impossible (likely the latter for all but the highest quality of business) to borrow. In fact conditions for business requiring credit have deteriorated substantially even in the face of a higher demand since the last survey.

Why am I worried about a crash?

Simply this, notice the increase in demand for loans (third chart above) is a good leading indicator of the direction of the economy and the markets. This is probably a function of using credit to expand business / productivity in anticipation of an acceleration of growth overall.

Having said that and looking at the chart above you are probably wondering why I am not saying the good times are just around the next quarter or 2. It would seem foolish to say its different this time.

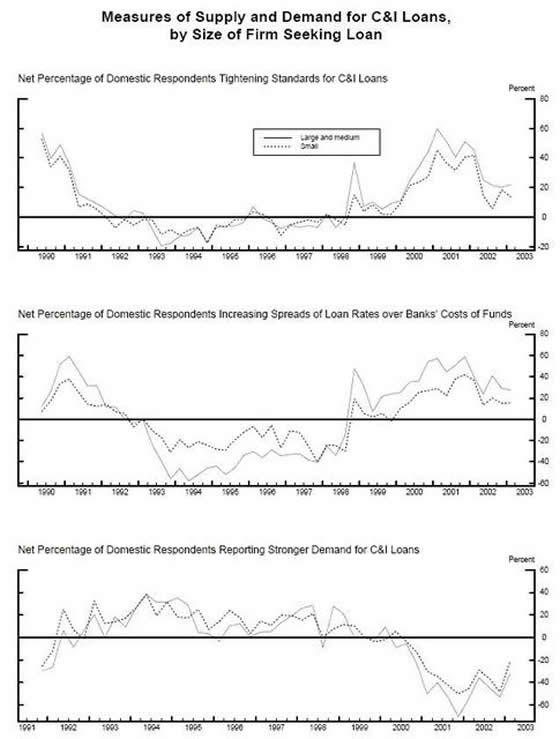

Yes, you guessed it:

This is the same information up to Q1 2003, just before the last Bull market took off. Notice the striking difference? Rising demand for loans occurred in a benign environment of looser lending standards and cheap credit as priced by the banks over their borrowing costs (Low risk). Q2 '03 is even more benign.

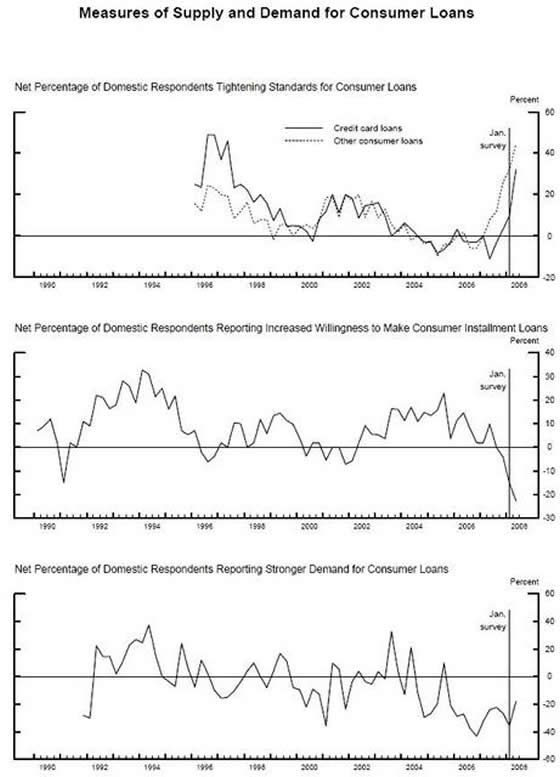

The problem for Bernanke is made no easier by the same predicament facing consumers:

So as consumer demand picks up do the banks take the business?

No, they do not. Loans and credit cards have tightening standards and there is no willingness to allow consumer instalment loans. The bottom of the consumer barrel has been scraped and there is no wish to return for the crumbs.

When compared to the last downturn and recession ('00-'03) you can see how much more difficult it is for consumers to borrow now, compared to then. No consumer and no business borrowing. What's a Fed chairman to do eh?

Am I saying its different this time?

Oh yes, without a doubt. Look again at the charts above, focussing on the last quarter of '99. Look how lending standards and costs rise as we tipped over into the weakening economy and eventual recession to come, yet lending demand from business contracted. This is the "natural" state of affairs, even back in '90/91 when demand for loans and the price above the banks borrowing costs rose, standards were dropping rapidly, business could borrow, it just cost more.

This is clearly not happening now. We have an environment were business needs to borrow but banks are unwilling or unable to lend.

Bernanke's conundrum is simple to see, after all the easing of rates and invention of facilities to enable credit markets to continue and even with the de facto underwriting of the whole fiat monetary system, banks will not lend.

How big a problem is this?

Unless business can borrow (either to offset costs, rollover previous borrowing or get ready for expansion) then 1929-33 looms large.

This though is not the final state we have achieved. By now all market participants know that the Fed will go to extraordinary lengths to keep the current system operating. The conundrum for Bernanke is what can he do to make banks loosen standards and lower costs?

You see, For Ben Bernanke the current situation isn't "news"

Bernanke has already studied the conundrum. I quote from "Non-Monetary Effects of the Financial Crisis in the Propagation of the Great Depression" as used in "New Keynsian Economics"(Mankiw and Romer Ch 29):

"An interesting aspect of the general financial crises - most clearly, of the bank failures-was their coincidence in timing with adverse developments in the macroeconomy"

The present paper builds on the Friedman-Schwartz work by considering a third way in which the financial crises (in which we include debtor bankrupties as well as failures of banks and other lenders) may have affected output".".....because markets for financial claims are incomplete, intermediation between...borrowers and....lenders required nontrivial market making and information gathering".

Bernanke then goes on to state that as the real costs of intermediation rose some borrowers found credit to be expensive and difficult to obtain. He then states:

"The effect of this credit squeeze on aggregate demand helped convert the severe.....downturn of 1929-1930 into a protracted depression"

Bernanke goes on to identify various problems from the '20s that made the 29-30 downturn, which included the expansion of debt and in 1930 the move by banks out of the loan markets into more liquid instruments. Indeed the 1932 National Industrial Conference Board survey of credit conditions reported that the shrinkage of commercial loans in 1931 and the first half of 1932 represented pressure from the banks on customers for repayment and refusal by banks to grant new loans. The worry is that the Fed Chairman saw no cure better than the one used in the '30s New Deal and the large scale intervention of the federal Govt:

"home mortgage market...function....was largely due to the direct involvement of the ferderal government....establishing ...FSLIC...federally chartered savings and loans....government "readjusted" existing debts....and substituted for recalcitrant private institutions in the provision of direct credit. In 1934.....Home Owners' Loan Corporation made 71 percent of all mortgage loans extended"

It looks to me that Bernanke has already instituted the measures he believes will help avoid a repeat of '29-'33 by delivering the medicine now rather than later. As we have seen earlier in this article, the medicine does not seem to be affecting the patient. Credit availability continues to contract due to the policies of banks. Ben Bernanke now finds himself in a situation where he has delivered all he can to no avail. Does he sit back and wait for a change in credit conditions to become apparent or is there more that he can do?

Whatever he does, unless lending conditions change markedly and rapidly in this quarter , it will be ineffective. Bernanke will no longer have to refer to history to see a deflationary depression, he will be living it.

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.